- Australia

- /

- Metals and Mining

- /

- ASX:AIS

The Aeris Resources Limited (ASX:AIS) Half-Year Results Are Out And Analysts Have Published New Forecasts

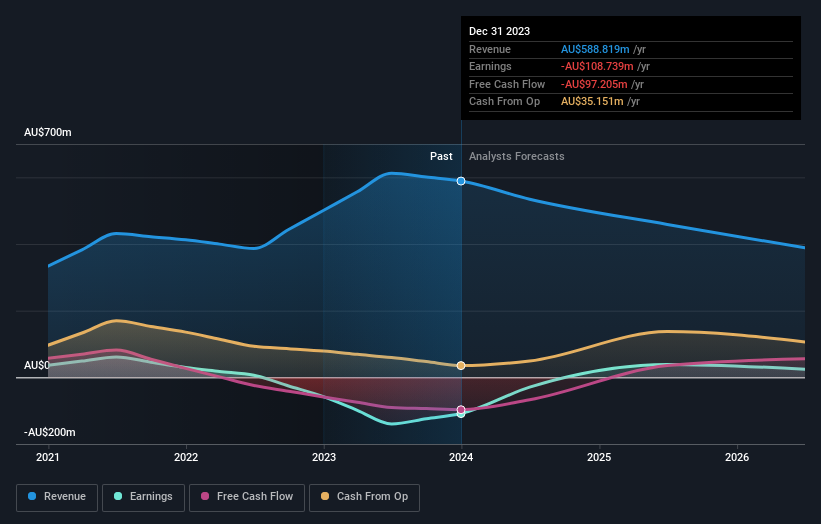

Aeris Resources Limited (ASX:AIS) investors will be delighted, with the company turning in some strong numbers with its latest results. Revenue crushed expectations at AU$286m, beating expectations by 26%. Aeris Resources reported a statutory loss of AU$0.019 per share, which - although not amazing - was much smaller than the analysts predicted. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

View our latest analysis for Aeris Resources

Taking into account the latest results, the current consensus, from the four analysts covering Aeris Resources, is for revenues of AU$534.3m in 2024. This implies a considerable 9.3% reduction in Aeris Resources' revenue over the past 12 months. Losses are predicted to fall substantially, shrinking 59% to AU$0.046. Before this earnings announcement, the analysts had been modelling revenues of AU$525.7m and losses of AU$0.047 per share in 2024.

The consensus price target was unchanged at AU$0.17, suggesting that the business - losses and all - is executing in line with estimates. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Aeris Resources, with the most bullish analyst valuing it at AU$0.23 and the most bearish at AU$0.13 per share. This shows there is still a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that revenue is expected to reverse, with a forecast 18% annualised decline to the end of 2024. That is a notable change from historical growth of 22% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 1.3% per year. It's pretty clear that Aeris Resources' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts reconfirmed their loss per share estimates for next year. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. The consensus price target held steady at AU$0.17, with the latest estimates not enough to have an impact on their price targets.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Aeris Resources going out to 2026, and you can see them free on our platform here.

Even so, be aware that Aeris Resources is showing 3 warning signs in our investment analysis , and 1 of those is significant...

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AIS

Aeris Resources

Explores, produces, and sells precious metals in Australia.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)