- Australia

- /

- Construction

- /

- ASX:SXE

ASX Penny Stocks: Cash Converters International And 2 Other Noteworthy Picks

Reviewed by Simply Wall St

As the Australian market faces a slight downturn, with shares heading for a 0.29% drop, the focus turns to how investors can navigate these fluctuating conditions. Penny stocks, while an outdated term, continue to represent smaller or less-established companies that might offer unique investment opportunities. By concentrating on those with solid financials and potential for growth, investors can uncover promising prospects in this niche area of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.475 | A$136.13M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.60 | A$122.65M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.91 | A$56.66M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.68 | A$412.63M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.17 | A$233.97M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.044 | A$51.47M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.071 | A$37.4M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.795 | A$379.78M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.31 | A$1.42B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 423 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Cash Converters International (ASX:CCV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cash Converters International Limited operates in unsecured lending and second-hand retail services across Australia, New Zealand, the United Kingdom, and other international markets, with a market cap of A$223.48 million.

Operations: The company's revenue is primarily derived from Store Operations (A$157.12 million), Personal Finance (A$78.53 million), and the United Kingdom (A$83.49 million), with additional contributions from New Zealand (A$22.19 million) and Vehicle Finance (A$12.02 million).

Market Cap: A$223.48M

Cash Converters International, with a market cap of A$223.48 million, operates in unsecured lending and second-hand retail services across various markets. The company has shown steady growth with revenues reaching A$385.27 million for the year ending June 2025, up from A$382.56 million the previous year, and net income increasing to A$24.48 million from A$17.4 million. Despite a low Return on Equity of 10.7%, its debt is well-covered by operating cash flow at 62.8%. Recent executive changes include the appointment of David Rose as CFO, potentially indicating strategic shifts aimed at further growth and transformation initiatives.

- Navigate through the intricacies of Cash Converters International with our comprehensive balance sheet health report here.

- Gain insights into Cash Converters International's outlook and expected performance with our report on the company's earnings estimates.

Lumos Diagnostics Holdings (ASX:LDX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lumos Diagnostics Holdings Limited develops, manufactures, and commercializes point-of-care diagnostic products for infectious disease management in the United States, with a market cap of A$141.45 million.

Operations: Lumos Diagnostics Holdings generates revenue of $12.4 million from providing point-of-care diagnostics goods and services.

Market Cap: A$141.45M

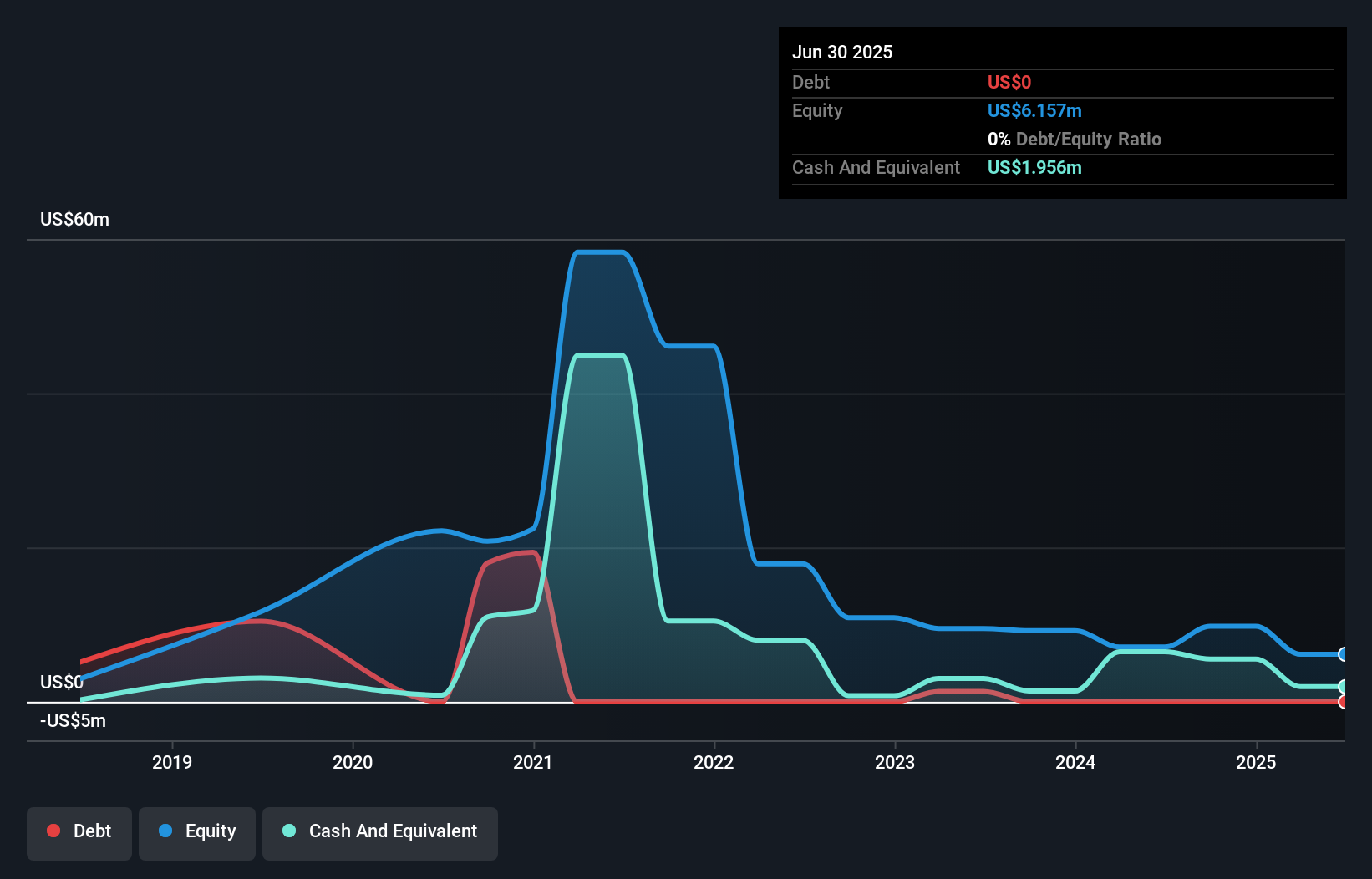

Lumos Diagnostics Holdings, with a market cap of A$141.45 million, focuses on point-of-care diagnostics in the U.S., generating US$12.4 million in revenue for the year ending June 2025. Despite reducing its net loss to US$7.18 million from US$8.59 million a year ago, it remains unprofitable and faces auditor concerns regarding its ability to continue as a going concern. The company recently secured an A$5 million loan facility at high interest rates and entered into an exclusive distribution agreement for FebriDx, potentially expanding its market presence amidst significant volatility in share price and limited cash runway of three months.

- Dive into the specifics of Lumos Diagnostics Holdings here with our thorough balance sheet health report.

- Assess Lumos Diagnostics Holdings' future earnings estimates with our detailed growth reports.

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Financial Health Rating: ★★★★★★

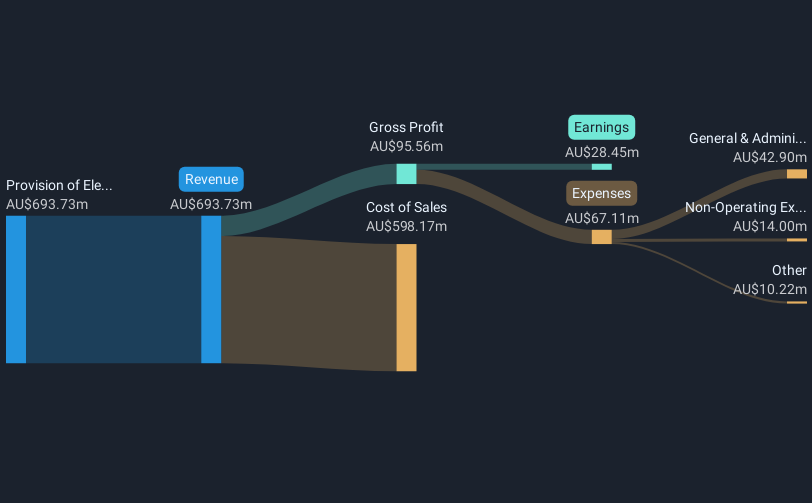

Overview: Southern Cross Electrical Engineering Limited, along with its subsidiaries, offers a range of services including electrical, instrumentation, communications, security, fire protection, and maintenance across Australia with a market capitalization of approximately A$594.97 million.

Operations: The company's revenue primarily comes from the provision of electrical services, amounting to A$801.45 million.

Market Cap: A$594.97M

Southern Cross Electrical Engineering Limited, with a market cap of approximately A$594.97 million, has demonstrated strong growth in earnings, rising by 44.5% over the past year and exceeding its industry peers. The company's revenue increased to A$801.45 million from A$551.87 million the previous year, supported by stable operations and no debt burden. Recent strategic moves include exploring acquisitions for geographic diversification and capability expansion, aligning with its history of successful value-accretive acquisitions. Despite a low return on equity at 15.5%, Southern Cross maintains financial stability with assets covering liabilities and an experienced management team guiding future growth initiatives.

- Take a closer look at Southern Cross Electrical Engineering's potential here in our financial health report.

- Explore Southern Cross Electrical Engineering's analyst forecasts in our growth report.

Summing It All Up

- Reveal the 423 hidden gems among our ASX Penny Stocks screener with a single click here.

- Contemplating Other Strategies? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SXE

Southern Cross Electrical Engineering

Provides electrical, instrumentation, communications, security, fire, and maintenance services and products in Australia.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives