ASX Value Picks: Genesis Minerals And 2 More Stocks That May Be Trading Below Fair Value

Reviewed by Simply Wall St

The Australian market has shown robust performance, rising 2.1% in the last 7 days and climbing 13% over the past year, with earnings forecasted to grow by 12% annually. In this promising environment, identifying undervalued stocks like Genesis Minerals can provide investors with opportunities to capitalize on potential gains as these stocks may be trading below their fair value.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hansen Technologies (ASX:HSN) | A$4.33 | A$8.20 | 47.2% |

| Duratec (ASX:DUR) | A$1.385 | A$2.60 | 46.7% |

| Genesis Minerals (ASX:GMD) | A$2.12 | A$3.99 | 46.9% |

| Charter Hall Group (ASX:CHC) | A$15.91 | A$29.26 | 45.6% |

| Megaport (ASX:MP1) | A$7.38 | A$13.56 | 45.6% |

| Ingenia Communities Group (ASX:INA) | A$5.13 | A$9.36 | 45.2% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Clover (ASX:CLV) | A$0.36 | A$0.72 | 49.8% |

| Ai-Media Technologies (ASX:AIM) | A$0.75 | A$1.42 | 47.1% |

| Superloop (ASX:SLC) | A$1.79 | A$3.31 | 46% |

Here we highlight a subset of our preferred stocks from the screener.

Genesis Minerals (ASX:GMD)

Overview: Genesis Minerals Limited focuses on the exploration, production, and development of gold deposits in Western Australia and has a market cap of A$2.39 billion.

Operations: Genesis Minerals Limited generates revenue of A$438.59 million from its mineral production, exploration, and development activities in Western Australia.

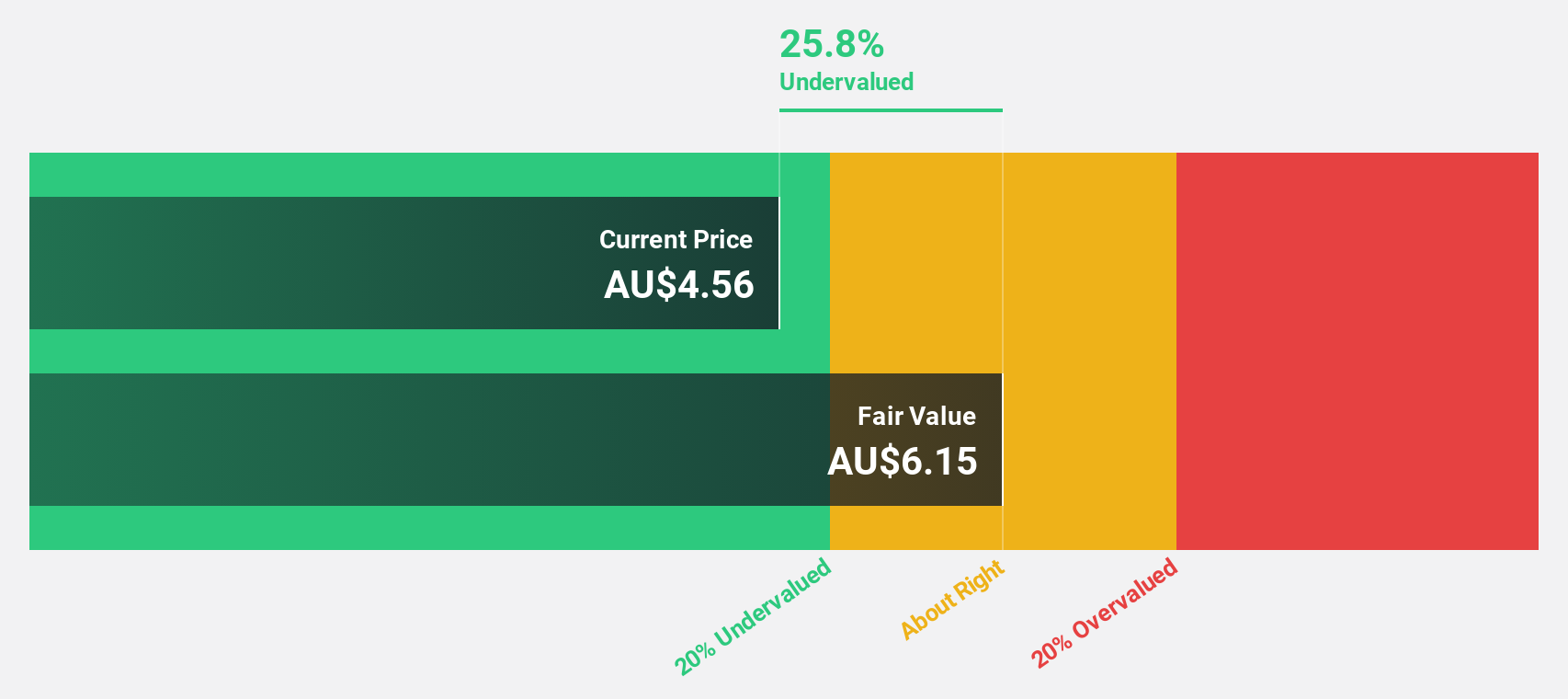

Estimated Discount To Fair Value: 46.9%

Genesis Minerals (A$2.12) is trading significantly below its estimated fair value of A$3.99, presenting a potential undervaluation based on discounted cash flow analysis. The company reported a substantial increase in sales to A$438.59 million for the year ended June 30, 2024, up from A$76.96 million the previous year, and turned profitable with net income of A$84 million compared to a loss of A$111.77 million previously. Earnings are expected to grow at 21.9% per year over the next three years, outpacing market averages, though shareholders have faced dilution recently and return on equity is forecasted to be modest at 12.7%.

- Insights from our recent growth report point to a promising forecast for Genesis Minerals' business outlook.

- Get an in-depth perspective on Genesis Minerals' balance sheet by reading our health report here.

Ingenia Communities Group (ASX:INA)

Overview: Ingenia Communities Group (ASX:INA) is a leading operator, owner, and developer of quality residential communities and holiday accommodation with a market cap of A$2.09 billion.

Operations: The company's revenue segments include A$19.26 million from Fuel, Food & Beverage, A$134.84 million from Tourism - Ingenia Holidays, A$23.67 million from Residential - Ingenia Gardens, A$86.50 million from Residential - Lifestyle Rental, and A$205.81 million from Residential - Lifestyle Development.

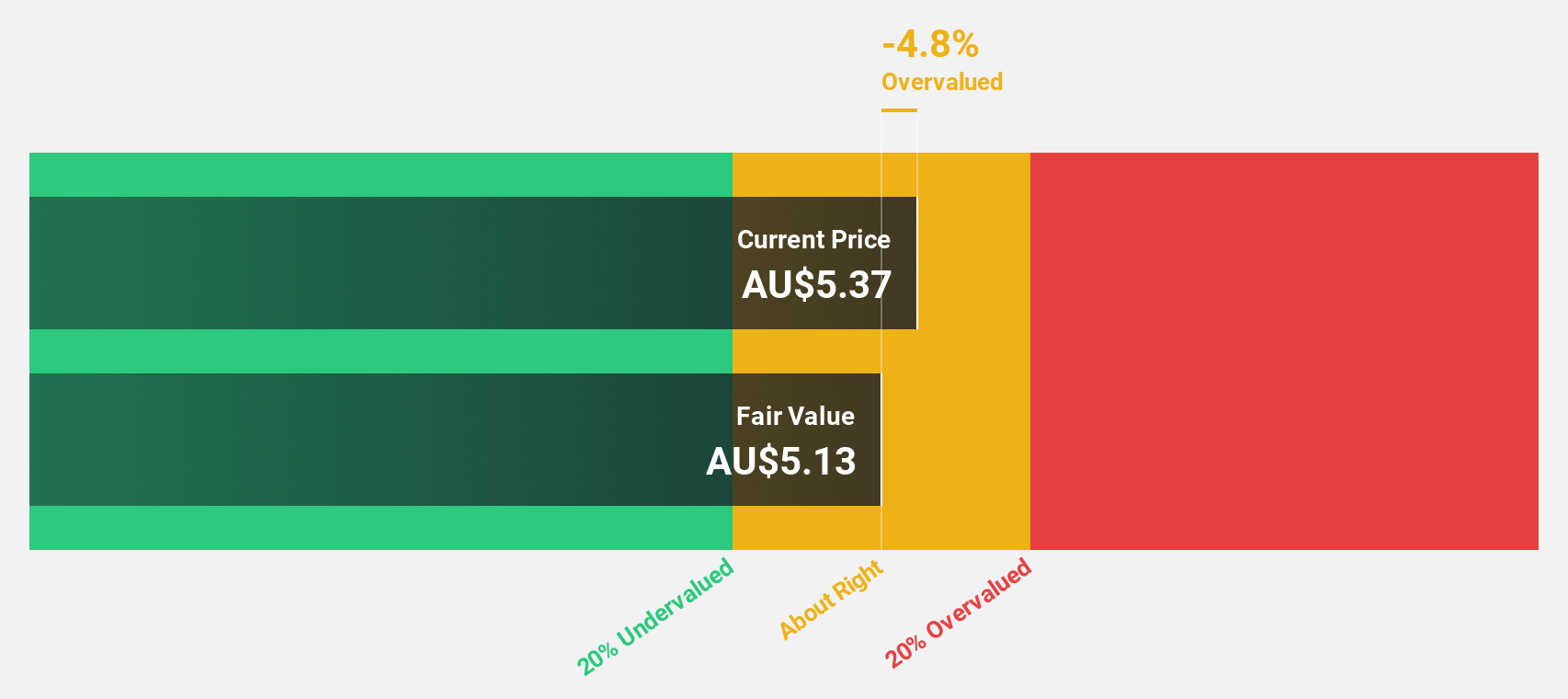

Estimated Discount To Fair Value: 45.2%

Ingenia Communities Group (A$5.13) is trading significantly below its estimated fair value of A$9.36, indicating potential undervaluation based on discounted cash flow analysis. Despite a decline in net income to A$14.02 million for the year ended June 30, 2024, from A$64.37 million previously, revenue increased to A$472.29 million from A$394.47 million a year ago. Earnings are forecasted to grow at 26% per year over the next three years, outpacing market averages but profit margins have decreased significantly over the past year due to large one-off items impacting financial results and debt coverage by operating cash flow remains weak.

- Our expertly prepared growth report on Ingenia Communities Group implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Ingenia Communities Group stock in this financial health report.

Medibank Private (ASX:MPL)

Overview: Medibank Private Limited (ASX:MPL) is an Australian company offering private health insurance and health services, with a market cap of A$10.08 billion.

Operations: Medibank's revenue segments include Health Insurance, generating A$7.90 billion, and Medibank Health, contributing A$360.10 million.

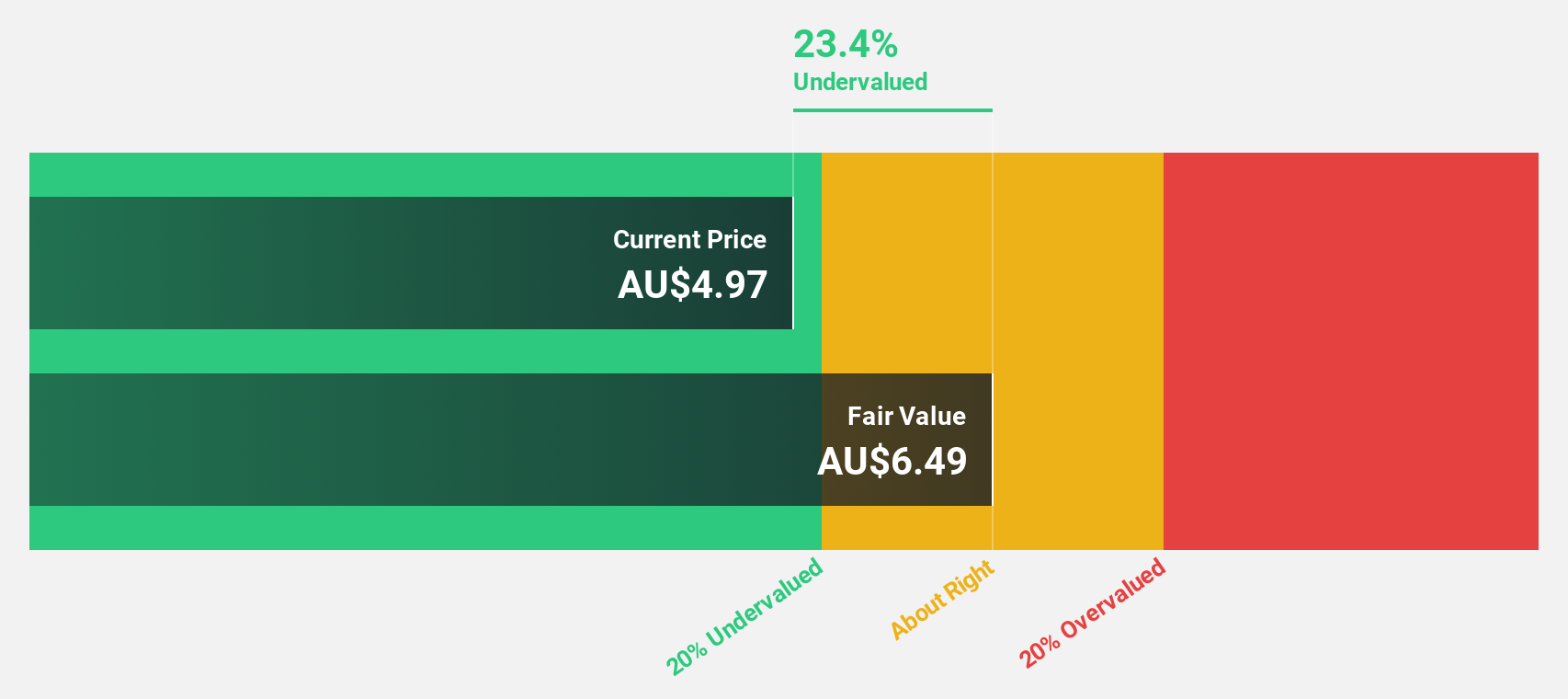

Estimated Discount To Fair Value: 43.5%

Medibank Private (A$3.66) is trading 43.5% below its estimated fair value of A$6.48, indicating significant undervaluation based on discounted cash flow analysis. Despite a modest net income of A$3.9 million for the year ended June 30, 2024, earnings are forecasted to grow at a robust rate of 28.1% per year over the next three years, outpacing the Australian market average growth rate of 12.3%. However, its dividend yield of 4.54% is not well covered by earnings.

- Our earnings growth report unveils the potential for significant increases in Medibank Private's future results.

- Take a closer look at Medibank Private's balance sheet health here in our report.

Next Steps

- Explore the 38 names from our Undervalued ASX Stocks Based On Cash Flows screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MPL

Medibank Private

Provides private health insurance and health services in Australia.

Excellent balance sheet and good value.