- Australia

- /

- Oil and Gas

- /

- ASX:MEU

3 Promising ASX Penny Stocks With At Least A$40M Market Cap

Reviewed by Simply Wall St

The Australian stock market is experiencing a cautious start to the day, with shares expected to open nearly flat amid global economic uncertainties and recent sell-offs in the U.S. technology sector. Despite these challenges, opportunities remain for investors willing to explore lesser-known areas of the market. Penny stocks, though often considered niche investments, can offer unique growth potential when supported by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.86 | A$237.13M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.53 | A$328.68M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.90 | A$106.54M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.04 | A$332.15M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$228.62M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.625 | A$796.38M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.08 | A$322.17M | ★★★★☆☆ |

| Servcorp (ASX:SRV) | A$4.99 | A$492.34M | ★★★★☆☆ |

Click here to see the full list of 1,051 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Bravura Solutions (ASX:BVS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bravura Solutions Limited develops, licenses, and maintains software applications for the wealth management and funds administration sectors across Australia, the United Kingdom, New Zealand, and internationally with a market cap of A$1.01 billion.

Operations: Bravura Solutions generates revenue from two primary segments: Wealth Management, contributing A$163.13 million, and Funds Administration, with A$87.28 million.

Market Cap: A$1.01B

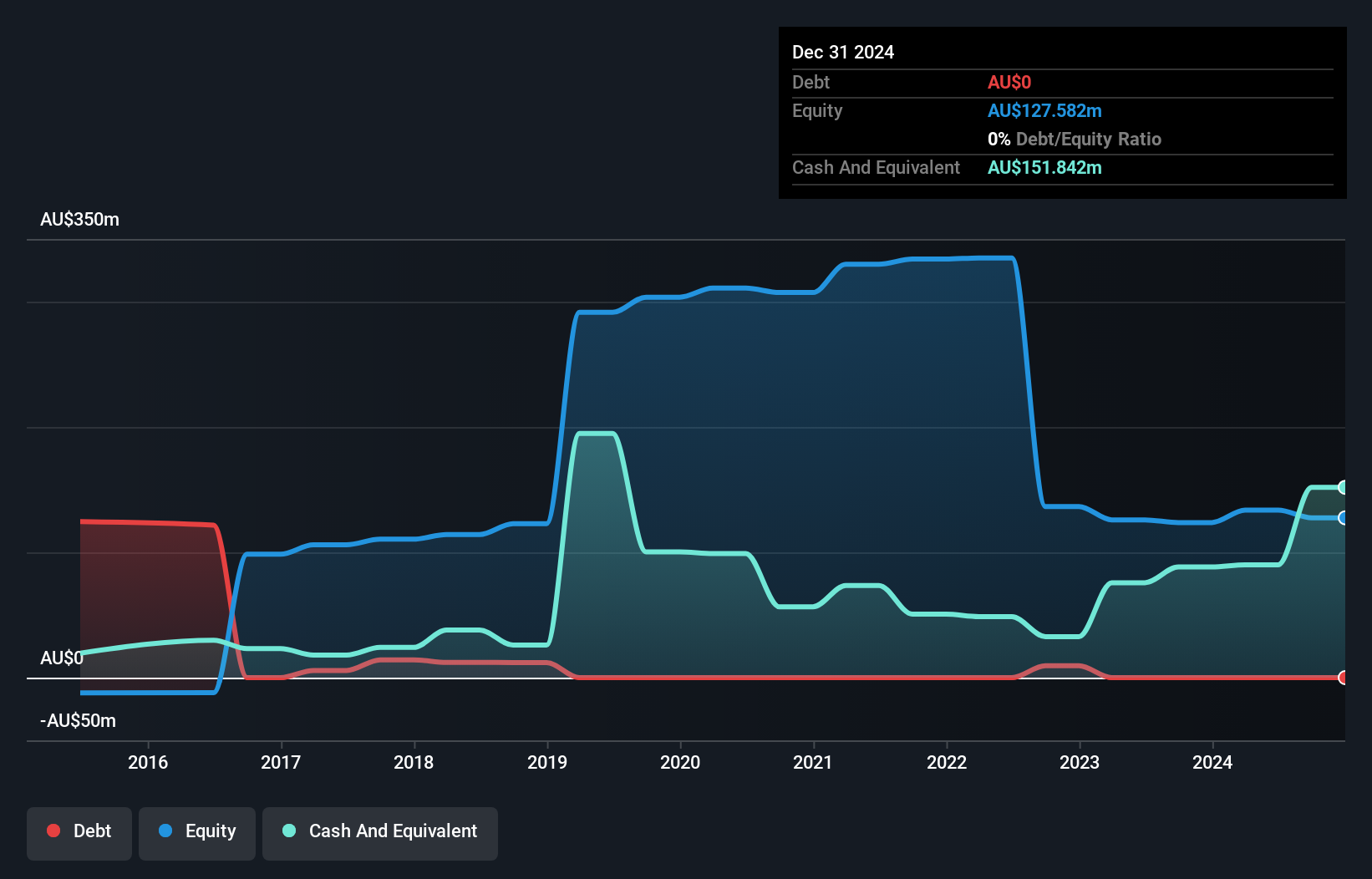

Bravura Solutions has recently raised its revenue guidance for fiscal 2025 to A$240 million to A$245 million, reflecting positive momentum. The company is debt-free, with short-term assets of A$154.8 million comfortably covering both short and long-term liabilities. Bravura has become profitable in the past year, although its Return on Equity remains low at 6.6%. Despite a relatively inexperienced board and management team, the company trades slightly below its estimated fair value and shows stable weekly volatility at 8%, indicating potential stability amidst growth prospects in the software sector.

- Get an in-depth perspective on Bravura Solutions' performance by reading our balance sheet health report here.

- Gain insights into Bravura Solutions' future direction by reviewing our growth report.

Estrella Resources (ASX:ESR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Estrella Resources Limited, with a market cap of A$45.62 million, is involved in the exploration of mineral resources in Western Australia and Timor-Leste.

Operations: Estrella Resources Limited has not reported any specific revenue segments.

Market Cap: A$45.62M

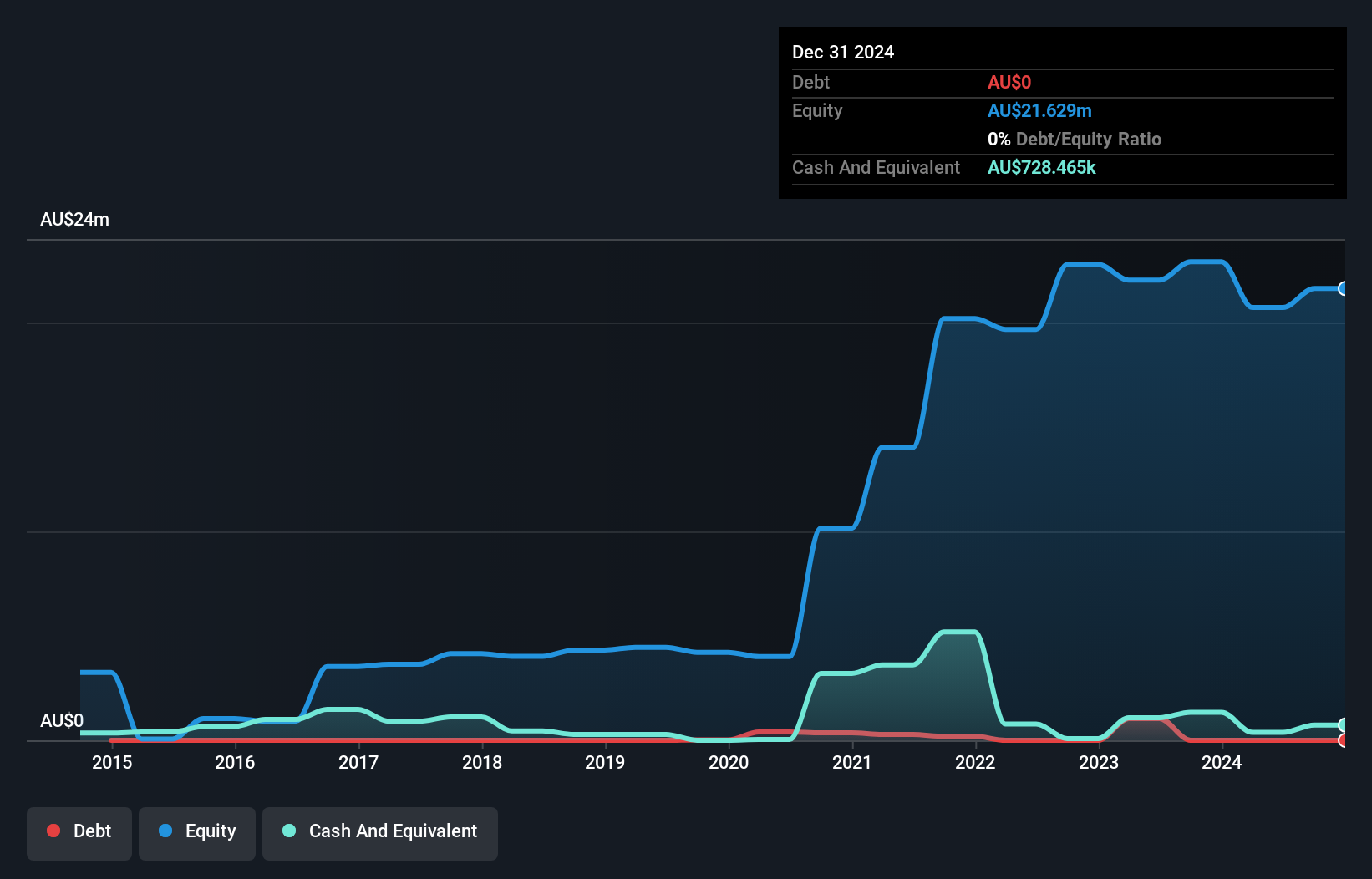

Estrella Resources Limited, with a market cap of A$45.62 million, is pre-revenue and currently unprofitable. The company recently completed a follow-on equity offering of A$1.25 million, which may extend its cash runway beyond the current two months based on free cash flow estimates. Despite having no debt and short-term assets exceeding liabilities, Estrella's share price has been highly volatile over the past three months. Shareholders have experienced dilution with an 8.1% increase in shares outstanding over the past year, while management's average tenure suggests some level of experience within the team.

- Take a closer look at Estrella Resources' potential here in our financial health report.

- Learn about Estrella Resources' historical performance here.

Marmota (ASX:MEU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Marmota Limited is an Australian company focused on the exploration of mineral properties, with a market capitalization of A$48.90 million.

Operations: Marmota Limited does not report any specific revenue segments.

Market Cap: A$48.9M

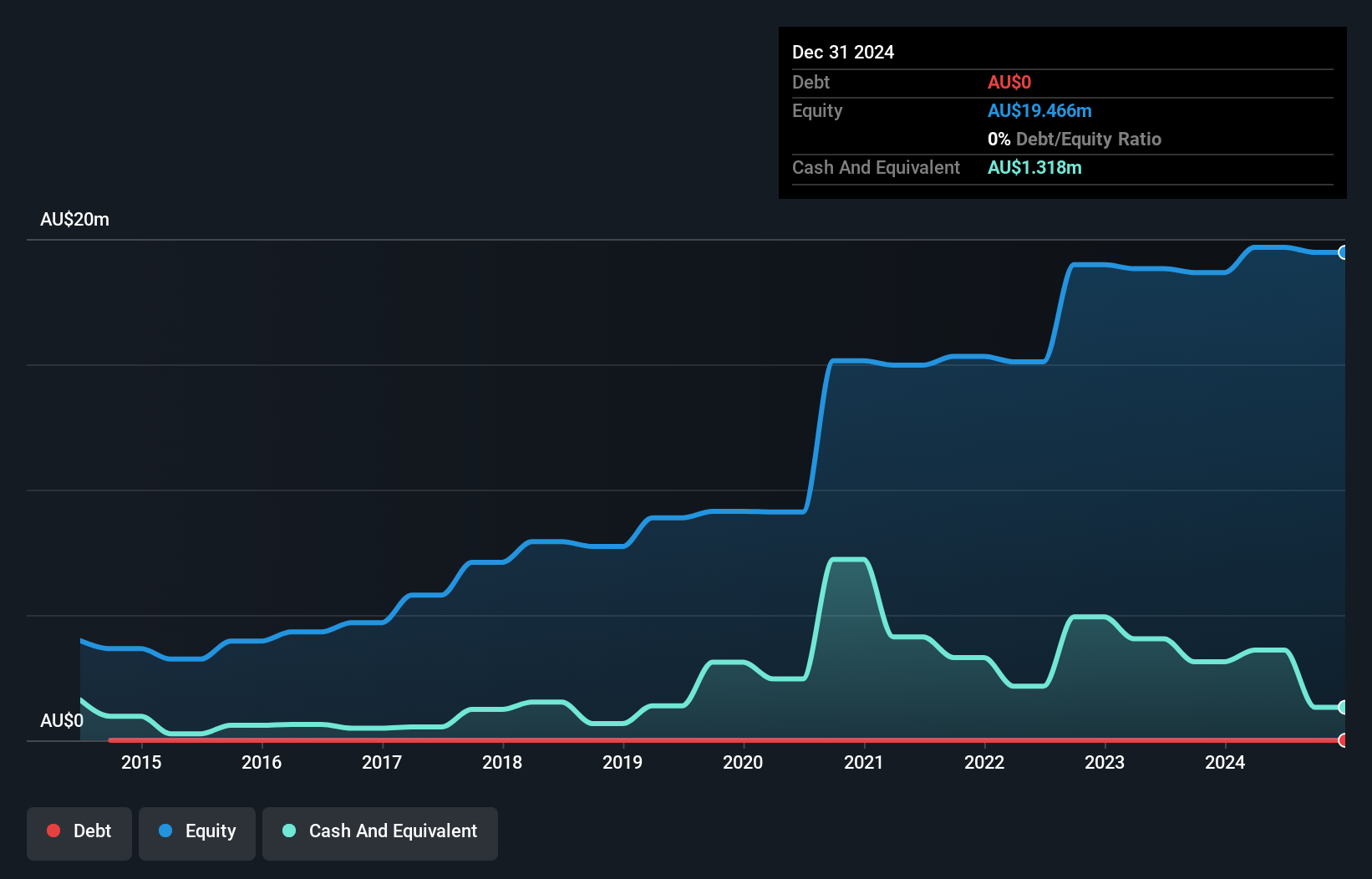

Marmota Limited, with a market capitalization of A$48.90 million, is pre-revenue and remains unprofitable. Its short-term assets of A$3.7 million comfortably cover both short-term and long-term liabilities, indicating sound liquidity management despite shareholder dilution over the past year. The company benefits from an experienced board and management team, with average tenures of 3.7 years and 5.3 years respectively, suggesting stability in leadership. Marmota's cash runway extends beyond one year based on current free cash flow levels, providing some financial flexibility as it continues its exploration activities without any debt burden.

- Jump into the full analysis health report here for a deeper understanding of Marmota.

- Review our historical performance report to gain insights into Marmota's track record.

Turning Ideas Into Actions

- Explore the 1,051 names from our ASX Penny Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MEU

Flawless balance sheet very low.

Market Insights

Community Narratives