Insurance Australia Group (ASX:IAG) Reports AUD 898M Net Profit and Announces AUD 350M Share Buyback Program

Reviewed by Simply Wall St

Insurance Australia Group (ASX:IAG) is currently experiencing a mix of strong financial performance and significant market challenges. Recent news highlights a 79% increase in its insurance result and strategic investments in technology, counterbalanced by inflationary pressures and regulatory risks. In the discussion that follows, we will explore IAG's strengths, weaknesses, growth opportunities, and potential threats to provide a comprehensive overview of the company's current business situation.

Explore the full analysis report here for a deeper understanding of Insurance Australia Group.

Strengths: Core Advantages Driving Sustained Success For Insurance Australia Group

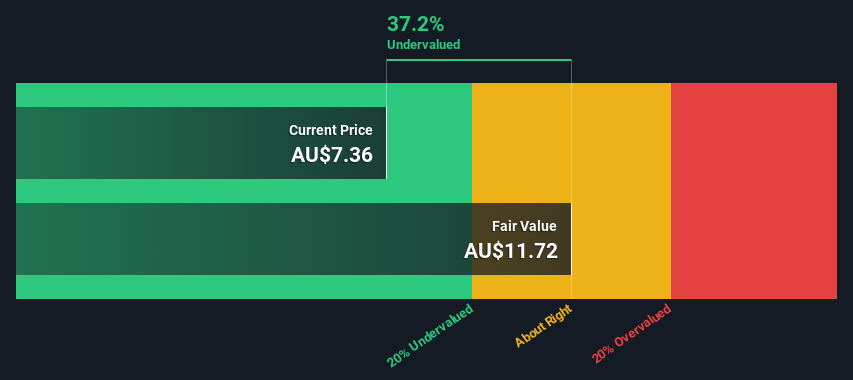

Insurance Australia Group (IAG) has demonstrated strong financial performance, with a net profit of AUD 898 million and a significant 79% increase in its insurance result, as highlighted by CEO Nicholas Hawkins. The company's solid capital position, with a debt-to-equity ratio of 35.1% and an interest coverage ratio of 9.1, underscores its financial health. IAG's investment in technological innovations, particularly in claims management, has enhanced customer satisfaction, reflected in high NPS scores in both Australia and New Zealand. Additionally, IAG is trading at 37.2% below its estimated fair value of AUD 11.72, presenting a potential upside despite being considered expensive based on its Price-To-Earnings Ratio (19.4x) compared to the global insurance industry average (11.3x).

Weaknesses: Critical Issues Affecting Insurance Australia Group's Performance and Areas For Growth

IAG faces several challenges, including the impact of inflation on premiums and high costs, particularly in motor parts inflation which peaked at 15% in FY '23. The company's earnings growth over the past year (8.8%) did not outperform the insurance industry average of 25.4%. Furthermore, IAG's current net profit margins (5.6%) are lower than last year (5.8%), indicating a potential area for improvement. Despite trading below its fair value, IAG is considered expensive based on its Price-To-Earnings Ratio (19.4x) compared to the global insurance industry average (11.3x), suggesting potential overvaluation concerns. To dive deeper into how Insurance Australia Group's valuation metrics are shaping its market position, check out our detailed analysis of Insurance Australia Group's Valuation.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

IAG has numerous growth opportunities, including the expansion of services through initiatives like the NRMA Insurance Help Nation education programs with the Australian Red Cross. The implementation of innovative pricing models, such as the new sophisticated pricing engine integrating climate science expertise, can enhance competitive advantage. The company's intermediated business in New Zealand, which delivered 12% growth and a $210 million insurance result, indicates potential for further market expansion. Additionally, IAG's Enterprise Platform, providing a consistent policy pricing claims engine across its retail business, positions it well for technological advancements and operational efficiency.

Threats: Key Risks and Challenges That Could Impact Insurance Australia Group's Success

Despite these opportunities, IAG faces significant threats, including competition and market challenges, with a slight slowdown in rate increases. Regulatory risks remain a concern, as ongoing scrutiny could impact operations. Economic factors, particularly the impact of climate change and natural perils, pose a substantial risk to the cost of insurance globally, including in Australia and New Zealand. Operational risks are also heightened by the expectation of more frequent and severe extreme weather events in these regions. These external factors could potentially affect IAG's growth and market share in the long term.

Conclusion

Insurance Australia Group (IAG) demonstrates strong financial health and innovative capabilities, yet faces challenges that could impact its future performance. Despite trading at 37.2% below its estimated fair value of AUD 11.72, IAG's Price-To-Earnings Ratio of 19.4x is higher than the global insurance industry average of 11.3x, indicating it may be priced higher relative to its peers. The company's technological advancements and market expansion initiatives offer promising growth opportunities, but rising costs, regulatory scrutiny, and climate-related risks present significant threats. Overall, while IAG's current market price suggests potential for appreciation, investors should weigh these opportunities against the inherent risks and competitive pressures in the insurance sector.

Make It Happen

- Is Insurance Australia Group part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

If you're looking to trade Insurance Australia Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:IAG

Insurance Australia Group

Insurance Australia Group Limited underwrites general insurance products and provides investment management services in Australia and New Zealand.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives