- Australia

- /

- Metals and Mining

- /

- ASX:ALK

Is Alkane Resources (ASX:ALK) Quietly Recasting Its Risk Culture With McComish’s Appointment?

Reviewed by Sasha Jovanovic

- Alkane Resources has appointed Denise McComish as an independent Non-Executive Director and Chair of its Audit & Risk Committee, effective 1 December 2025, bringing three decades of audit and advisory experience from KPMG and multiple board roles across mining and other sectors.

- Her background in finance, ESG oversight and mining governance may reshape Alkane’s risk management approach and strengthen confidence among lenders, regulators and long-term shareholders.

- Next, we’ll examine how McComish’s appointment as Audit & Risk Committee Chair could influence Alkane Resources’ broader investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is Alkane Resources' Investment Narrative?

To own Alkane Resources, you really need to believe in its ability to turn a growing production profile and exploration upside at Tomingley into sustainably better earnings, while keeping costs and balance sheet risk in check. Recent quarters show solid revenue but thin margins, high one-off impacts and a rich earnings multiple, so near-term catalysts still revolve around execution on FY2026 guidance, AISC discipline and translating exploration success into reserves and mine life. Denise McComish’s appointment as Audit & Risk Committee Chair slots directly into this picture: it strengthens financial oversight and ESG governance at a time when returns have been volatile and the board is relatively new. That said, her arrival is more of a governance upgrade than a swing factor for short-term cash flow.

However, investors should be aware of one key risk that sits behind those thin profit margins. Alkane Resources' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

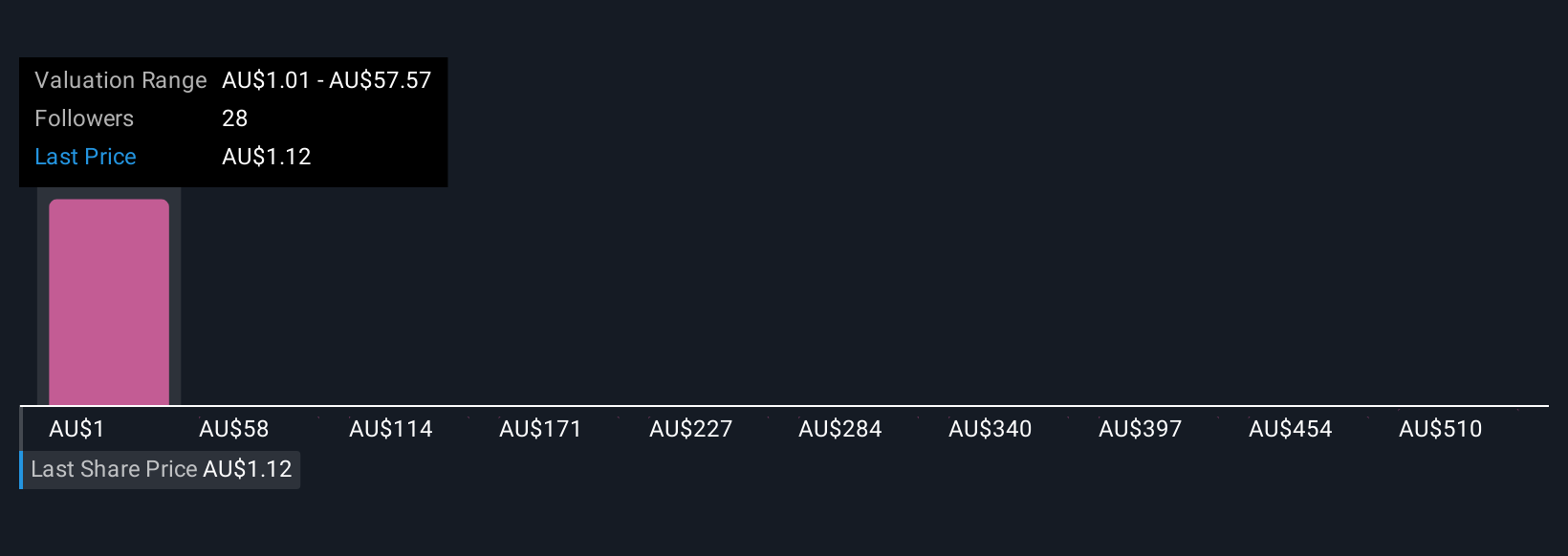

Five fair value estimates from the Simply Wall St Community span from A$1.01 to a very large A$566.63, showing just how far apart individual views can be. When you set that against Alkane’s high price to earnings ratio, modest profit margins and the board reset described above, it underlines why many participants are focusing on execution risks as much as growth potential. You may want to explore several of those viewpoints before deciding how this story fits in your portfolio.

Explore 5 other fair value estimates on Alkane Resources - why the stock might be a potential multi-bagger!

Build Your Own Alkane Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alkane Resources research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Alkane Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alkane Resources' overall financial health at a glance.

No Opportunity In Alkane Resources?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALK

Alkane Resources

Operates as a gold exploration and production company in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026