How QBE’s Tougher Climate Rules and Board Shift At QBE Insurance Group (ASX:QBE) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- QBE Insurance Group has recently tightened climate requirements for its oil and gas clients, advanced its net zero commitments, continued expanding leadership in its UK casualty business, issued and converted 3,845 new ordinary shares, and announced that Non-Executive Director Peter Wilson will leave the board at the end of 2025 to join a competitor.

- Together, these moves highlight QBE’s push to sharpen climate risk oversight, deepen specialist underwriting capability in key markets, and refresh governance as its board evolves.

- We’ll now examine how QBE’s tougher climate stance for oil and gas clients may reshape its existing investment narrative for long-term investors.

Find companies with promising cash flow potential yet trading below their fair value.

QBE Insurance Group Investment Narrative Recap

To own QBE, you generally need to believe in its ability to price risk accurately, manage catastrophe exposure and keep improving efficiency across a diversified global book. The tougher climate requirements for oil and gas clients may not materially change the near term catalysts around premium growth and expense discipline, but they could subtly influence where future underwriting growth comes from and how investors think about long term climate and regulatory risk.

The climate policy update stands out as the most relevant recent announcement, because it goes straight to QBE’s core underwriting profile and risk selection. For investors watching premium rate trends and large loss volatility, tighter rules on fossil fuel clients introduce an extra variable in how QBE balances margin protection with growth opportunities in specialty and catastrophe exposed lines.

Yet even as QBE refines its climate stance, investors should still be aware that persistent softening in premium rate increases could...

Read the full narrative on QBE Insurance Group (it's free!)

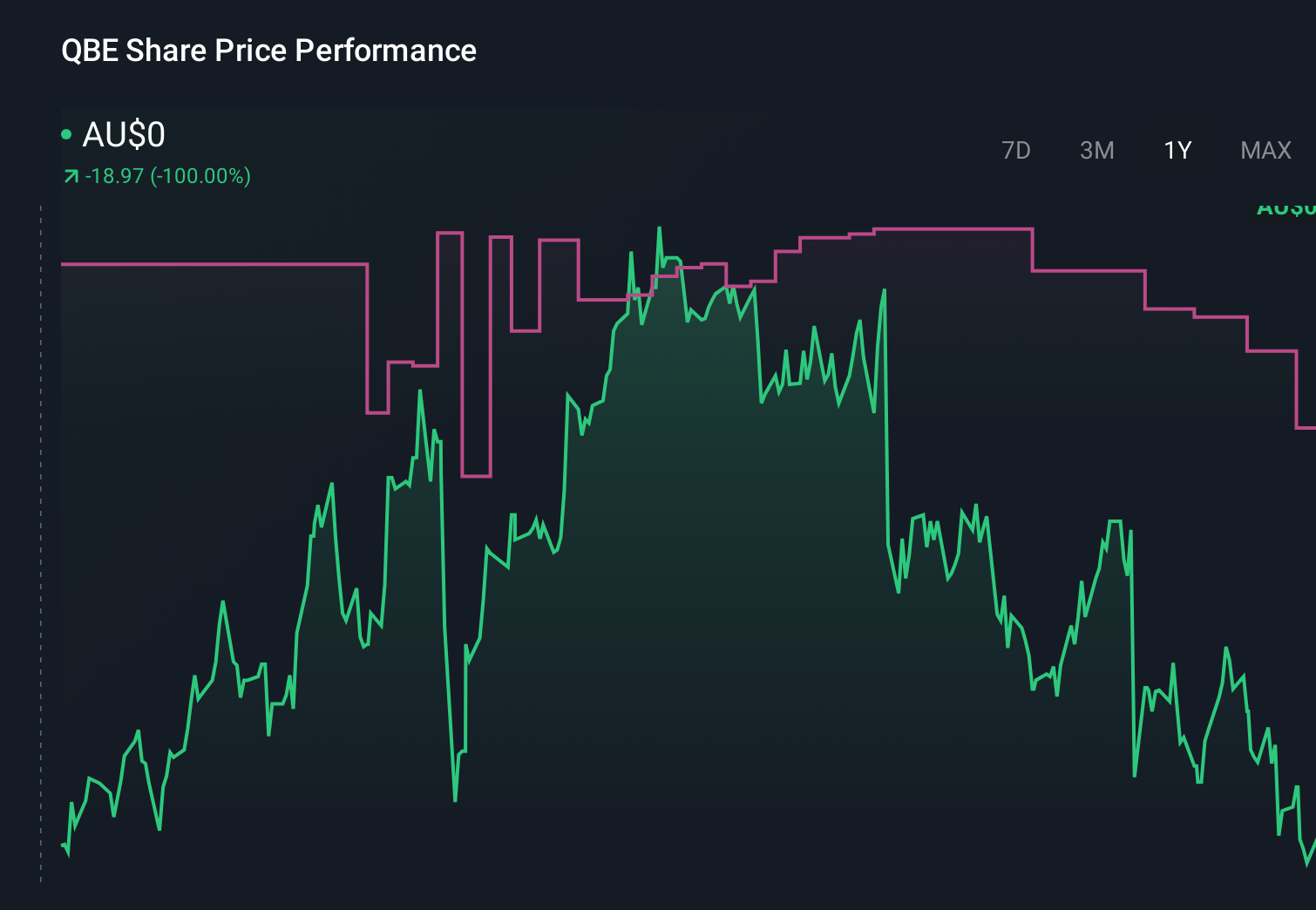

QBE Insurance Group's narrative projects $20.7 billion revenue and $1.9 billion earnings by 2028. This requires revenue to decline by 3.7% per year, with earnings remaining flat at $1.9 billion, implying no change from current earnings.

Uncover how QBE Insurance Group's forecasts yield a A$22.33 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for QBE span roughly A$22 to A$49 per share, showing how far apart individual views can sit. You can weigh those against the risk that premium rate increases may lag claims inflation, with important implications for the company’s margins and long term earnings power.

Explore 3 other fair value estimates on QBE Insurance Group - why the stock might be worth just A$22.27!

Build Your Own QBE Insurance Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QBE Insurance Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free QBE Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QBE Insurance Group's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if QBE Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QBE

QBE Insurance Group

Engages in underwriting general insurance and reinsurance risks in the Australia Pacific, North America, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026