- Australia

- /

- Healthcare Services

- /

- ASX:RHY

Here's Why We're Not Too Worried About Rhythm Biosciences' (ASX:RHY) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. Indeed, Rhythm Biosciences (ASX:RHY) stock is up 1,830% in the last year, providing strong gains for shareholders. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given its strong share price performance, we think it's worthwhile for Rhythm Biosciences shareholders to consider whether its cash burn is concerning. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for Rhythm Biosciences

Does Rhythm Biosciences Have A Long Cash Runway?

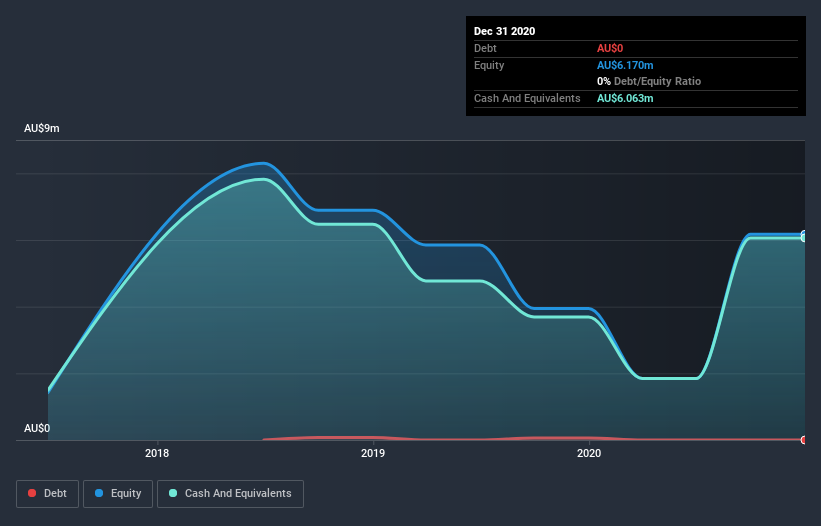

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. Rhythm Biosciences has such a small amount of debt that we'll set it aside, and focus on the AU$6.1m in cash it held at December 2020. Importantly, its cash burn was AU$3.3m over the trailing twelve months. So it had a cash runway of approximately 22 months from December 2020. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. Depicted below, you can see how its cash holdings have changed over time.

How Is Rhythm Biosciences' Cash Burn Changing Over Time?

In our view, Rhythm Biosciences doesn't yet produce significant amounts of operating revenue, since it reported just AU$1.1m in the last twelve months. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. With the cash burn rate up 21% in the last year, it seems that the company is ratcheting up investment in the business over time. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. Admittedly, we're a bit cautious of Rhythm Biosciences due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Hard Would It Be For Rhythm Biosciences To Raise More Cash For Growth?

Given its cash burn trajectory, Rhythm Biosciences shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Rhythm Biosciences has a market capitalisation of AU$313m and burnt through AU$3.3m last year, which is 1.1% of the company's market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

How Risky Is Rhythm Biosciences' Cash Burn Situation?

As you can probably tell by now, we're not too worried about Rhythm Biosciences' cash burn. For example, we think its cash burn relative to its market cap suggests that the company is on a good path. Although its increasing cash burn does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. On another note, we conducted an in-depth investigation of the company, and identified 4 warning signs for Rhythm Biosciences (3 are concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

When trading Rhythm Biosciences or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:RHY

Rhythm Biosciences

A medical diagnostics company, provides blood tests for the detection of cancers in Australia and the United States.

Adequate balance sheet with very low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026