- Australia

- /

- Metals and Mining

- /

- ASX:MAH

3 Promising ASX Penny Stocks With Market Caps Under A$800M

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 closing up 0.85% at 8,393 points amid shifting expectations around interest rate cuts and sector performances. Penny stocks, though a somewhat outdated term, continue to offer intriguing opportunities for investors looking for growth potential in smaller or newer companies. When these stocks are supported by strong financial health and fundamentals, they can present attractive prospects that stand out in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$325.64M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.89 | A$238.78M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.53 | A$334.88M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.65 | A$808.63M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.44 | A$87.7M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.61 | A$126.61M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.155 | A$65.35M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.79 | A$473.59M | ★★★★☆☆ |

Click here to see the full list of 1,046 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

DevEx Resources (ASX:DEV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: DevEx Resources Limited, with a market cap of A$48.59 million, is involved in the exploration and evaluation of mineral properties in Australia through its subsidiaries.

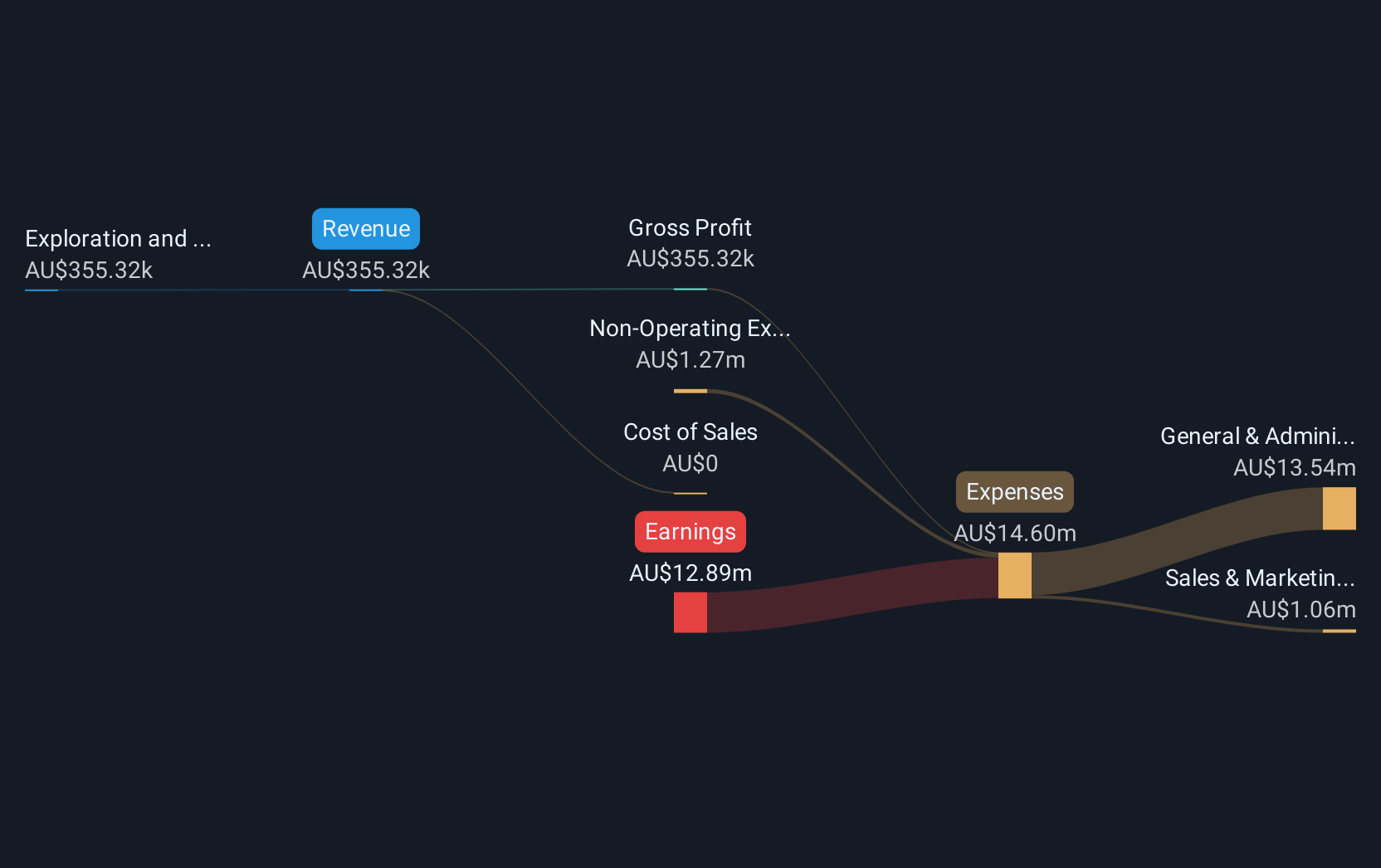

Operations: The company's revenue comes from its exploration and evaluation activities, totaling A$0.1 million.

Market Cap: A$48.59M

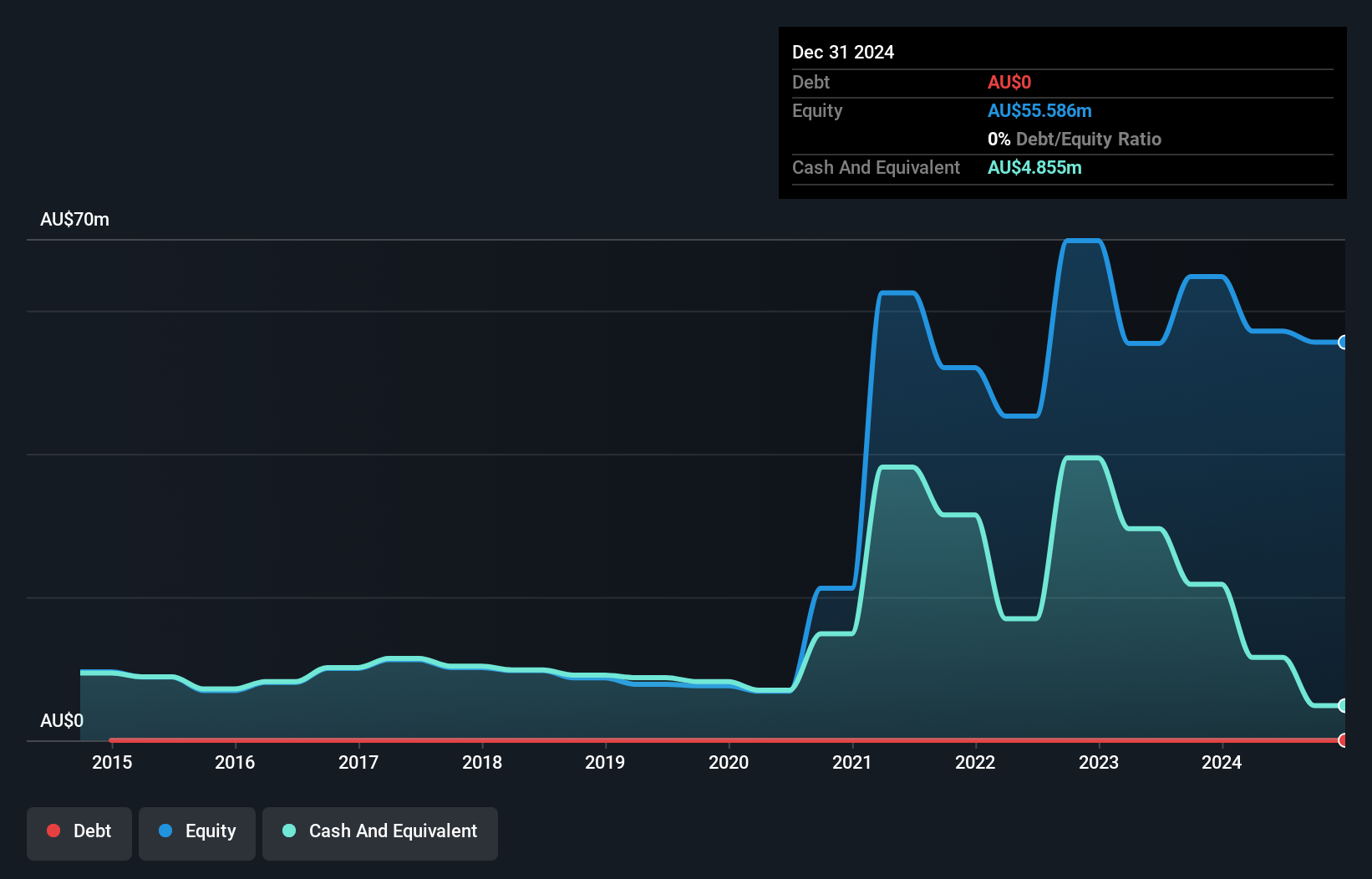

DevEx Resources, with a market cap of A$48.59 million, is a pre-revenue company focused on mineral exploration in Australia. Despite its unprofitability and negative return on equity, the company maintains a strong financial position with short-term assets exceeding both short- and long-term liabilities. Recent leadership changes include appointing Todd Ross as Managing Director to spearhead growth initiatives, reflecting strategic shifts in its project portfolio management. While the share price has been volatile recently, the company's board and management team bring experienced oversight to navigate these challenges. DevEx remains debt-free but has less than one year of cash runway if current cash flow trends persist.

- Click to explore a detailed breakdown of our findings in DevEx Resources' financial health report.

- Learn about DevEx Resources' historical performance here.

Element 25 (ASX:E25)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Element 25 Limited is an Australian company focused on the exploration of mineral properties, with a market capitalization of A$61.03 million.

Operations: The company generates revenue of A$13.30 million from its exploration activities.

Market Cap: A$61.03M

Element 25 Limited, with a market cap of A$61.03 million, focuses on mineral exploration and reported A$13.30 million in revenue for the year ended June 2024. Despite being unprofitable with increasing losses over five years, the company remains debt-free and has short-term assets of A$20.4 million covering both its short- and long-term liabilities. However, it faces challenges with less than a year of cash runway if current cash flow trends continue. Recent initiatives include launching an Investor Hub to enhance transparency and engagement during its growth phase amidst high share price volatility.

- Dive into the specifics of Element 25 here with our thorough balance sheet health report.

- Evaluate Element 25's historical performance by accessing our past performance report.

Macmahon Holdings (ASX:MAH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Macmahon Holdings Limited offers surface and underground mining services, mining support, and civil infrastructure solutions to companies in Australia and Southeast Asia, with a market cap of A$728.47 million.

Operations: The company's revenue is derived entirely from its Mining (Including Civil) segment, which generated A$2.03 billion.

Market Cap: A$728.47M

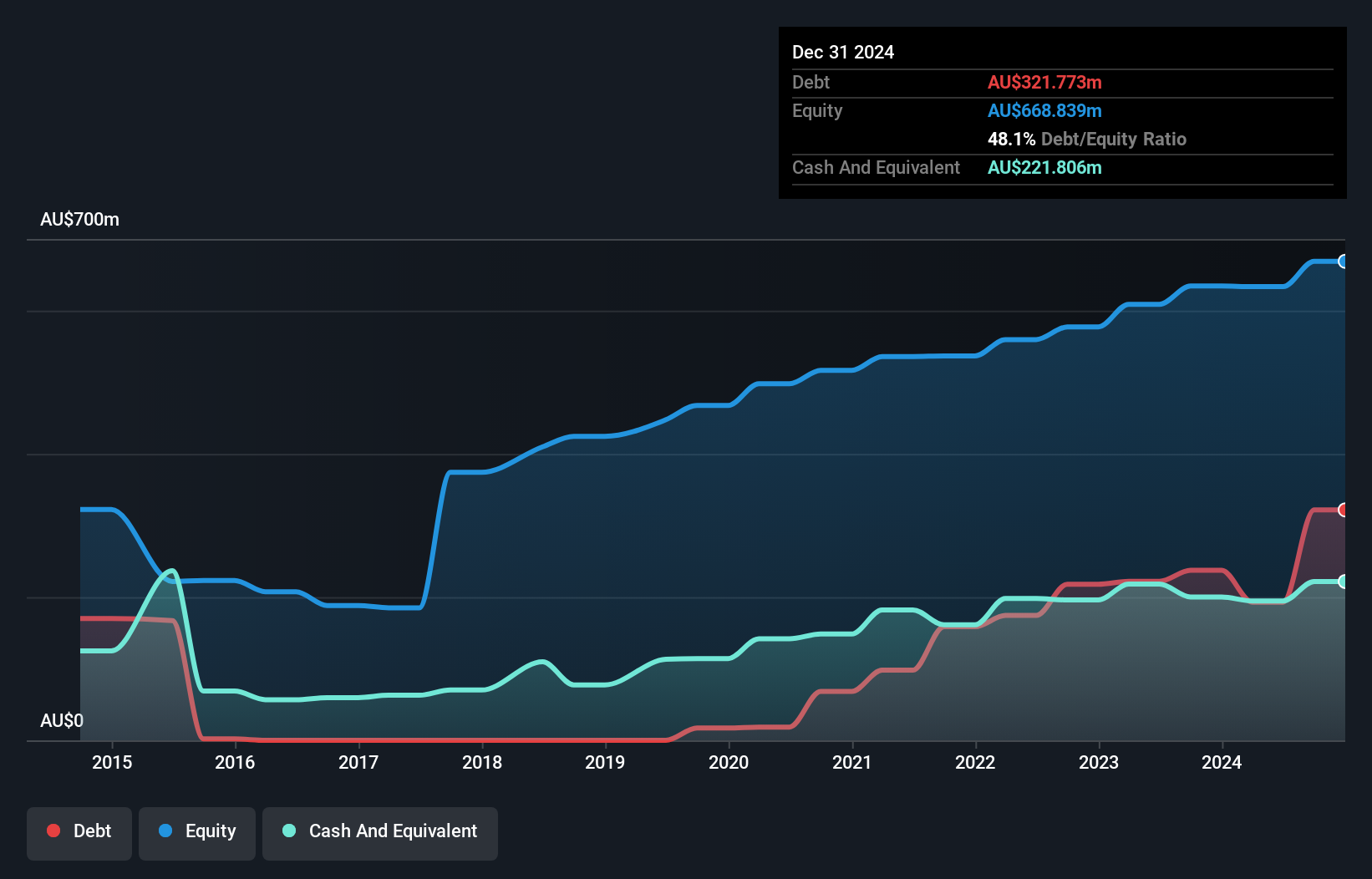

Macmahon Holdings Limited, with a market cap of A$728.47 million, generates substantial revenue from its mining segment, reaching A$2.03 billion. The company maintains a solid financial position with short-term assets exceeding both its short- and long-term liabilities, and cash surpassing total debt. Despite high-quality earnings and well-covered interest payments by EBIT, Macmahon faces challenges such as declining net profit margins and negative earnings growth over the past year. Recent board appointments aim to strengthen governance amidst ongoing strategic adjustments including amendments to the company's constitution approved at the recent AGM.

- Take a closer look at Macmahon Holdings' potential here in our financial health report.

- Explore Macmahon Holdings' analyst forecasts in our growth report.

Summing It All Up

- Get an in-depth perspective on all 1,046 ASX Penny Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAH

Macmahon Holdings

Provides surface mining, underground mining and mining support, and civil infrastructure services to mining companies in Australia and Southeast Asia.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives