- Australia

- /

- Metals and Mining

- /

- ASX:GOR

3 ASX Stocks That Could Be Trading At A Discount For Savvy Investors

Reviewed by Simply Wall St

The Australian stock market has been experiencing a remarkable upswing, with the ASX200 closing at a new record high and showing a significant 19% increase over the past year. Amidst this strong performance, identifying stocks that may be trading at a discount can offer potential opportunities for investors seeking value in an otherwise buoyant market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Accent Group (ASX:AX1) | A$2.55 | A$4.92 | 48.2% |

| DUG Technology (ASX:DUG) | A$1.75 | A$3.36 | 47.9% |

| MLG Oz (ASX:MLG) | A$0.64 | A$1.17 | 45.2% |

| Ingenia Communities Group (ASX:INA) | A$5.03 | A$9.24 | 45.6% |

| Genesis Minerals (ASX:GMD) | A$2.43 | A$4.82 | 49.6% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Vault Minerals (ASX:VAU) | A$0.34 | A$0.65 | 47.8% |

| Gold Road Resources (ASX:GOR) | A$2.00 | A$3.65 | 45.2% |

| Energy One (ASX:EOL) | A$5.30 | A$10.56 | 49.8% |

| FINEOS Corporation Holdings (ASX:FCL) | A$1.915 | A$3.75 | 48.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Gold Road Resources (ASX:GOR)

Overview: Gold Road Resources Limited, along with its subsidiaries, is involved in the exploration of gold properties in Western Australia and has a market capitalization of approximately A$2.21 billion.

Operations: The company generates revenue primarily from its Development and Production segment, amounting to A$454.82 million.

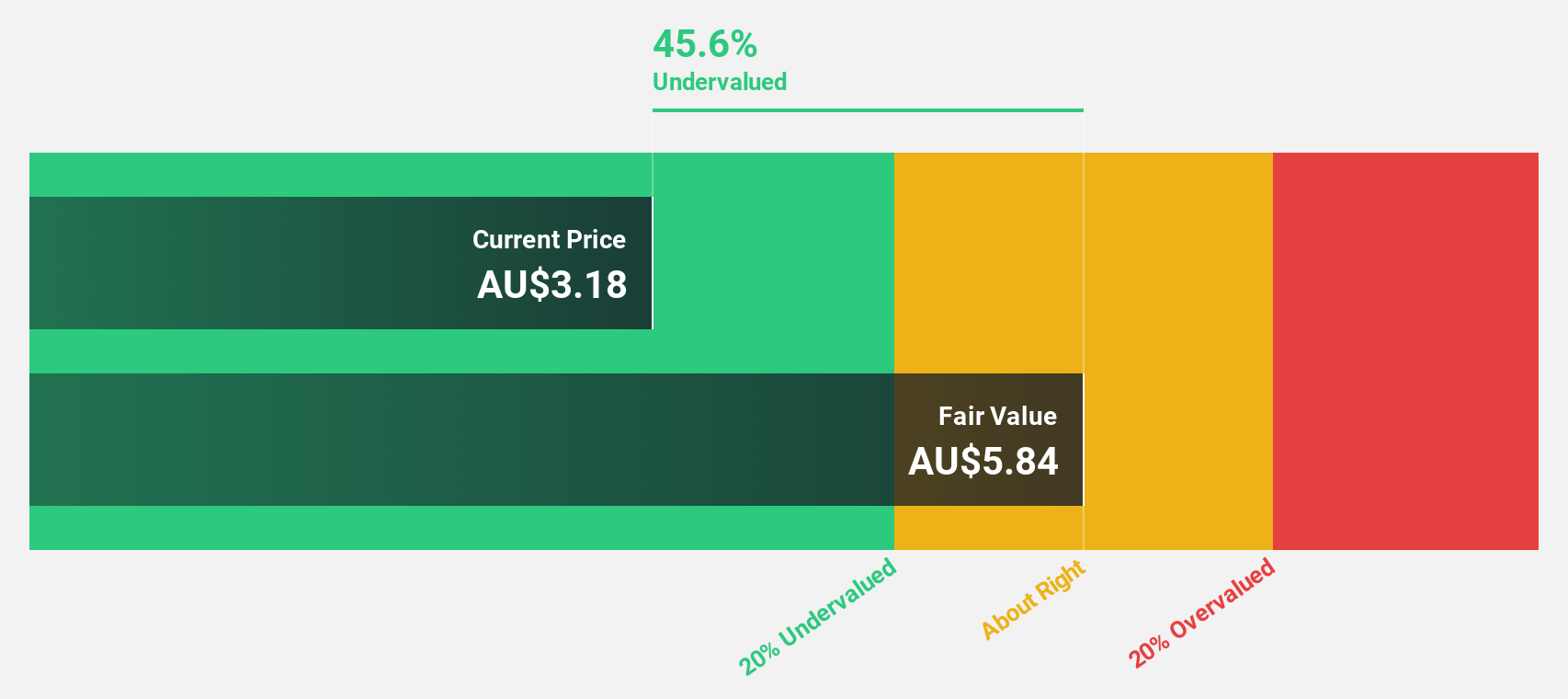

Estimated Discount To Fair Value: 45.2%

Gold Road Resources is trading at A$2, significantly below its estimated fair value of A$3.65, suggesting it might be undervalued based on cash flows. The company's earnings are expected to grow 20.8% annually over the next three years, outpacing the Australian market's growth rate of 12.6%. However, its forecasted Return on Equity remains modest at 13.2%. Recent M&A discussions involving Gold Road highlight potential strategic opportunities in the gold sector.

- Our growth report here indicates Gold Road Resources may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Gold Road Resources stock in this financial health report.

PolyNovo (ASX:PNV)

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices in the United States, Australia, New Zealand, and internationally with a market cap of A$1.51 billion.

Operations: The company's revenue is primarily generated from the development, manufacturing, and commercialization of the NovoSorb Technology, amounting to A$103.23 million.

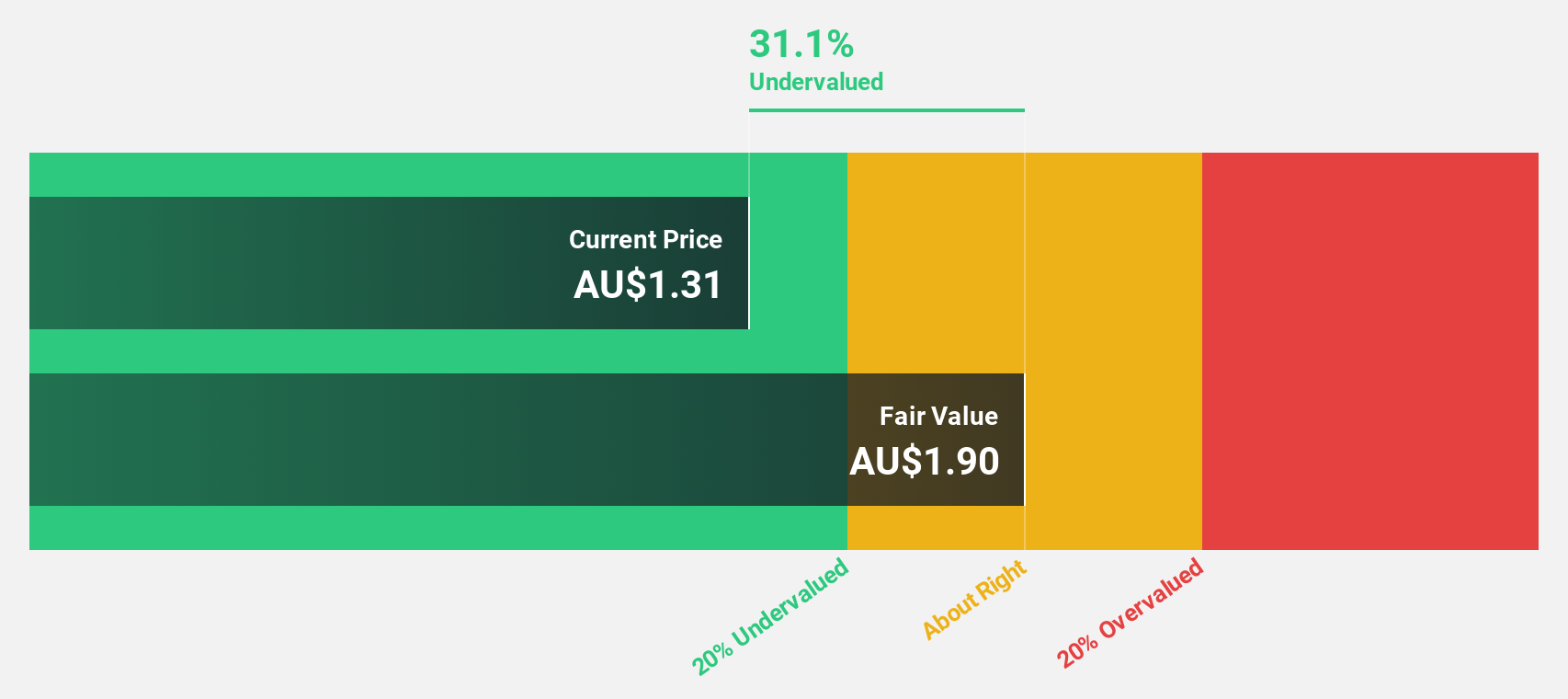

Estimated Discount To Fair Value: 25.6%

PolyNovo, currently trading at A$2.25, is valued below its estimated fair value of A$3.02, presenting a potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 38.4% annually over the next three years, surpassing the Australian market's growth rate of 12.6%. Despite recent insider selling and executive changes, including the retirement of long-serving director Bruce Rathie, its high forecasted Return on Equity (28.1%) remains promising.

- Upon reviewing our latest growth report, PolyNovo's projected financial performance appears quite optimistic.

- Click here to discover the nuances of PolyNovo with our detailed financial health report.

Temple & Webster Group (ASX:TPW)

Overview: Temple & Webster Group Ltd operates as an online retailer specializing in furniture, homewares, and home improvement products in Australia, with a market cap of A$1.41 billion.

Operations: The company's revenue primarily comes from the sale of furniture, homewares, and home improvement products, totaling A$497.84 million.

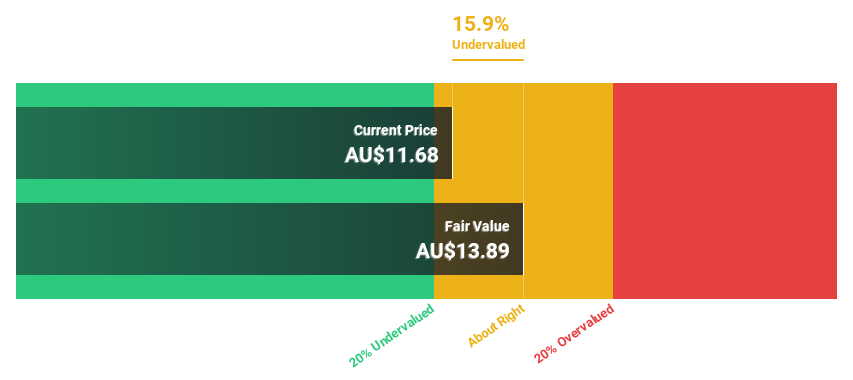

Estimated Discount To Fair Value: 10.6%

Temple & Webster Group, trading at A$12.26, is slightly undervalued relative to its fair value estimate of A$13.71. Despite a decrease in profit margins from 2.1% to 0.4%, earnings are expected to grow significantly at 40.16% annually, outpacing the broader Australian market's growth rate of 12.6%. Revenue growth is forecasted at 15.8% per year, surpassing the market average of 5.8%, although impacted by large one-off items affecting financial results.

- According our earnings growth report, there's an indication that Temple & Webster Group might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Temple & Webster Group.

Taking Advantage

- Get an in-depth perspective on all 37 Undervalued ASX Stocks Based On Cash Flows by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GOR

Gold Road Resources

Engages in the exploration of gold properties in Western Australia.

Excellent balance sheet with reasonable growth potential.