- Australia

- /

- Basic Materials

- /

- ASX:WGN

3 Promising ASX Penny Stocks With At Least A$200M Market Cap

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat, but it is up 20% over the past year with earnings expected to grow by 12% per annum in the coming years. While 'penny stocks' might seem like a term from a bygone era, they continue to offer intriguing opportunities for investors seeking affordability and growth potential. By focusing on companies with strong financials and clear growth trajectories, investors can find promising options among these smaller or newer firms.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.555 | A$63.88M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$127.64M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$303.87M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.865 | A$298M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$838.04M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.71 | A$1.82B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.13 | A$56.64M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$93.09M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.93 | A$114.45M | ★★★★★★ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Alkane Resources (ASX:ALK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alkane Resources Ltd is an Australian company focused on gold exploration and production, with a market cap of A$329.50 million.

Operations: The company generates revenue primarily from its Gold Operations segment, which contributed A$173.58 million.

Market Cap: A$329.5M

Alkane Resources Ltd, with a market cap of A$329.50 million, primarily generates revenue from its gold operations, reporting A$172.99 million in sales for the year ending June 30, 2024. Despite a decrease in net income to A$17.68 million from the previous year's A$42.45 million and declining profit margins (10.2% compared to 22.3%), Alkane remains debt-free and has stable weekly volatility at 7%. The seasoned management team and board bring valuable experience to navigate challenges such as covering long-term liabilities exceeding short-term assets by A$31M while aiming for future earnings growth forecasted at over 36% annually.

- Click to explore a detailed breakdown of our findings in Alkane Resources' financial health report.

- Learn about Alkane Resources' future growth trajectory here.

Aurelia Metals (ASX:AMI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aurelia Metals Limited is an Australian company involved in the exploration and production of mineral properties, with a market capitalization of A$346.77 million.

Operations: The company's revenue is derived from its operations at the Peak Mine (A$207.34 million), Dargues Mine (A$102.36 million), and Hera Mine (A$0.20 million).

Market Cap: A$346.77M

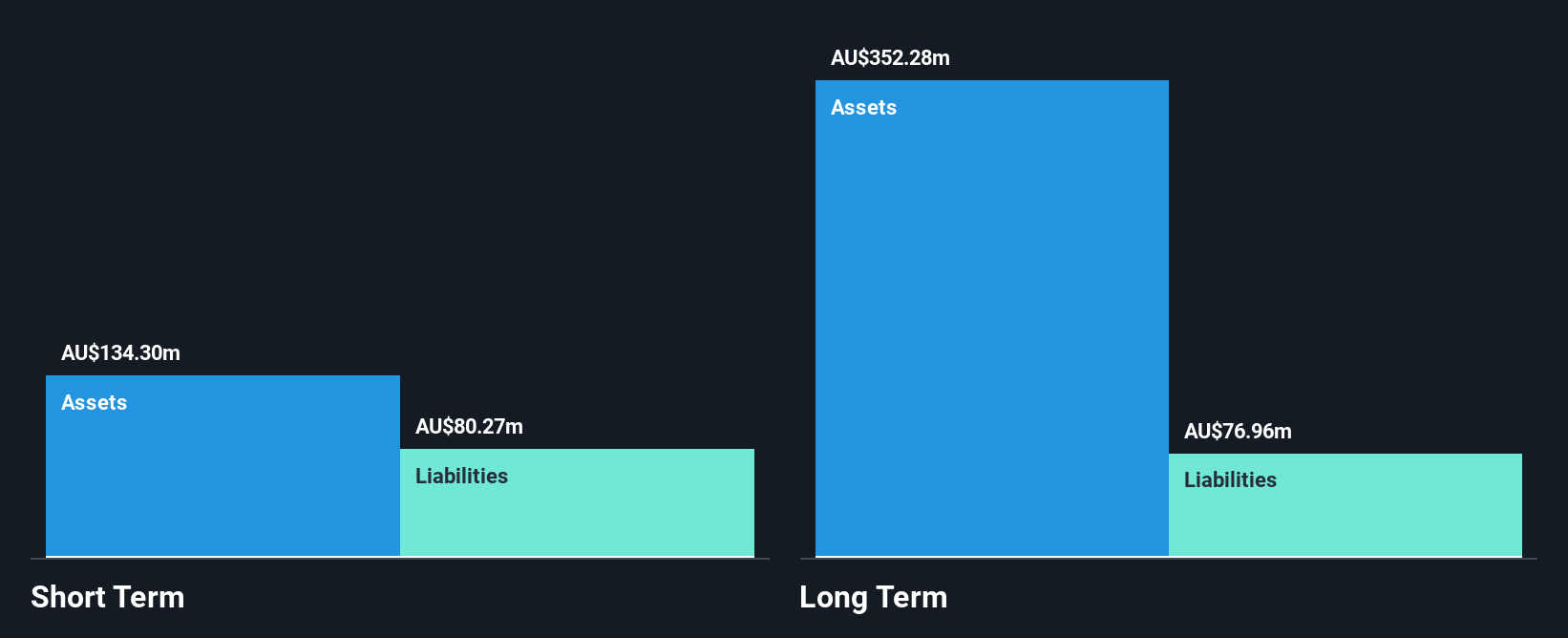

Aurelia Metals, with a market cap of A$346.77 million, reported A$309.89 million in sales for the year ending June 30, 2024, but remains unprofitable with a net loss of A$5.73 million. The company benefits from stable weekly volatility (10%) and has more cash than total debt, providing a solid financial footing despite increasing losses over five years at 49.1% annually. Short-term assets exceed both short-term and long-term liabilities, ensuring liquidity stability. While the management team is relatively new and inexperienced, production guidance for fiscal year 2025 indicates potential growth in gold and base metal outputs.

- Jump into the full analysis health report here for a deeper understanding of Aurelia Metals.

- Gain insights into Aurelia Metals' future direction by reviewing our growth report.

Wagners Holding (ASX:WGN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wagners Holding Company Limited is involved in the production and sale of construction materials across Australia, the United States, New Zealand, the United Kingdom, PNG, and Malaysia with a market cap of A$227.02 million.

Operations: Wagners Holding generates revenue through its Construction Materials segment with A$224.39 million, Project Services at A$206.20 million, Earth Friendly Concrete contributing A$0.27 million, and Composite Fibre Technology adding A$59.38 million.

Market Cap: A$227.02M

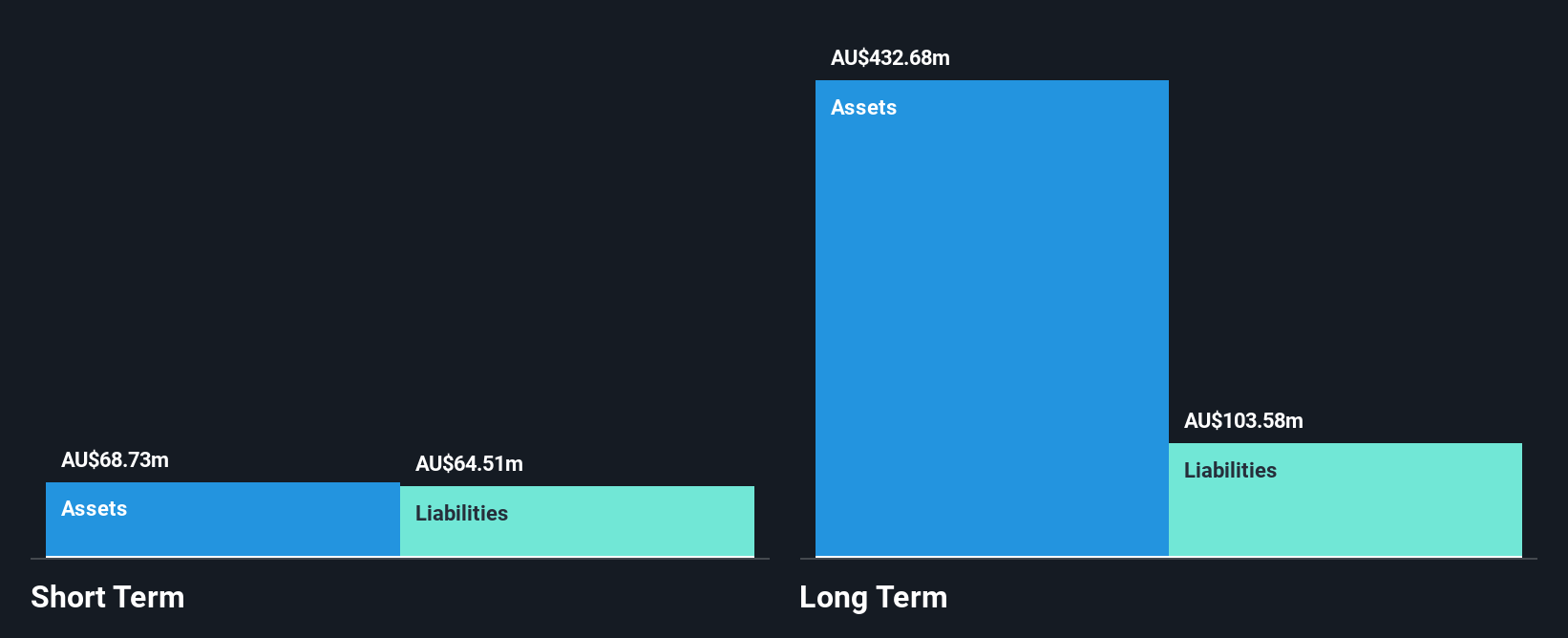

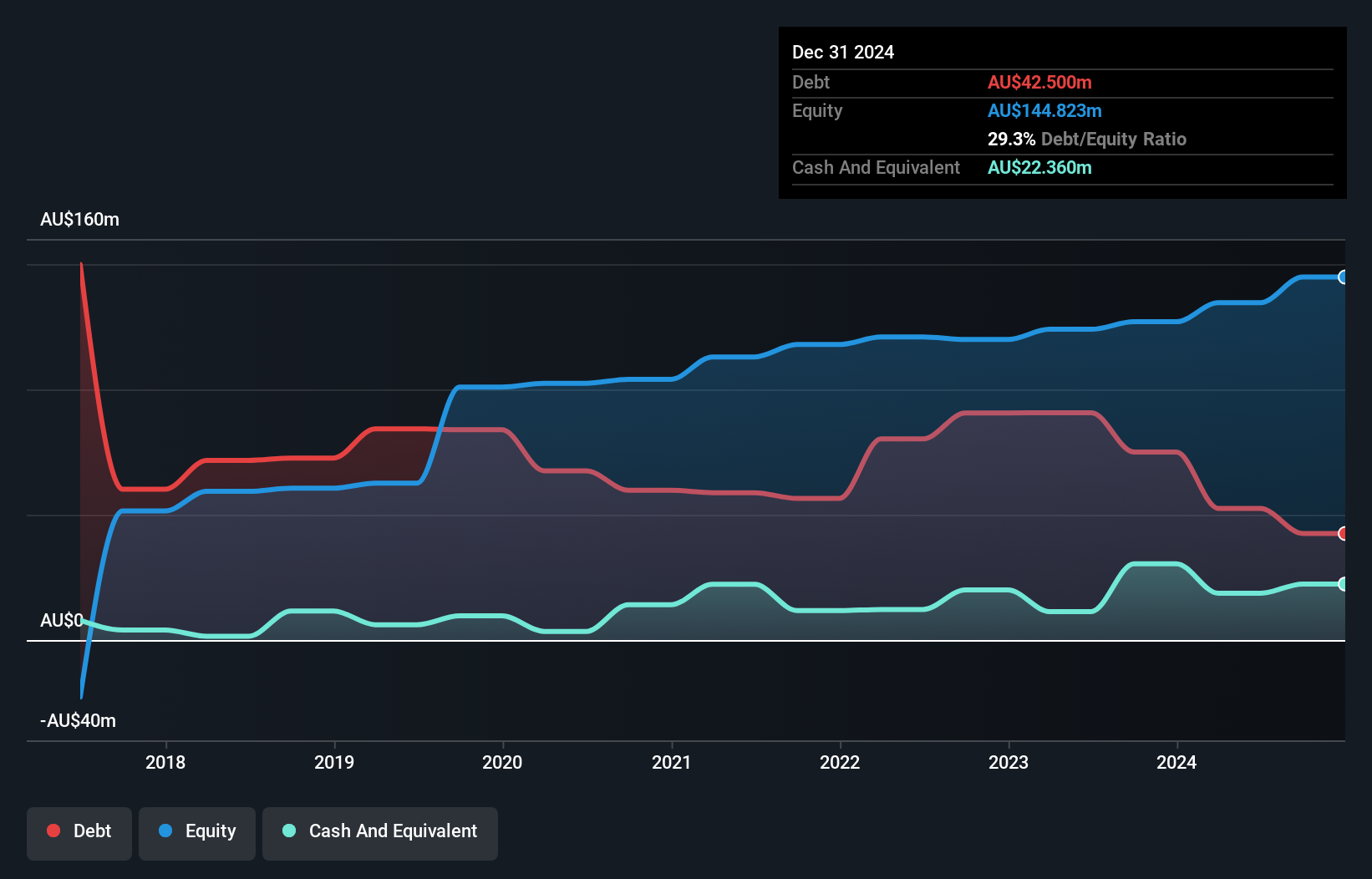

Wagners Holding, with a market cap of A$227.02 million, has shown significant earnings growth of 229.2% over the past year, surpassing its five-year average of 1.7%. Despite large one-off losses impacting recent financial results and a low return on equity at 7.6%, the company maintains satisfactory debt levels with net debt to equity at 25.1% and coverage by operating cash flow at 138.3%. Wagners resumed dividend payments in October 2024 after six years, reflecting improved financial health as net income rose to A$10.28 million for the year ending June 30, 2024, compared to A$3.12 million previously.

- Navigate through the intricacies of Wagners Holding with our comprehensive balance sheet health report here.

- Assess Wagners Holding's future earnings estimates with our detailed growth reports.

Key Takeaways

- Investigate our full lineup of 1,026 ASX Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wagners Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WGN

Wagners Holding

Engages in the production and sale of construction materials in Australia, the United States, New Zealand, the United Kingdom, and PNG & Malaysia.

Proven track record with adequate balance sheet.