Suncorp Group (ASX:SUN): Assessing Valuation Following Strategic On-Market Share Buy-Back Updates

Reviewed by Kshitija Bhandaru

Suncorp Group (ASX:SUN) is making waves with a series of updates on its share buy-back program, which is aimed at optimizing its capital structure and boosting shareholder value. Investors are watching these moves closely.

See our latest analysis for Suncorp Group.

Suncorp’s ongoing buy-back comes as its shares have seen some volatility this year, dipping to $20.75 despite solid total shareholder returns. While its year-to-date price return is down, a resilient 22.14% total return over the past 12 months and more than 200% over five years highlight robust long-term momentum and growing confidence in the company’s capital management strategy.

If you’re curious to see what else is catching attention beyond financials, this could be the perfect moment to discover fast growing stocks with high insider ownership.

But with shares trading at just over A$20 and some analyst targets higher, is Suncorp still undervalued? Or is the current price already reflecting expected growth, leaving little room for fresh upside?

Most Popular Narrative: 9% Undervalued

Suncorp’s last close at A$20.75 sits well below the fair value estimate of A$22.83, suggesting a meaningful gap according to the narrative from Robbo. After the banking division spin-off and a renewed focus on insurance, this valuation puts the spotlight on Suncorp’s evolving strategy and capital strength.

The sale of the banking business brought in approximately A$4.1 billion. A substantial portion of that was returned to shareholders through a $3.00 per share capital return and a fully franked $0.22 special dividend. While investors did not receive ANZ shares as part of the transaction, Suncorp emerged with a much stronger capital position. This boost enhances its underwriting capacity and leaves the business well placed to seize growth opportunities when they arise.

What bold financial assumption justifies this higher fair value? The secret hinges on a fresh growth focus, upgraded margins, and a profit outlook that reshapes Suncorp’s future. Want to see which turning point really powers this valuation? There’s more to the numbers than meets the eye.

Result: Fair Value of $22.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Suncorp faces ongoing climate-related claims and rising reinsurance costs, which could challenge its margins and affect the outlook for sustained growth.

Find out about the key risks to this Suncorp Group narrative.

Another View: Multiples Paint a Complex Picture

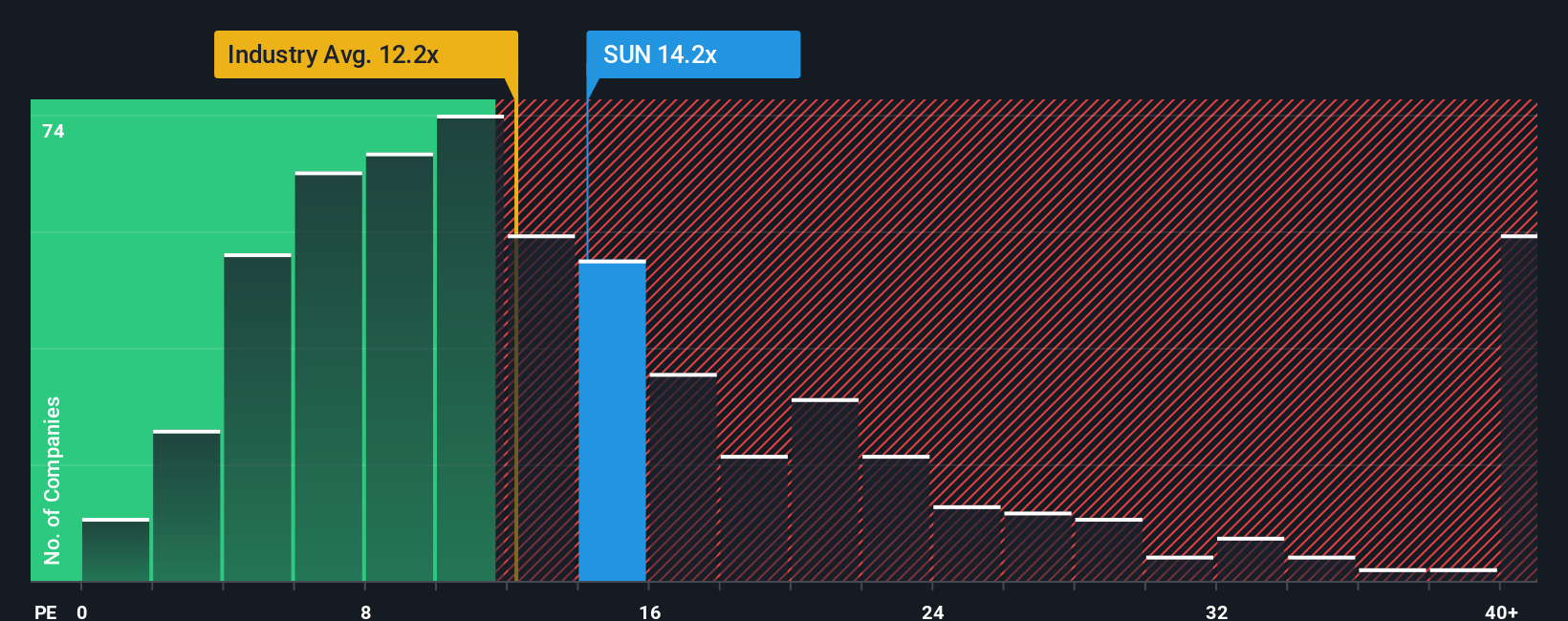

Looking through the lens of price-to-earnings ratios, Suncorp is trading at 14.4x, which is higher than the global insurance industry average of 12.2x, but lower than its peer group at 18x. The fair ratio for Suncorp stands at 17.9x. This suggests potential for re-rating. Does this signal a valuation opportunity, or added risk as the market weighs its transformation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Suncorp Group Narrative

If the numbers above do not quite match your outlook or you like digging into the details yourself, you can craft your perspective in just a few minutes. Do it your way.

A great starting point for your Suncorp Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Broaden your portfolio and get ahead of the market by targeting opportunities smart investors are chasing right now. These picks are updated regularly and packed with potential.

- Tap into cutting-edge advances by browsing these 24 AI penny stocks poised to benefit from the surge in artificial intelligence applications across industries.

- Boost your passive income strategy by picking from these 19 dividend stocks with yields > 3% that consistently offer yields above 3% and have reliable payout histories.

- Capitalize on volatility and growth prospects with these 3586 penny stocks with strong financials that have strong financials and could deliver outsized returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SUN

Suncorp Group

Provides insurance products to retail, corporate, and commercial customers in Australia and New Zealand.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives