- Australia

- /

- Auto Components

- /

- ASX:AOV

Top 3 Undervalued Small Caps On ASX With Insider Action In November 2024

Reviewed by Simply Wall St

As the Australian market experiences a modest uplift with the ASX200 closing up 0.85% at 8,393 points, investors are closely watching economic indicators such as interest rate expectations, which have been pushed out to May by major forecasters due to recent hawkish signals from the RBA. In this environment of fluctuating sector performances—where Energy and Utilities lead while Information Technology lags—identifying small-cap stocks with strong fundamentals and insider action can present unique opportunities for growth-oriented investors.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GWA Group | 16.0x | 1.5x | 42.48% | ★★★★★★ |

| Magellan Financial Group | 8.0x | 5.1x | 31.75% | ★★★★★☆ |

| Collins Foods | 17.9x | 0.7x | 5.06% | ★★★★☆☆ |

| Dicker Data | 18.9x | 0.7x | -57.23% | ★★★★☆☆ |

| Centuria Capital Group | 21.7x | 4.8x | 44.55% | ★★★★☆☆ |

| Eagers Automotive | 11.4x | 0.3x | 37.85% | ★★★★☆☆ |

| FINEOS Corporation Holdings | NA | 3.5x | 45.55% | ★★★★☆☆ |

| Coventry Group | 246.2x | 0.4x | -24.73% | ★★★☆☆☆ |

| Corporate Travel Management | 23.8x | 2.8x | 42.01% | ★★★☆☆☆ |

| Eureka Group Holdings | 18.9x | 6.1x | 25.73% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

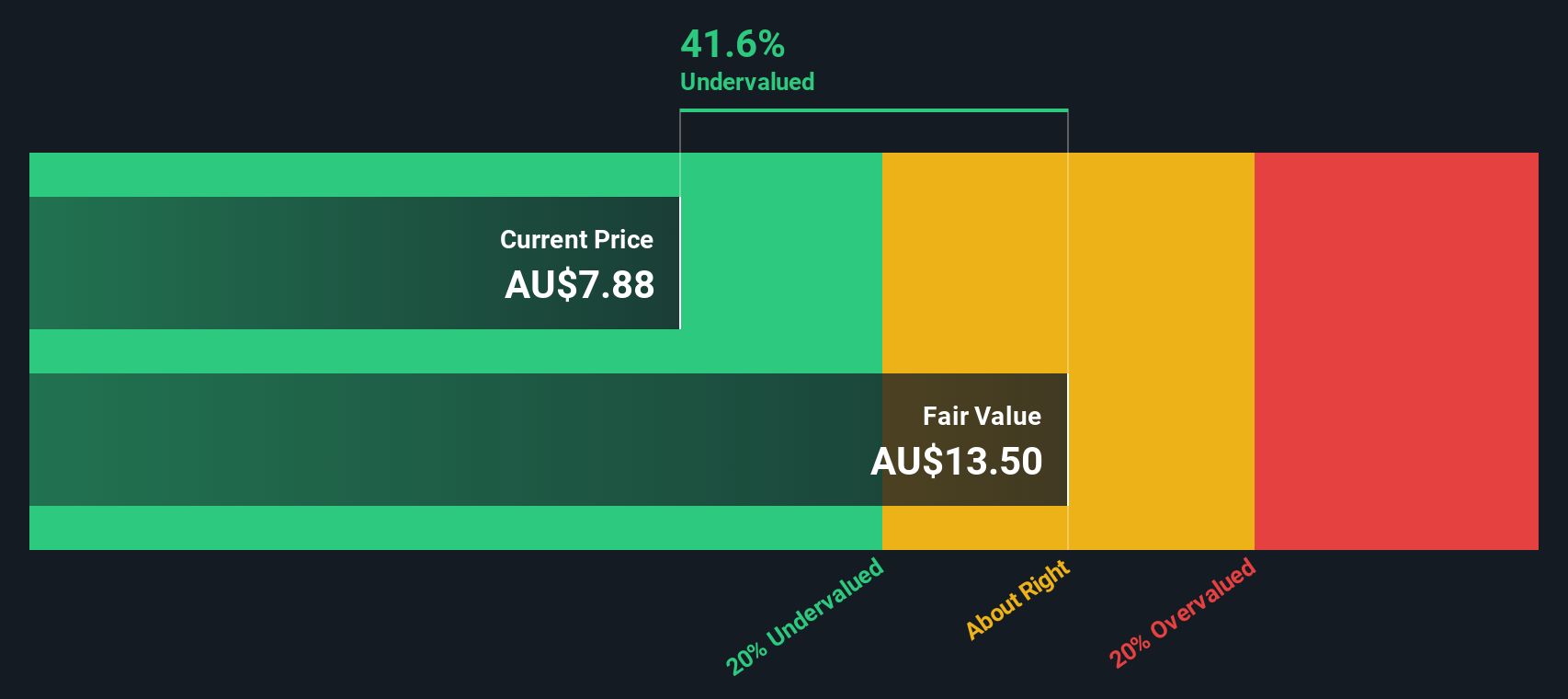

Amotiv (ASX:AOV)

Simply Wall St Value Rating: ★★★★★★

Overview: Amotiv specializes in the production and distribution of powertrain and undercar components, lighting power and electrical systems, as well as 4WD accessories and trailering equipment, with a market cap of A$1.25 billion.

Operations: Amotiv generates revenue primarily from three segments: Powertrain & Undercar, Lighting Power & Electrical, and 4WD Accessories & Trailering. The company has seen fluctuations in its gross profit margin, which reached as high as 57.13% in late 2016 but settled around 44.29% by mid-2024. Operating expenses are a significant component of costs, with sales and marketing being the largest expense within this category.

PE: 14.5x

Amotiv, a smaller Australian company, is drawing attention with insider confidence as they embark on a share buyback program authorized in October 2024. This initiative allows the repurchase of up to 7 million shares, signaling potential value recognition by the company itself. Despite relying entirely on external borrowing for funding, Amotiv projects an annual earnings growth of 8%. Recent leadership changes include Aaron Canning stepping in as CFO, bringing extensive experience from various industries.

- Take a closer look at Amotiv's potential here in our valuation report.

Gain insights into Amotiv's past trends and performance with our Past report.

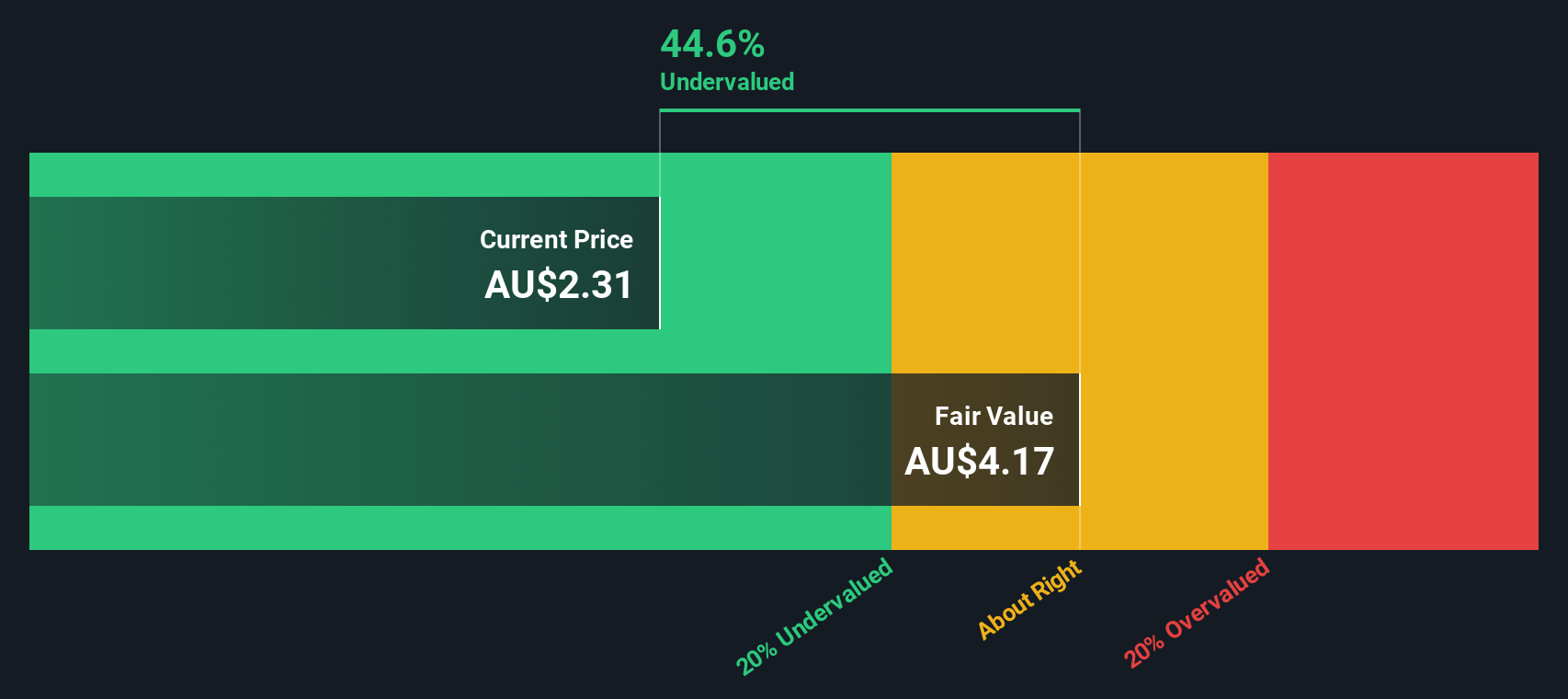

GWA Group (ASX:GWA)

Simply Wall St Value Rating: ★★★★★★

Overview: GWA Group is a company that specializes in water solutions, with operations focused on providing innovative products and services in this sector, and has a market capitalization of A$0.76 billion.

Operations: GWA Group's revenue primarily stems from Water Solutions, with recent figures reaching A$413.49 million. The company's cost of goods sold (COGS) stands at A$251.14 million, leading to a gross profit of A$162.35 million and a gross profit margin of 39.26%. Operating expenses are recorded at A$96.32 million, contributing to a net income margin of 9.34%.

PE: 16.0x

GWA Group, a small company in Australia, shows potential for growth with earnings projected to rise 9.9% annually. Despite relying solely on external borrowing for funding, recent insider confidence is evident as they have been purchasing shares over the past few months. Leadership changes include Brett Draffen joining as Director and Bernadette Inglis succeeding Mr. McDonough as Chair. These developments suggest a strategic shift that could enhance future prospects amidst its current financial structure challenges.

- Delve into the full analysis valuation report here for a deeper understanding of GWA Group.

Gain insights into GWA Group's historical performance by reviewing our past performance report.

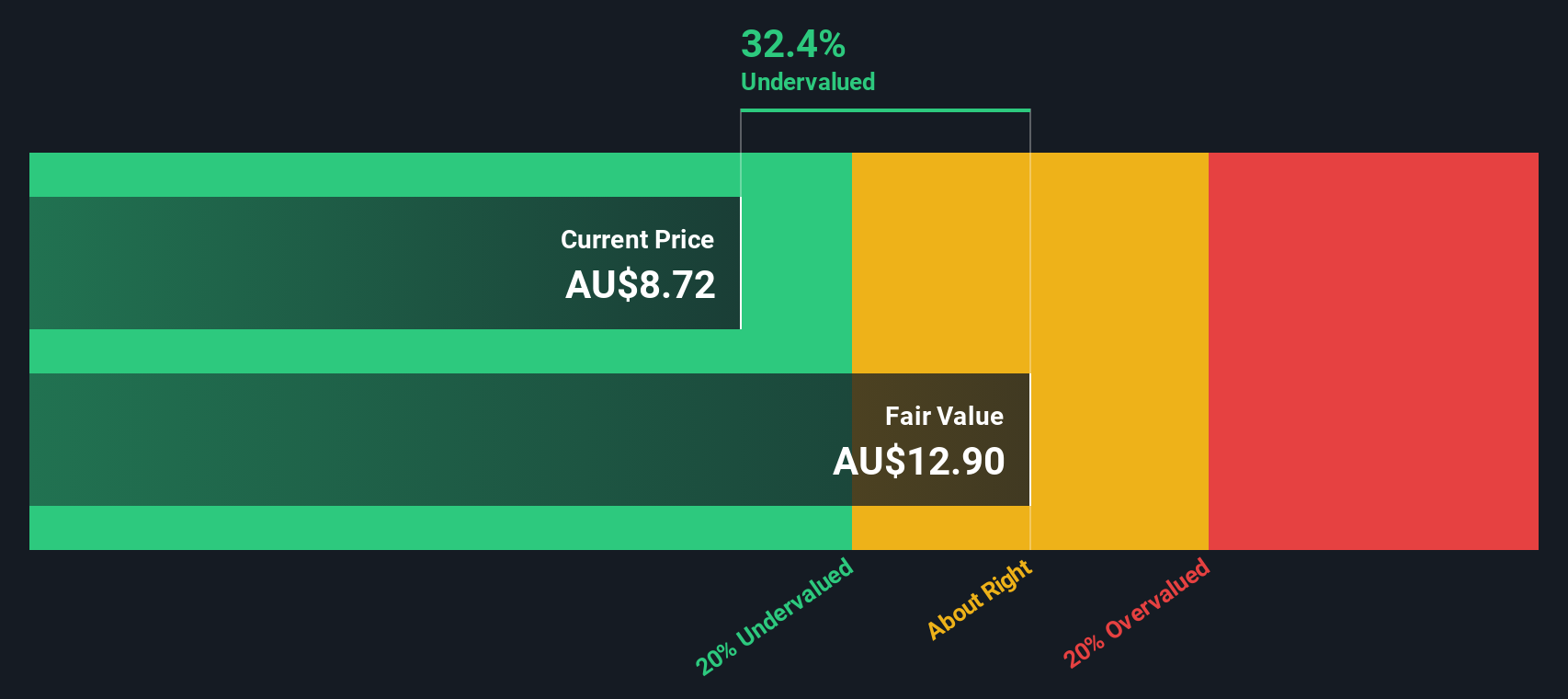

Magellan Financial Group (ASX:MFG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Magellan Financial Group is an Australian-based investment management company that provides investment management services and manages fund investments, with a market capitalization of A$4.98 billion.

Operations: Magellan Financial Group generates revenue primarily through its Investment Management Services, which is the largest contributor among its segments. The company has experienced fluctuations in net income margin, with a notable peak of 69.63% for the period ending June 30, 2022. Operating expenses are a significant cost factor, including general and administrative expenses that have shown variations across different periods.

PE: 8.0x

Magellan Financial Group, a smaller player in Australia, faces challenges with earnings projected to decline by 9.2% annually over the next three years. Despite this, recent insider confidence is evident as they extended their buyback plan until April 2025. The company relies entirely on external borrowing for funding, which adds risk compared to customer deposits. Leadership changes are underway with key figures like Kirsten Morton resigning but staying through 2024 to ensure stability during transitions.

Key Takeaways

- Click here to access our complete index of 25 Undervalued ASX Small Caps With Insider Buying.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AOV

Amotiv

Through its subsidiaries, manufactures, imports, distributes, and sells automotive products in Australia, New Zealand, Thailand, South Korea, France, and the United States.

Very undervalued with excellent balance sheet and pays a dividend.