- Australia

- /

- Metals and Mining

- /

- ASX:AIS

Aeris Resources (ASX:AIS) Production Outlook and Analyst Downgrade Might Change Its Investment Case

Reviewed by Sasha Jovanovic

- Aeris Resources Limited presented at the Ignite Investment Summit on October 16, 2025, at the Grand Hyatt Hong Kong, following a recent analyst downgrade due to valuation concerns and reduced production forecasts.

- This sequence of events has drawn heightened attention from investors and industry watchers, as anticipation builds around how the company will address both challenges and opportunities in its upcoming communications.

- We'll explore whether Aeris Resources' investment case shifts as investor focus turns to its production outlook amid the recent analyst downgrade.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Aeris Resources Investment Narrative Recap

At its core, the Aeris Resources investment case relies on the company's ability to deliver increased copper and gold production from key projects like Murrawombie and Constellation while prudently managing costs and capital. The recent analyst downgrade, driven by valuation concerns and lowered production forecasts, puts a spotlight on output risks, but, for now, the announced news does not appear to materially alter the main short-term catalyst: achieving production targets at flagship developments. The chief risk remains the possibility of production delays or underperformance, which could threaten earnings momentum.

Among recent updates, the March 2025 mineral resource announcement for the Constellation deposit stands out as especially relevant. The updated resource of 7.6 million tonnes at 2.01 percent copper and improved metallurgical recoveries underscores the importance of this project to Aeris’ growth trajectory, directly tying production ramp-up milestones to investor sentiment and upcoming company communications. In contrast, investors should also be mindful of potential headwinds if projected output at Constellation were to fall short of expectations...

Read the full narrative on Aeris Resources (it's free!)

Aeris Resources is projected to reach A$510.9 million in revenue and A$4.0 million in earnings by 2028. This outlook reflects a 4.0% annual revenue decline and a decrease in earnings of A$41.2 million from current earnings of A$45.2 million.

Uncover how Aeris Resources' forecasts yield a A$0.362 fair value, a 33% downside to its current price.

Exploring Other Perspectives

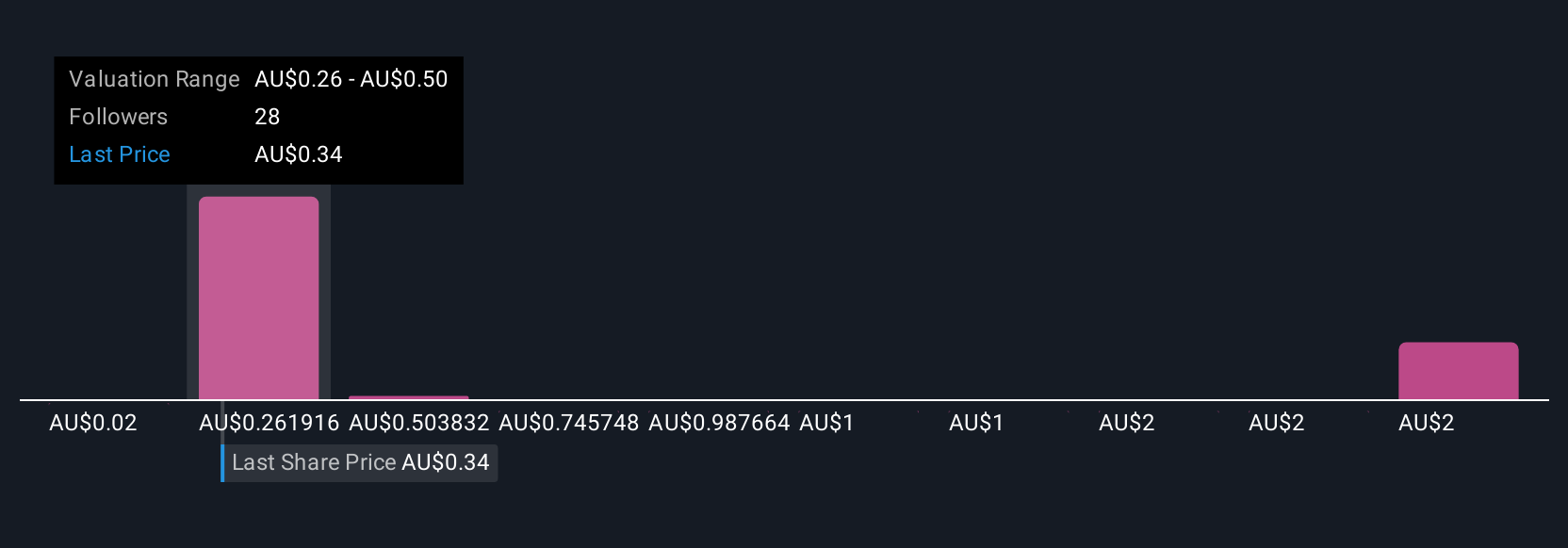

Seven fair value estimates from the Simply Wall St Community range from A$0.29 to over A$2.43 per share. While many see significant upside, concerns about reduced production forecasts continue to test confidence across the market.

Explore 7 other fair value estimates on Aeris Resources - why the stock might be worth 46% less than the current price!

Build Your Own Aeris Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aeris Resources research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Aeris Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aeris Resources' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AIS

Aeris Resources

Explores, produces, and sells precious metals in Australia.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)