The Australian market has recently experienced a downturn, with the ASX200 closing 0.67% lower at 8,150 points amid investor concerns over geopolitical tensions in the Middle East, leading to a pullback in riskier equities. In this environment, identifying high-growth tech stocks requires careful consideration of their resilience and potential for innovation despite broader market challenges.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Pureprofile | 14.94% | 80.73% | ★★★★★☆ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| Telix Pharmaceuticals | 20.10% | 38.31% | ★★★★★★ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| SiteMinder | 19.40% | 60.64% | ★★★★★☆ |

Click here to see the full list of 64 stocks from our ASX High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

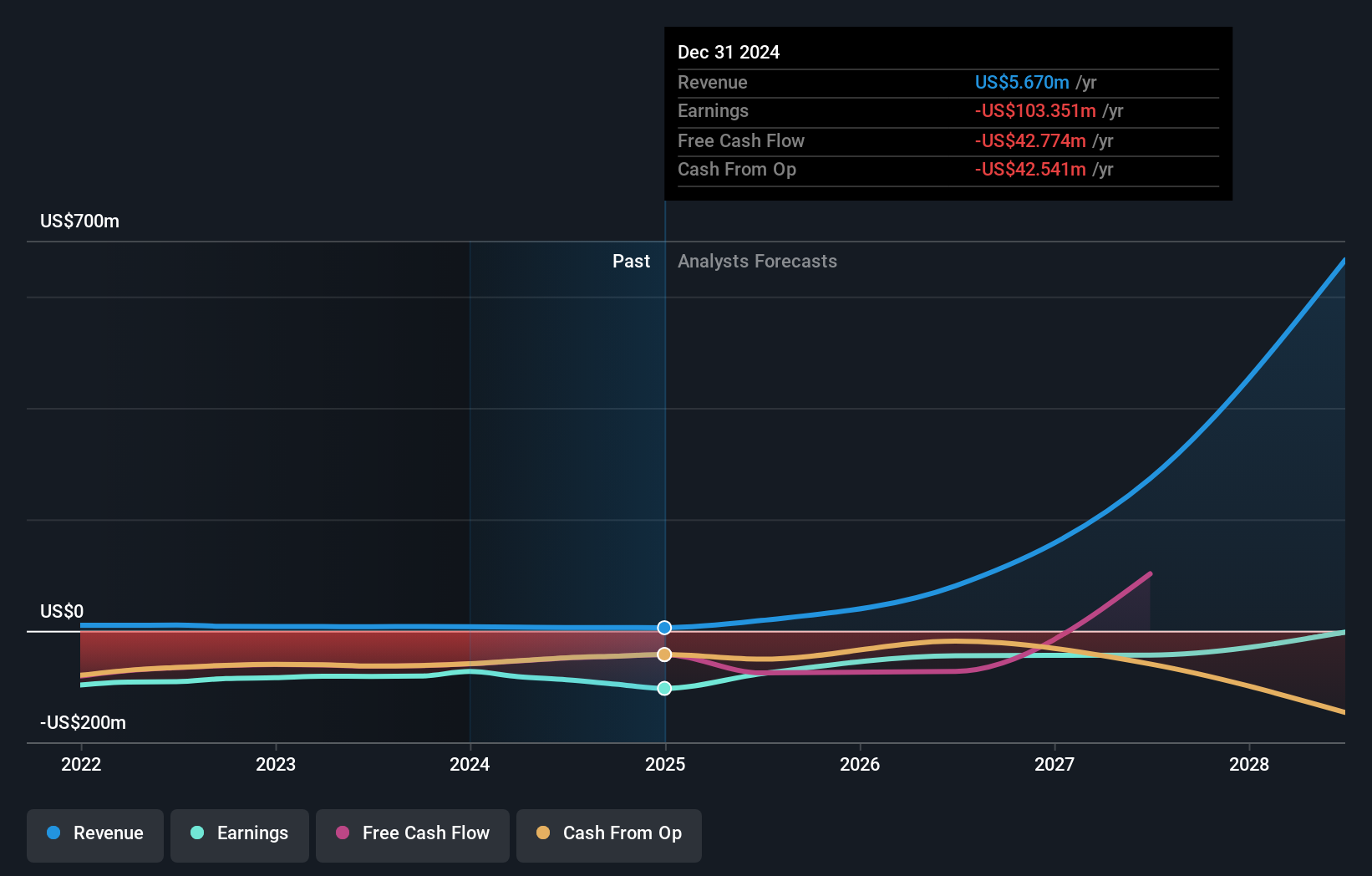

Mesoblast (ASX:MSB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mesoblast Limited is a biotechnology company focused on developing regenerative medicine products across Australia, the United States, Singapore, and Switzerland, with a market capitalization of A$1.70 billion.

Operations: Mesoblast generates revenue primarily from the development of its cell technology platform for commercialization, amounting to $5.90 million. The company's focus is on advancing regenerative medicine products across multiple regions.

Despite recent setbacks, including being dropped from the S&P/ASX Emerging Companies Index, Mesoblast Limited shows promise with a significant anticipated revenue growth of 45.8% annually. This forecast surpasses the general Australian market's growth rate of 5.5%. Furthermore, earnings are expected to surge by 60.82% per year as Mesoblast transitions towards profitability within three years, showcasing its potential in a challenging biotech landscape. The company’s focus on innovative treatments like Ryoncil for SR-aGVHD highlights its commitment to addressing unmet medical needs, potentially revolutionizing care standards and improving survival rates for affected children.

- Get an in-depth perspective on Mesoblast's performance by reading our health report here.

Examine Mesoblast's past performance report to understand how it has performed in the past.

Pro Medicus (ASX:PME)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies imaging software and radiology information system (RIS) software services to hospitals, imaging centers, and healthcare groups across Australia, North America, and Europe, with a market cap of A$18.71 billion.

Operations: The company generates revenue primarily through the production of integrated software applications for the healthcare industry, amounting to A$161.50 million. It operates across Australia, North America, and Europe, focusing on providing advanced imaging and radiology information system software to various healthcare entities.

Pro Medicus, a standout in the Australian tech landscape, has demonstrated robust financial health with a 16.9% yearly revenue growth rate, outpacing the general market's 5.5%. This growth is complemented by an impressive forecast of 18.8% annual earnings growth. The company's commitment to innovation is evident in its R&D spending trends, which have consistently aligned with expanding capabilities and product offerings within the healthcare technology sector. Notably, Pro Medicus has also increased its dividends significantly by 33.3%, reflecting strong financial management and shareholder value creation amidst its expansion efforts.

- Click here and access our complete health analysis report to understand the dynamics of Pro Medicus.

Gain insights into Pro Medicus' historical performance by reviewing our past performance report.

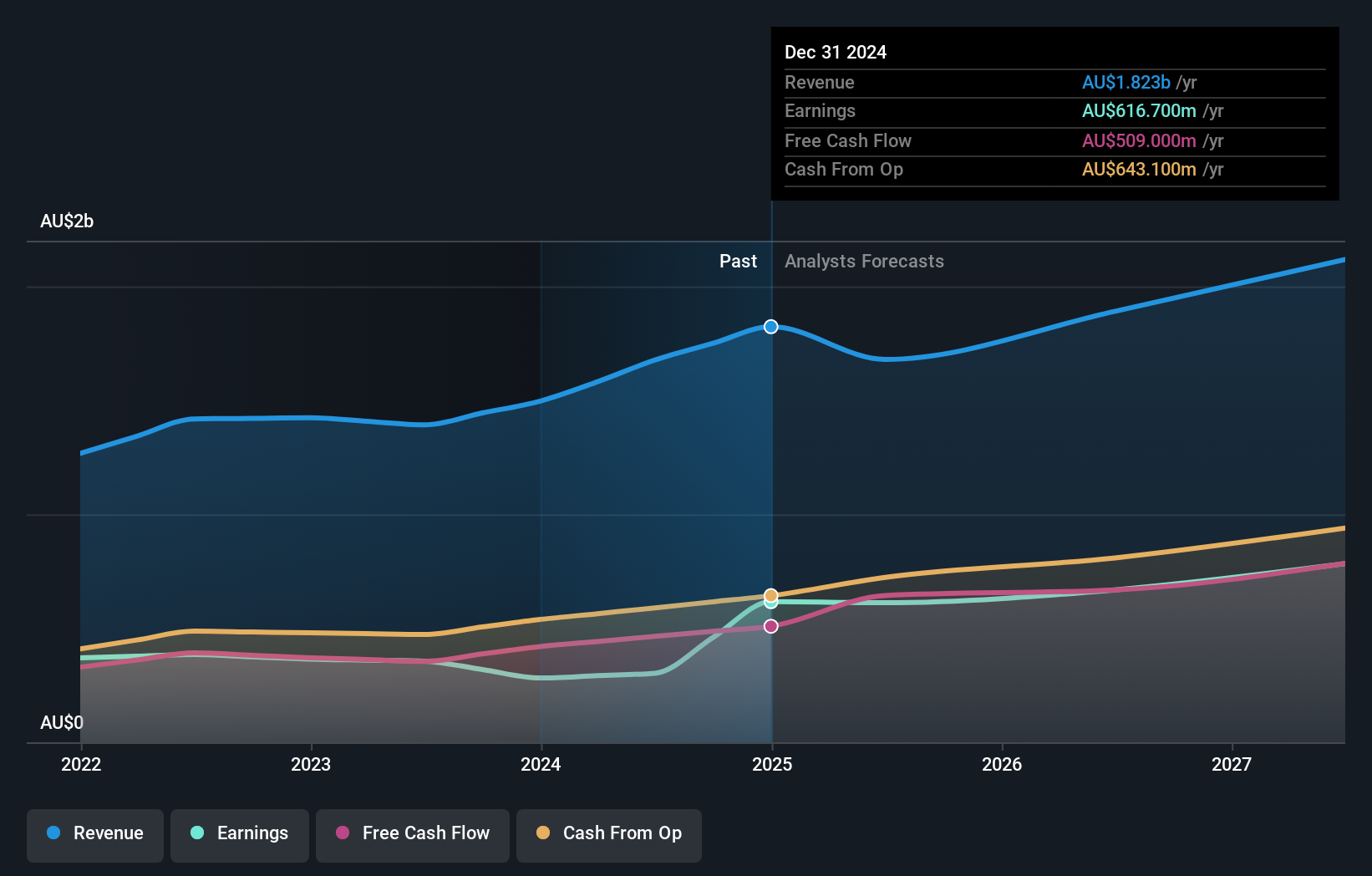

REA Group (ASX:REA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: REA Group Limited operates as an online property advertising business across Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and other international markets with a market capitalization of A$28.15 billion.

Operations: The company's primary revenue streams include property and online advertising in Australia, contributing A$1.25 billion, and financial services generating A$320.60 million. Additionally, operations in India add A$103.10 million to the revenue mix. The diverse geographical presence supports its core business model of online property advertising across multiple international markets.

REA Group, navigating through a challenging year with a one-off loss of A$153.6 million, still forecasts robust earnings growth at 16.8% annually, outpacing the Australian market average of 12.2%. Despite slower revenue growth projections at 6.5%, REA's strategic focus on innovation is underscored by significant R&D investments aimed at enhancing its digital real estate services platform. The company's recent decision to increase dividends by 23% signals confidence in future profitability and commitment to shareholder returns amidst evolving market dynamics.

- Click here to discover the nuances of REA Group with our detailed analytical health report.

Evaluate REA Group's historical performance by accessing our past performance report.

Taking Advantage

- Click here to access our complete index of 64 ASX High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade REA Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:REA

REA Group

Engages in online property advertising business in Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and internationally.

Outstanding track record with flawless balance sheet.