Is Suncorp Group’s (ASX:SUN) Ongoing Buy-Back a Sign of Capital Discipline or Limited Investment Options?

Reviewed by Sasha Jovanovic

- In recent news, Suncorp Group Limited continued its on-market buy-back of ordinary shares, repurchasing a total of 1,227,040 fully paid securities as of October 10, 2025.

- This move highlights Suncorp’s focus on optimizing its capital structure and returning capital to shareholders, signaling management’s confidence in its financial position and capital flexibility.

- We’ll now explore how Suncorp’s proactive share buy-back program may influence the company’s overall investment outlook and long-term value proposition.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Suncorp Group Investment Narrative Recap

To be a shareholder in Suncorp Group, you need to believe that disciplined capital management, robust insurance operations, and continued digital transformation will underpin steady earnings even through industry volatility. The recent on-market buy-back reflects a continued commitment to returning capital but does not materially shift the most important near-term catalyst, claims performance and premium growth in response to extreme weather risks. The biggest risk remains that natural hazard costs could spike, putting pressure on margins and capital buffers. One recent announcement that ties directly to the buy-back news is the Board's August approval to repurchase up to A$400 million of shares by June 2026, supporting the company's wider capital optimization strategy. This complements recent earnings momentum, but investors closely watching catalysts like claims costs and investment income will still find the buy-back is only one piece of the puzzle. However, investors should also keep in mind that if natural hazard allowances are not set high enough...

Read the full narrative on Suncorp Group (it's free!)

Suncorp Group's narrative projects A$15.0 billion revenue and A$1.4 billion earnings by 2028. This requires a -0.2% yearly revenue decline and a decrease of A$0.2 billion in earnings from the current A$1.6 billion.

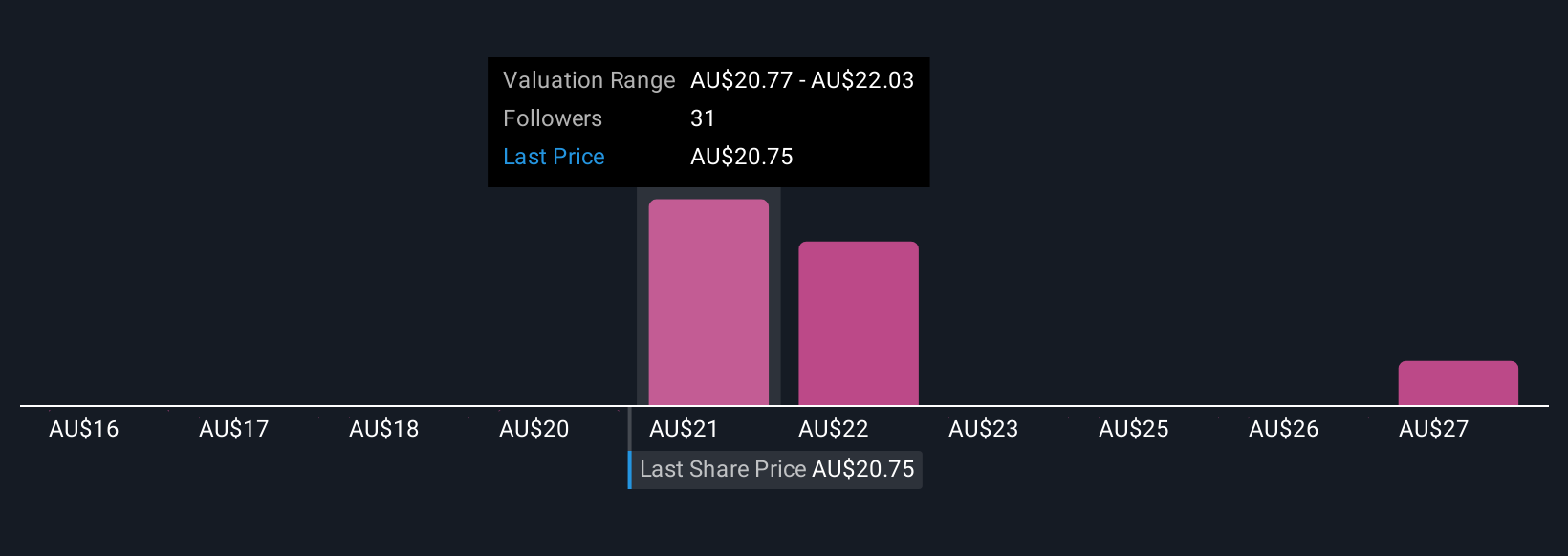

Uncover how Suncorp Group's forecasts yield a A$21.94 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community show targets ranging from A$15.75 to A$28.30. While opinions about Suncorp’s worth differ widely, a key debate centers on how well current reinsurance pricing and capital actions can offset possible future earnings volatility.

Explore 6 other fair value estimates on Suncorp Group - why the stock might be worth 24% less than the current price!

Build Your Own Suncorp Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Suncorp Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Suncorp Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Suncorp Group's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SUN

Suncorp Group

Provides insurance products to retail, corporate, and commercial customers in Australia and New Zealand.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success