- Australia

- /

- Electrical

- /

- ASX:FOS

3 ASX Penny Stocks With Market Caps Over A$10M

Reviewed by Simply Wall St

The Australian market has seen mixed performances recently, with the ASX200 closing slightly down and sectors like Industrials and Health Care showing strength. In this context, penny stocks may seem like a relic of past market trends, but they continue to offer unique opportunities for investors seeking growth in smaller or newer companies. With the right financial health and fundamentals, these stocks can provide potential upside without the typical risks associated with their category.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.91 | A$311.8M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.515 | A$310.07M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.87 | A$236.3M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.77 | A$97.91M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.565 | A$779.23M | ★★★★★☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$217.98M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.78 | A$102.64M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$5.01 | A$485.43M | ★★★★☆☆ |

Click here to see the full list of 1,051 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

FOS Capital (ASX:FOS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FOS Capital Limited, with a market cap of A$19.37 million, operates in Australia and New Zealand through its subsidiaries by manufacturing and distributing commercial luminaires, outdoor fittings, linear extruded lighting, and architectural lighting solutions.

Operations: The company's revenue is primarily derived from its Electric Lighting & Other Fixtures segment, which generated A$24.53 million.

Market Cap: A$19.37M

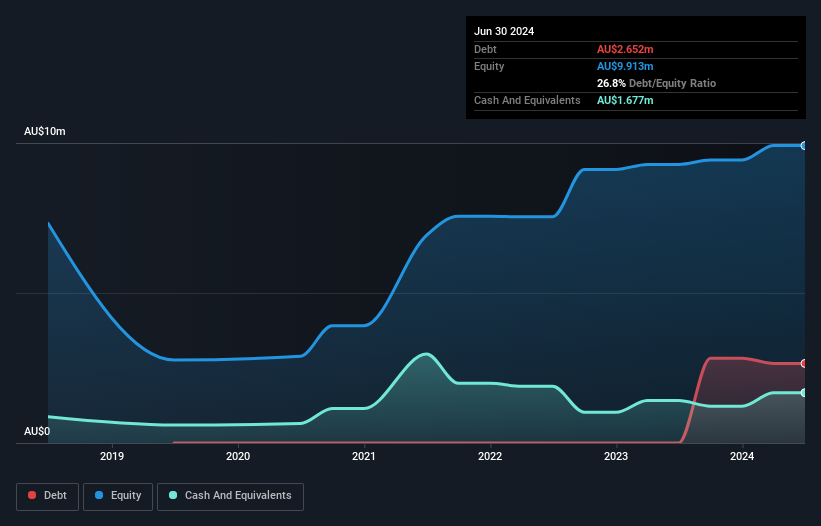

FOS Capital Limited, with a market cap of A$19.37 million, has experienced moderate earnings growth of 8.7% annually over the past five years, though recent growth has slightly decelerated to 8.3%. The company's Return on Equity is low at 6.4%, and its debt-to-equity ratio has increased to 26.8%. Despite this, FOS maintains satisfactory net debt levels and covers interest payments well with an EBIT coverage of 5.8x. Short-term assets exceed both short- and long-term liabilities, indicating financial stability despite volatile share prices and a one-off loss impacting recent results by A$600.5K.

- Navigate through the intricacies of FOS Capital with our comprehensive balance sheet health report here.

- Assess FOS Capital's previous results with our detailed historical performance reports.

Jatcorp (ASX:JAT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jatcorp Limited operates in Australia, focusing on the production and sale of dairy and nutrient products, with a market capitalization of A$30.81 million.

Operations: The company generates revenue of A$52.46 million from trading fast-moving consumer goods.

Market Cap: A$30.81M

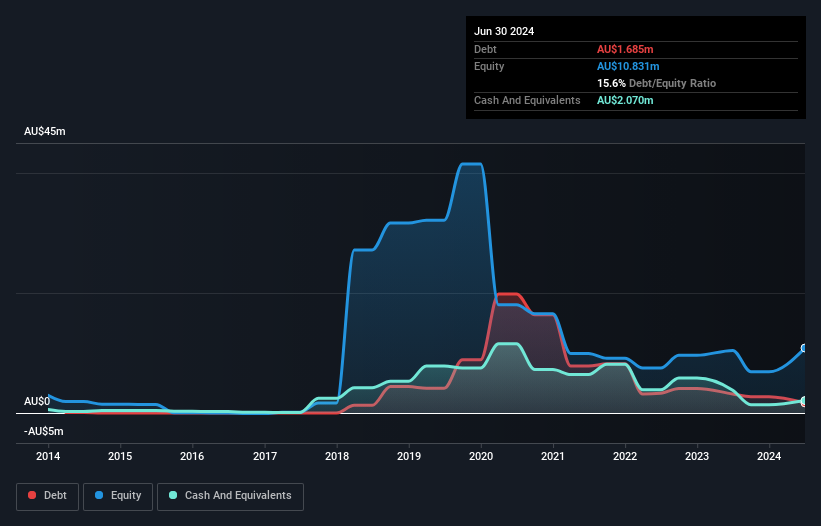

Jatcorp Limited, with a market cap of A$30.81 million, has recently become profitable, marking a significant shift in its financial trajectory. The company's debt is well covered by operating cash flow, and it holds more cash than total debt, indicating strong liquidity management. Short-term assets exceed both short- and long-term liabilities, further underscoring financial stability. Despite low Return on Equity at 15.5%, Jatcorp's high-quality earnings and lack of shareholder dilution over the past year are positive signs for potential investors. Recent executive changes include the resignation of Managing Director Jack Wang while CEO Sunny Liang ensures operational continuity.

- Get an in-depth perspective on Jatcorp's performance by reading our balance sheet health report here.

- Understand Jatcorp's track record by examining our performance history report.

Jade Gas Holdings (ASX:JGH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jade Gas Holdings Limited is involved in the exploration and appraisal of coal bed methane projects in Mongolia, with a market capitalization of A$55.19 million.

Operations: No revenue segments have been reported.

Market Cap: A$55.19M

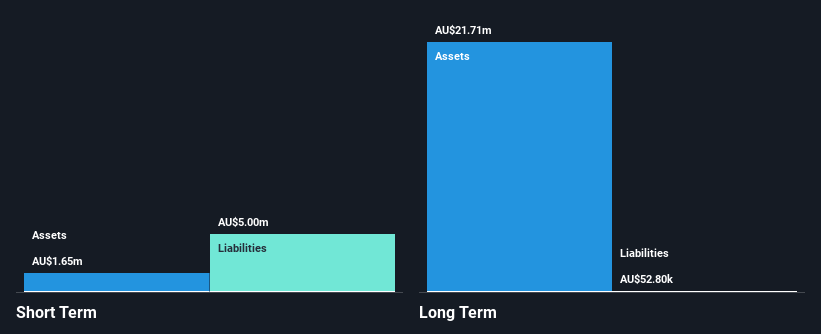

Jade Gas Holdings Limited, with a market cap of A$55.19 million, is pre-revenue and unprofitable, with losses increasing by 13.5% annually over the past five years. The company recently raised A$3.63 million through a follow-on equity offering to bolster its cash runway beyond the previously limited one-month span. Short-term assets of A$1.6 million fall short of covering liabilities of A$5 million, indicating liquidity challenges despite satisfactory net debt to equity ratio at 17.5%. While management's tenure suggests inexperience, the board's average tenure reflects more stability and experience within governance structures.

- Unlock comprehensive insights into our analysis of Jade Gas Holdings stock in this financial health report.

- Evaluate Jade Gas Holdings' historical performance by accessing our past performance report.

Where To Now?

- Explore the 1,051 names from our ASX Penny Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FOS

FOS Capital

Through its subsidiaries, manufactures and distributes commercial luminaires, outdoor fittings, linear extruded lighting, and architectural lighting solutions in Australia and New Zealand.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives