- Australia

- /

- Professional Services

- /

- ASX:IPH

3 ASX Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

In recent trading, the ASX200 experienced a slight decline, influenced by shifts in consumer discretionary stocks and banking shares, as well as comments from RBA Governor Michele Bullock regarding interest rate adjustments. Amidst this backdrop of market fluctuations and sector-specific performances, dividend stocks remain an attractive option for investors seeking stable returns; they can provide a buffer against volatility while offering consistent income streams.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| IPH (ASX:IPH) | 7.08% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.40% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.48% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.07% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.50% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.41% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 5.99% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.89% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.74% | ★★★★☆☆ |

| Ricegrowers (ASX:SGLLV) | 5.17% | ★★★★☆☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

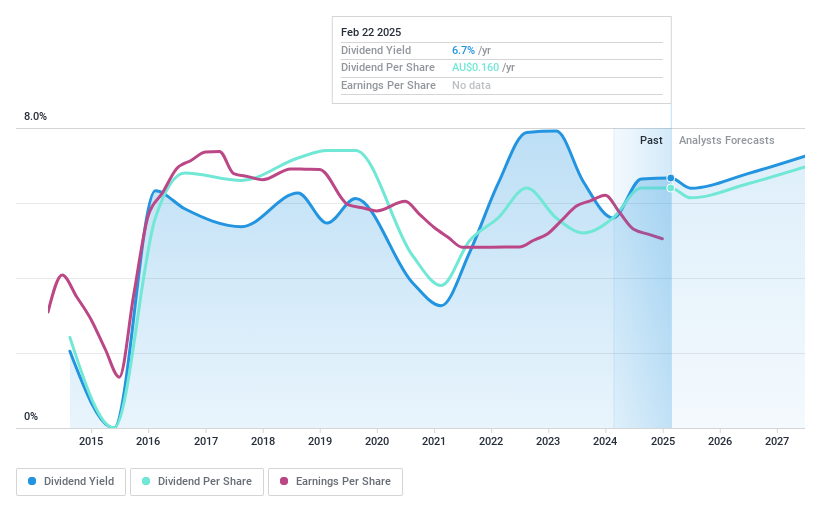

GWA Group (ASX:GWA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GWA Group Limited is engaged in the research, design, manufacture, import, and marketing of building fixtures and fittings for residential and commercial properties across Australia, New Zealand, and international markets with a market cap of A$663.01 million.

Operations: GWA Group Limited generates revenue from its Water Solutions segment, which contributed A$417.40 million.

Dividend Yield: 6.4%

GWA Group's recent dividend increase to A$0.075 per share, payable March 7, 2025, underscores its commitment to shareholders despite a high payout ratio of 111.7%, indicating dividends are not well-covered by earnings. However, the cash payout ratio of 74.3% suggests dividends are supported by cash flows. The company's dividend yield is among the top quartile in Australia but has been historically volatile and unreliable over the past decade, highlighting potential risks for investors prioritizing stability.

- Unlock comprehensive insights into our analysis of GWA Group stock in this dividend report.

- Our valuation report unveils the possibility GWA Group's shares may be trading at a discount.

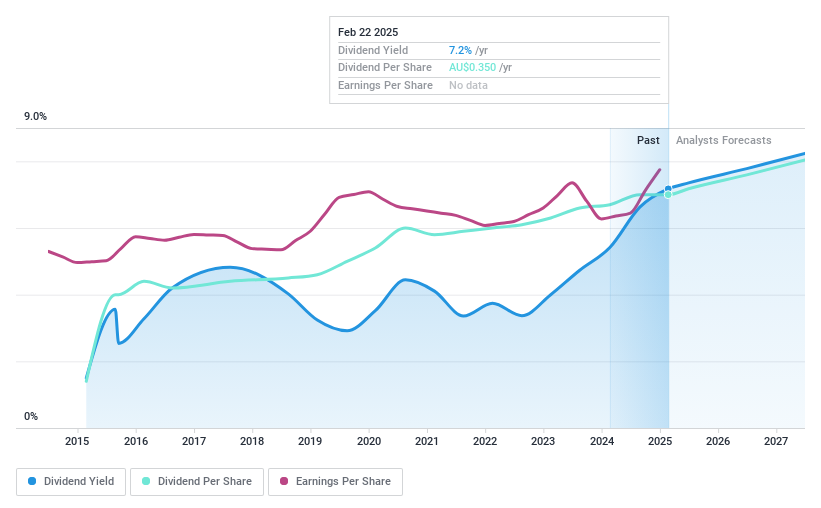

IPH (ASX:IPH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IPH Limited, along with its subsidiaries, offers intellectual property services and products and has a market capitalization of A$1.35 billion.

Operations: IPH Limited generates revenue through its intellectual property services and products.

Dividend Yield: 7.1%

IPH Limited's recent earnings report shows a strong performance with increased sales and revenue, yet its dividend yield of 7.09% is not well-supported by earnings given the high payout ratio of 116.2%. However, dividends are covered by cash flows at an 86.9% cash payout ratio, indicating some level of sustainability. IPH's dividends have been stable and growing over the past decade, offering reliability despite coverage concerns. The stock trades at a favorable value compared to peers.

- Dive into the specifics of IPH here with our thorough dividend report.

- Upon reviewing our latest valuation report, IPH's share price might be too pessimistic.

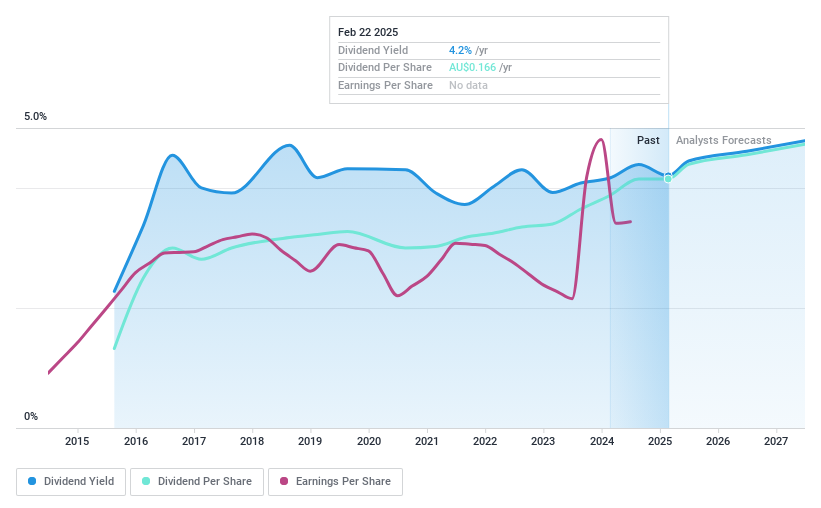

Medibank Private (ASX:MPL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Medibank Private Limited operates as a provider of private health insurance and health services in Australia, with a market cap of A$10.88 billion.

Operations: Medibank Private Limited generates revenue primarily from its Health Insurance segment, which accounts for A$7.90 billion, and its Medibank Health segment, contributing A$360.10 million.

Dividend Yield: 4.2%

Medibank Private's dividend yield of 4.2% is lower than the top quartile in Australia, and its high payout ratio of 92.8% indicates dividends aren't well-covered by earnings. However, with a cash payout ratio of 56.4%, dividends are supported by cash flows, providing some stability. Over the past decade, Medibank has consistently increased its dividends with minimal volatility, though future sustainability may be challenged without improved earnings coverage.

- Click here and access our complete dividend analysis report to understand the dynamics of Medibank Private.

- Our comprehensive valuation report raises the possibility that Medibank Private is priced lower than what may be justified by its financials.

Next Steps

- Delve into our full catalog of 30 Top ASX Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IPH

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives