Exploring Pro Medicus And Two Other High Growth Tech Stocks In Australia

Reviewed by Simply Wall St

The Australian market has climbed 1.1% in the last 7 days and is up 18% over the last 12 months, with earnings forecast to grow by 12% annually. In this favorable environment, identifying high-growth tech stocks like Pro Medicus and two others can be key to capitalizing on these positive trends.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| DUG Technology | 10.79% | 31.83% | ★★★★★☆ |

| Telix Pharmaceuticals | 20.10% | 38.31% | ★★★★★★ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| Careteq | 37.17% | 126.21% | ★★★★★☆ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

Click here to see the full list of 64 stocks from our ASX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Pro Medicus (ASX:PME)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies imaging software and radiology information system (RIS) software and services to hospitals, imaging centers, and healthcare groups in Australia, North America, and Europe; it has a market cap of A$18.73 billion.

Operations: Pro Medicus generates revenue primarily from producing integrated software applications for the healthcare industry, amounting to A$161.50 million. The company's operations span Australia, North America, and Europe.

Pro Medicus, a standout in Australia's tech landscape, has demonstrated robust financial health with earnings growth of 36.5% last year, surpassing the Healthcare Services industry average of 13.3%. This growth trajectory is supported by an aggressive R&D investment strategy that not only fuels innovation but also aligns with expected revenue increases of 16.9% annually—outpacing the broader Australian market's forecast of 5.6%. Moreover, the company’s commitment to enhancing shareholder value is evident from its recent dividend increase to AUD 0.40 per share fully franked, up by 33.3%, reflecting confidence in its financial stability and future prospects. In addition to strong earnings performance and strategic reinvestments in R&D, Pro Medicus benefits from high-quality earnings characterized by significant non-cash components. The firm’s forward-looking approach is underscored by a projected annual profit growth rate of 18.8%, which significantly exceeds the national average of 12.2%. These figures highlight not just the company's current success but its potential for sustained leadership and innovation within the tech sector, positioning it well for ongoing expansion and market penetration.

REA Group (ASX:REA)

Simply Wall St Growth Rating: ★★★★☆☆

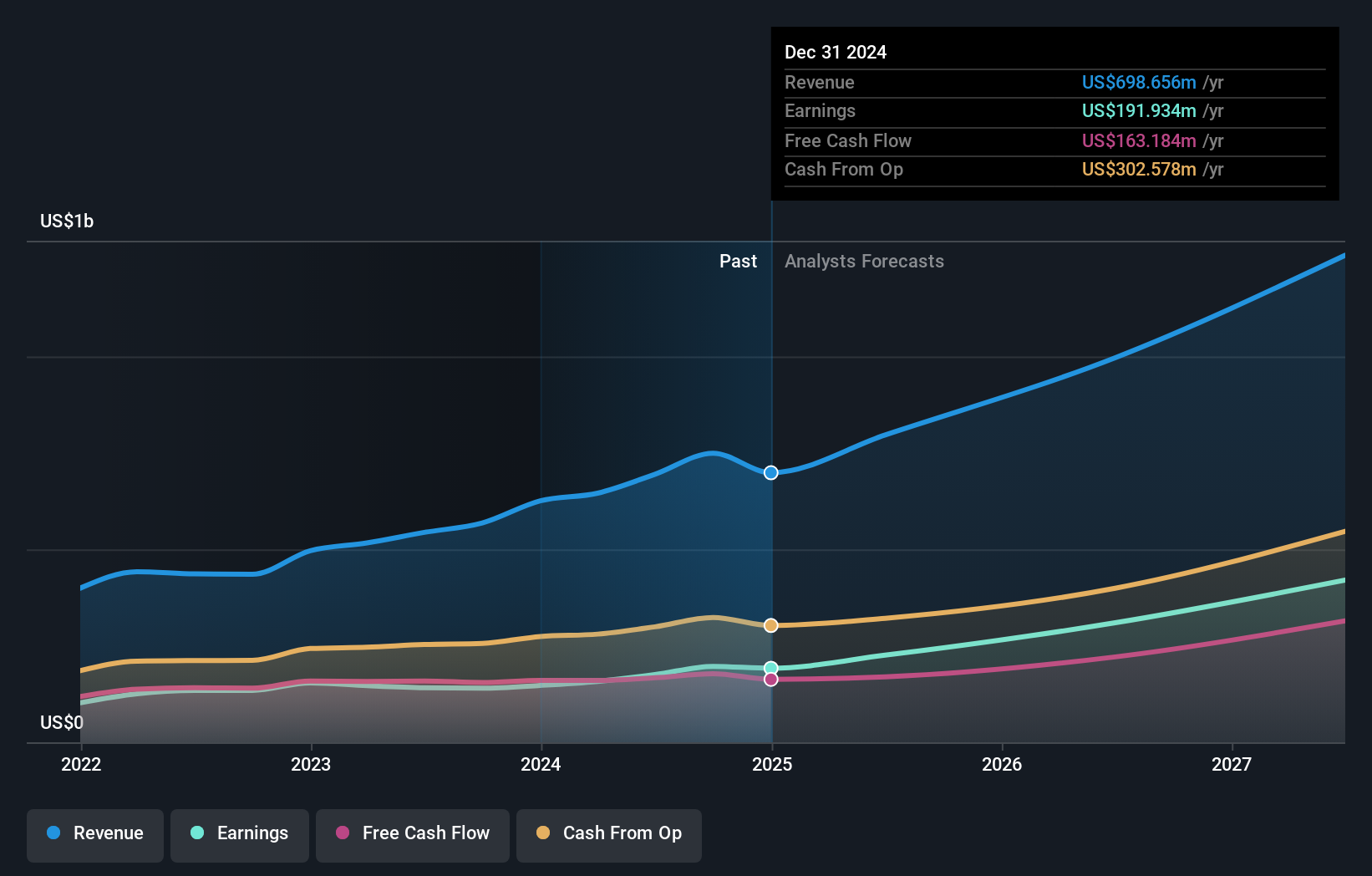

Overview: REA Group Limited operates an online property advertising business across Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and other international markets with a market cap of approximately A$27.65 billion.

Operations: REA Group generates revenue primarily from property and online advertising in Australia (A$1.25 billion) and financial services (A$320.60 million), with additional contributions from its operations in India (A$103.10 million). The company's business model focuses on leveraging its digital platforms to connect real estate buyers, sellers, and renters across multiple international markets.

REA Group, amid a challenging year with a net income drop to AUD 302.8 million from AUD 356.1 million, still forecasts promising growth with expected revenue increases of 6.5% annually, outpacing the broader Australian market's forecast of 5.6%. This resilience is bolstered by a robust R&D focus, where expenses are strategically aligned to fuel innovation and future capabilities, essential for maintaining competitive advantage in the dynamic online real estate marketplace. Moreover, the company's recent decision to increase its dividend by 23% signals confidence in its financial health and commitment to shareholder returns despite past earnings fluctuations.

- Navigate through the intricacies of REA Group with our comprehensive health report here.

Examine REA Group's past performance report to understand how it has performed in the past.

WiseTech Global (ASX:WTC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WiseTech Global Limited develops and provides software solutions for the logistics execution industry across various regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa, with a market cap of A$44.80 billion.

Operations: WiseTech Global Limited focuses on delivering software solutions specifically tailored for the logistics execution industry, generating revenue primarily from its Internet Software & Services segment, which amounts to A$1.04 billion.

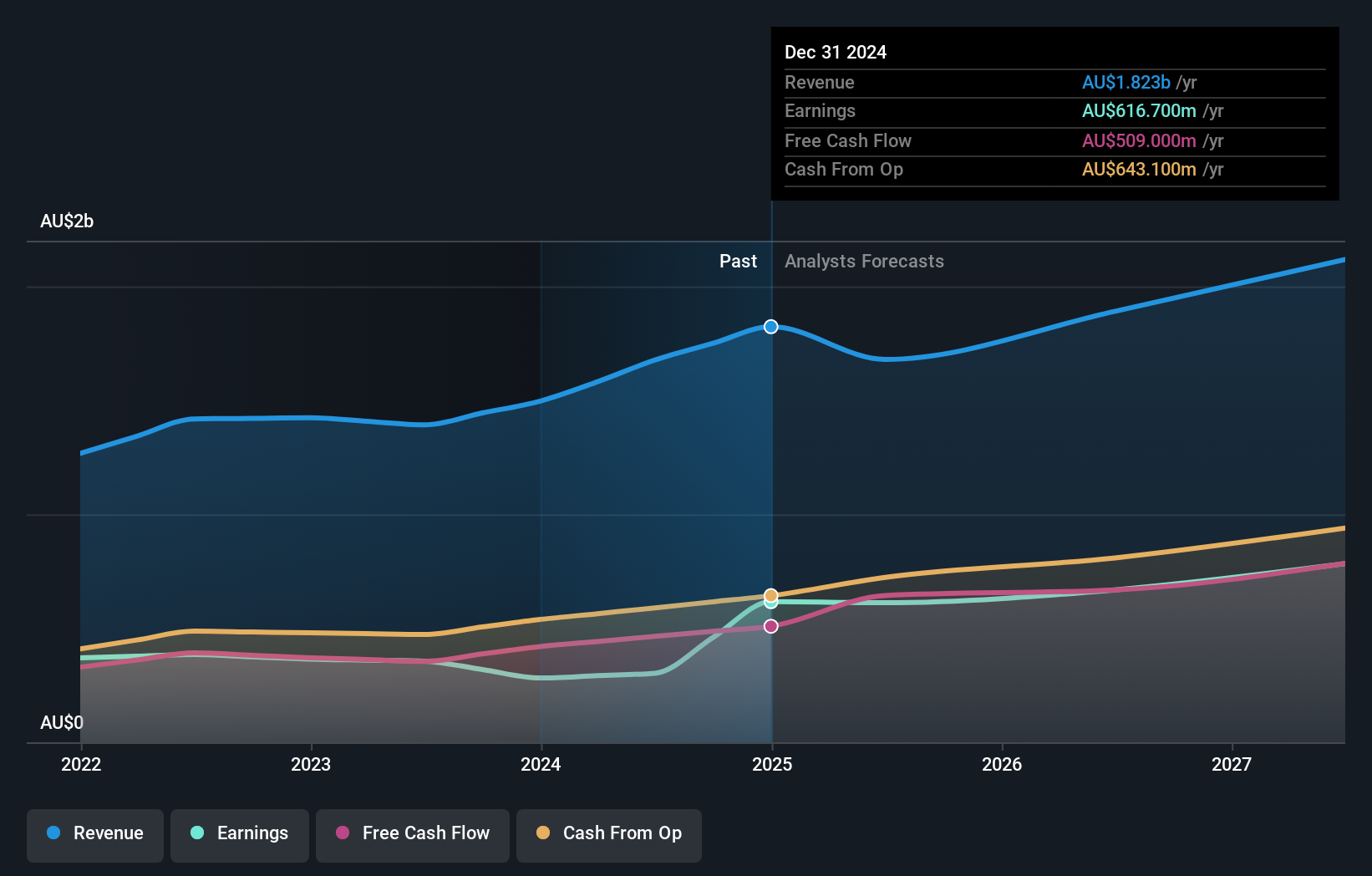

WiseTech Global, a trailblazer in the logistics software sector, has demonstrated robust financial performance with its latest earnings revealing a significant revenue jump to AUD 1.04 billion from AUD 816.8 million year-over-year. This growth is underpinned by an aggressive R&D strategy, where the company invested heavily, aligning with its forecasted revenue growth of 19.1% per year. Notably, WiseTech's recent guidance anticipates even stronger future revenues between AUD 1.3 billion and AUD 1.35 billion for FY2025, showcasing potential market leadership amidst technological advancements in supply chain management solutions.

- Get an in-depth perspective on WiseTech Global's performance by reading our health report here.

Understand WiseTech Global's track record by examining our Past report.

Next Steps

- Discover the full array of 64 ASX High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:REA

REA Group

Engages in online property advertising business in Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and internationally.

Flawless balance sheet with reasonable growth potential.