- Australia

- /

- Medical Equipment

- /

- ASX:NXS

Next Science Limited (ASX:NXS) Analysts Just Trimmed Their Revenue Forecasts By 10%

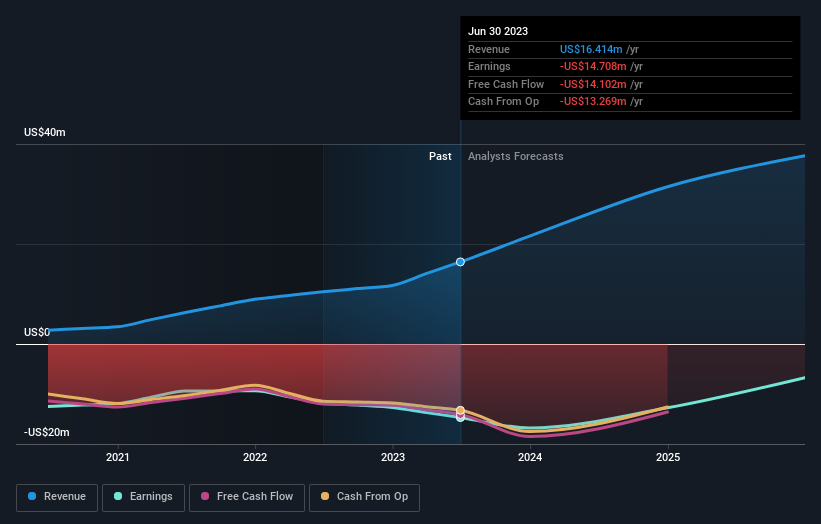

One thing we could say about the analysts on Next Science Limited (ASX:NXS) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Revenue estimates were cut sharply as the analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

After this downgrade, Next Science's dual analysts are now forecasting revenues of US$22m in 2023. This would be a sizeable 31% improvement in sales compared to the last 12 months. The loss per share is expected to ameliorate slightly, reducing to US$0.057. However, before this estimates update, the consensus had been expecting revenues of US$24m and US$0.057 per share in losses. So there's definitely been a change in sentiment in this update, with the analysts administering a substantial haircut to this year's revenue estimates, while at the same time holding losses per share steady.

See our latest analysis for Next Science

The consensus price target fell 41% to US$0.22, with the analysts clearly concerned about the weaker revenue outlook and expectation of ongoing losses. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic Next Science analyst has a price target of US$0.25 per share, while the most pessimistic values it at US$0.18. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's clear from the latest estimates that Next Science's rate of growth is expected to accelerate meaningfully, with the forecast 73% annualised revenue growth to the end of 2023 noticeably faster than its historical growth of 51% p.a. over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 10% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Next Science is expected to grow much faster than its industry.

The Bottom Line

Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by recent business developments, leading to a lower estimate of Next Science's future valuation. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Next Science after today.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with Next Science's business, like dilutive stock issuance over the past year. For more information, you can click here to discover this and the 4 other flags we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Next Science might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NXS

Next Science

Engages in the research, development, and commercialization of technologies that resolve the issues in human health caused by biofilms, incumbent bacteria, fungus, viruses, and infections in North America, Australia, and New Zealand.

Slight risk and slightly overvalued.

Market Insights

Community Narratives