- Australia

- /

- Medical Equipment

- /

- ASX:PNV

ASX Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

After a challenging Week 11, the Australian market is showing signs of recovery, buoyed by Wall Street's rally and China's new stimulus measures. In such a fluctuating landscape, identifying stocks with strong fundamentals becomes crucial for investors. Penny stocks, though often associated with speculative trading, can still offer significant opportunities when backed by solid financials. This article will explore three penny stocks that stand out for their potential to deliver value and growth amidst current market conditions.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.61 | A$75.95M | ★★★★★★ |

| Bisalloy Steel Group (ASX:BIS) | A$3.10 | A$147.1M | ★★★★★★ |

| Regal Partners (ASX:RPL) | A$2.78 | A$932.4M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.595 | A$116.84M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.26 | A$350.05M | ★★★★★☆ |

| CTI Logistics (ASX:CLX) | A$1.62 | A$126.38M | ★★★★☆☆ |

| West African Resources (ASX:WAF) | A$2.21 | A$2.52B | ★★★★★★ |

| MotorCycle Holdings (ASX:MTO) | A$1.855 | A$136.91M | ★★★★★★ |

| NRW Holdings (ASX:NWH) | A$2.73 | A$1.25B | ★★★★★☆ |

| Accent Group (ASX:AX1) | A$1.76 | A$996.16M | ★★★★☆☆ |

Click here to see the full list of 983 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Bega Cheese (ASX:BGA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bega Cheese Limited engages in the receiving, processing, manufacturing, and distribution of dairy and other food-related products in Australia, with a market cap of A$1.52 billion.

Operations: The company's revenue is derived from two main segments: Bulk, contributing A$1.00 billion, and Branded products, generating A$3.05 billion.

Market Cap: A$1.52B

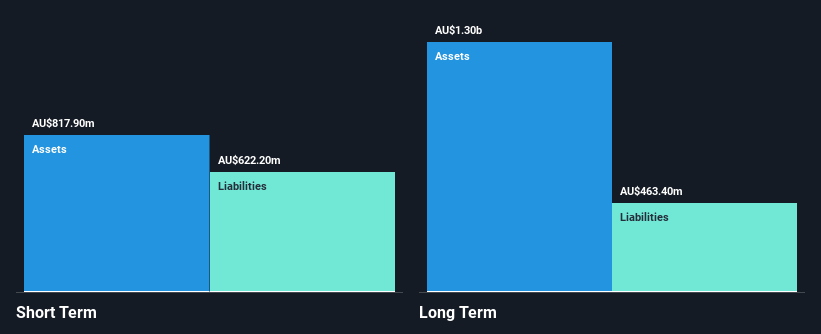

Bega Cheese has recently achieved profitability, distinguishing itself from the broader food industry downturn. Its financial health is supported by short-term assets exceeding both short and long-term liabilities, and its debt is well-covered by operating cash flow. However, interest coverage remains below optimal levels. Despite a 38.7% annual decline in earnings over five years, recent results show improvement with net income rising to A$30.2 million for the half-year ending December 2024. The company declared a fully franked interim dividend of 6 cents per share, reflecting confidence in its ongoing financial stability amidst market volatility.

- Navigate through the intricacies of Bega Cheese with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Bega Cheese's future.

Berkeley Energia (ASX:BKY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Berkeley Energia Limited is involved in the exploration and development of mineral properties in Spain, with a market cap of A$191.69 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$191.69M

Berkeley Energia Limited, with a market cap of A$191.69 million, is pre-revenue and has become profitable recently, reporting a net income of A$0.831 million for the half-year ending December 2024. Despite low revenue (A$-25K), the company benefits from having no debt and strong financial stability with short-term assets (A$80.1M) exceeding both short-term (A$1.7M) and long-term liabilities (A$1.8M). The management team is experienced, averaging 9.4 years in tenure, which may contribute to its operational stability amidst high volatility in penny stocks markets.

- Click to explore a detailed breakdown of our findings in Berkeley Energia's financial health report.

- Evaluate Berkeley Energia's historical performance by accessing our past performance report.

PolyNovo (ASX:PNV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices across the United States, Australia, New Zealand, and internationally with a market cap of A$849.74 million.

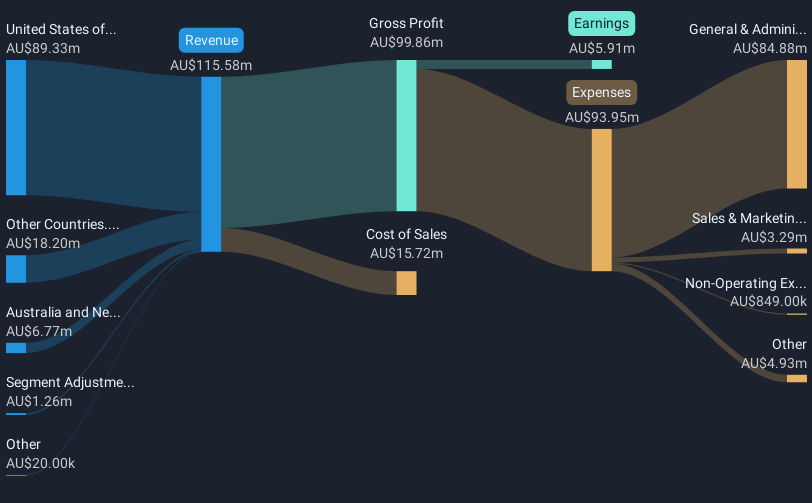

Operations: The company generates revenue of A$115.58 million from the development, manufacturing, and commercialization of its NovoSorb technology.

Market Cap: A$849.74M

PolyNovo Limited, with a market cap of A$849.74 million, has demonstrated robust growth in earnings, increasing by 270.2% over the past year and surpassing industry averages. The company reported half-year revenue of A$59.89 million and net income of A$3.34 million, reflecting improved profit margins from 1.9% to 5.1%. Despite negative operating cash flow impacting debt coverage, PolyNovo maintains more cash than total debt and has not experienced significant shareholder dilution recently. While its board is seasoned with an average tenure of 5.4 years, the management team remains relatively new with an average tenure of 1.5 years.

- Dive into the specifics of PolyNovo here with our thorough balance sheet health report.

- Gain insights into PolyNovo's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Navigate through the entire inventory of 983 ASX Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PNV

PolyNovo

Designs, manufactures, and sells biodegradable medical devices in the United States, Australia, New Zealand, and internationally.

High growth potential with proven track record.

Market Insights

Community Narratives