- Australia

- /

- Metals and Mining

- /

- ASX:ALK

3 Promising ASX Penny Stocks With Market Caps Under A$500M

Reviewed by Simply Wall St

The Australian stock market has faced a mixed bag of performances, with recent comments from the RBA and global trade tensions influencing investor sentiment. For those exploring opportunities beyond the well-known companies, penny stocks—typically smaller or newer enterprises—remain an intriguing area for potential growth. Despite their vintage name, these stocks can offer surprising value and stability when backed by solid financial foundations.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$111.77M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.21 | A$104.25M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$114.4M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.00 | A$462.55M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.39 | A$2.72B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.84 | A$486.51M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.66 | A$894.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.805 | A$884.59M | ✅ 5 ⚠️ 3 View Analysis > |

| Austco Healthcare (ASX:AHC) | A$0.38 | A$138.34M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.92 | A$154.65M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 465 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Alkane Resources (ASX:ALK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alkane Resources Ltd is an Australian company engaged in gold exploration and production, with a market cap of A$423.88 million.

Operations: The company's revenue is primarily derived from its gold operations, which generated A$239.14 million.

Market Cap: A$423.88M

Alkane Resources Ltd has shown significant earnings growth, with a 47.3% increase over the past year, surpassing both its historical performance and industry averages. The company is debt-free, enhancing financial stability, though its short-term assets do not cover long-term liabilities. Recent earnings reports highlight improved profitability with net income rising to A$8.1 million in the third quarter from a loss previously. Despite these positives, Alkane's return on equity remains low at 8.5%, and it trades significantly below estimated fair value, indicating potential undervaluation in the market for investors considering penny stocks within this sector.

- Click to explore a detailed breakdown of our findings in Alkane Resources' financial health report.

- Gain insights into Alkane Resources' future direction by reviewing our growth report.

Horizon Gold (ASX:HRN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Horizon Gold Limited is an Australian company focused on the exploration, evaluation, development, and production of gold deposits with a market cap of A$86.90 million.

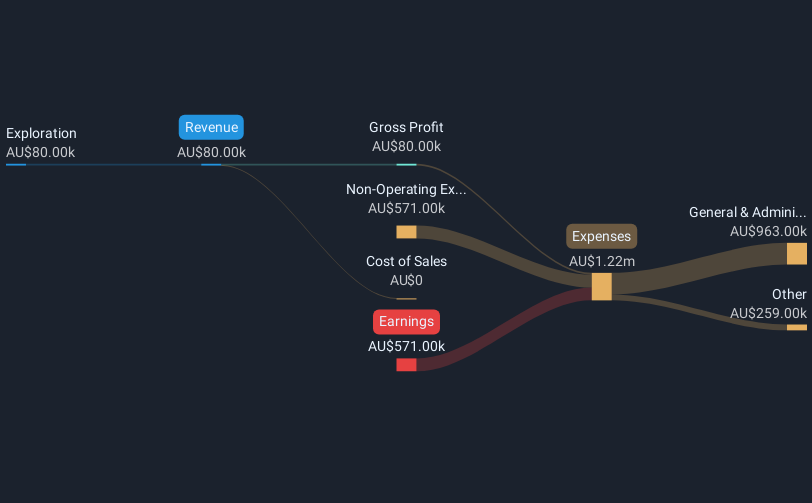

Operations: The company generates revenue from its exploration activities, amounting to A$0.08 million.

Market Cap: A$86.9M

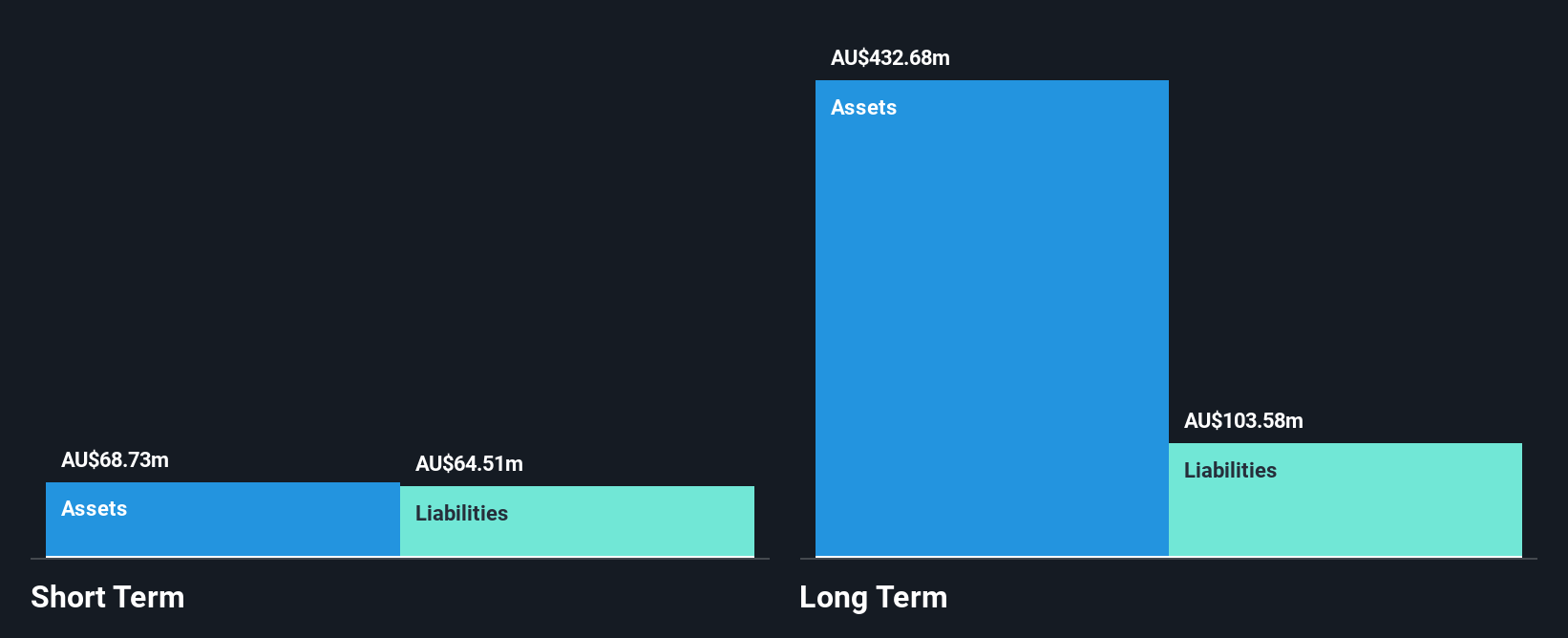

Horizon Gold Limited, with a market cap of A$86.90 million, is pre-revenue, generating only A$0.08 million from exploration activities. The company remains debt-free and recently raised capital through follow-on equity offerings totaling approximately A$11.91 million, which could extend its cash runway beyond the current 11 months based on free cash flow estimates. While Horizon's short-term assets of A$3.7 million exceed its short-term liabilities of A$594K, they fall short against long-term liabilities of A$11.9 million. Despite an experienced management team and stable volatility, Horizon continues to face challenges due to unprofitability and negative return on equity at -1.65%.

- Dive into the specifics of Horizon Gold here with our thorough balance sheet health report.

- Learn about Horizon Gold's historical performance here.

OFX Group (ASX:OFX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OFX Group Limited operates as a provider of international payments and foreign exchange services across regions including the Asia Pacific, North America, Europe, the Middle East, and Africa with a market capitalization of A$196.56 million.

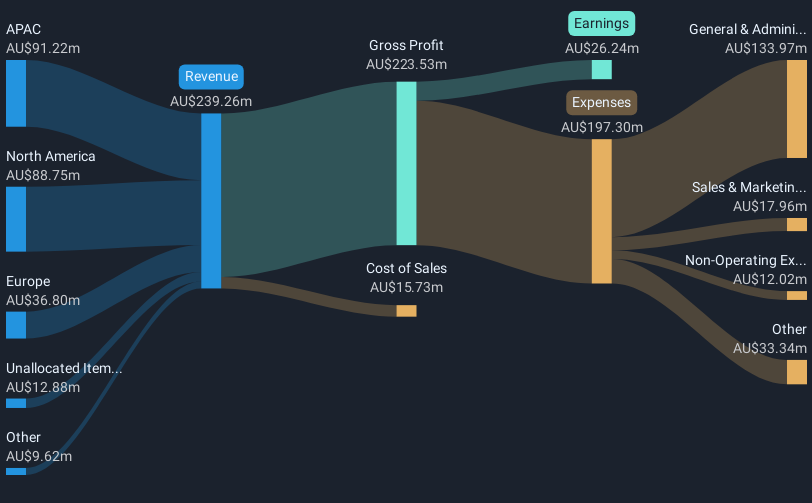

Operations: The company's revenue segments include APAC with A$90.31 million, North America generating A$86.63 million, Europe contributing A$33.77 million, and Treasury adding A$11.23 million.

Market Cap: A$196.56M

OFX Group Limited, with a market cap of A$196.56 million, operates in international payments and foreign exchange services, demonstrating robust regional revenue streams—A$90.31 million from APAC and A$86.63 million from North America. Despite a recent decline in net income to A$24.86 million, OFX maintains strong financial health with short-term assets exceeding liabilities and debt well-covered by cash flow. The company has initiated a share buyback program for capital management purposes, targeting 9.96% of its issued share capital by August 2026. However, challenges include high volatility and negative earnings growth over the past year.

- Unlock comprehensive insights into our analysis of OFX Group stock in this financial health report.

- Gain insights into OFX Group's outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Explore the 465 names from our ASX Penny Stocks screener here.

- Want To Explore Some Alternatives? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALK

Alkane Resources

Operates as a gold exploration and production company in Australia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives