- Australia

- /

- Healthcare Services

- /

- ASX:IDX

ASX Stocks Estimated To Be Trading Below Fair Value In January 2025

Reviewed by Simply Wall St

The Australian stock market recently saw the ASX200 reach a record high of 8,566 points before closing slightly lower at 8,532 points, buoyed by positive investor sentiment due to easing concerns over potential tariffs on China. In this environment of fluctuating indices and sector performances, identifying undervalued stocks—those trading below their perceived fair value—can offer investors potential opportunities for growth amidst the broader market dynamics.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SKS Technologies Group (ASX:SKS) | A$2.09 | A$3.83 | 45.4% |

| Mader Group (ASX:MAD) | A$6.20 | A$11.91 | 47.9% |

| Atlas Arteria (ASX:ALX) | A$5.07 | A$9.51 | 46.7% |

| MLG Oz (ASX:MLG) | A$0.625 | A$1.17 | 46.7% |

| SciDev (ASX:SDV) | A$0.47 | A$0.87 | 46.1% |

| Charter Hall Group (ASX:CHC) | A$15.72 | A$28.70 | 45.2% |

| IDP Education (ASX:IEL) | A$13.34 | A$26.40 | 49.5% |

| ReadyTech Holdings (ASX:RDY) | A$3.19 | A$6.18 | 48.4% |

| South32 (ASX:S32) | A$3.36 | A$6.68 | 49.7% |

| Integral Diagnostics (ASX:IDX) | A$3.12 | A$6.17 | 49.4% |

We'll examine a selection from our screener results.

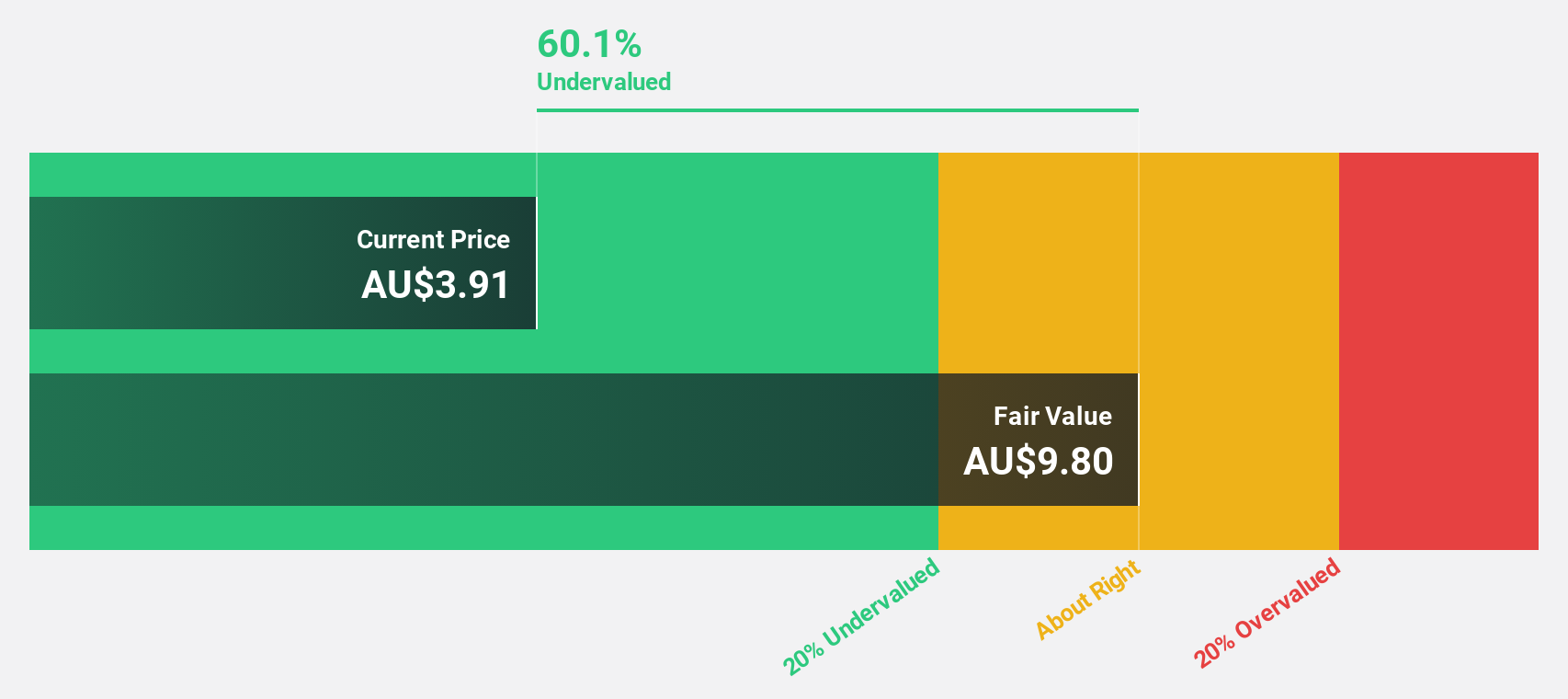

Aussie Broadband (ASX:ABB)

Overview: Aussie Broadband Limited offers telecommunications and technology services in Australia with a market cap of A$1.14 billion.

Operations: The company's revenue segments include Business (A$96.97 million), Wholesale (A$159.73 million), Residential (A$585.07 million), Symbio Group (A$69.93 million), and Enterprise and Government (A$88.04 million).

Estimated Discount To Fair Value: 38.6%

Aussie Broadband appears undervalued, trading at A$3.94 compared to an estimated fair value of A$6.42, indicating it's priced 38.6% below its intrinsic value based on discounted cash flow analysis. Despite significant insider selling recently, earnings are projected to grow significantly at 22.34% annually, outpacing the broader Australian market's growth rate of 12.5%. Recent strategic moves include a share buyback program and leadership transition with Brian Maher assuming the CEO role in March 2025.

- Upon reviewing our latest growth report, Aussie Broadband's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Aussie Broadband.

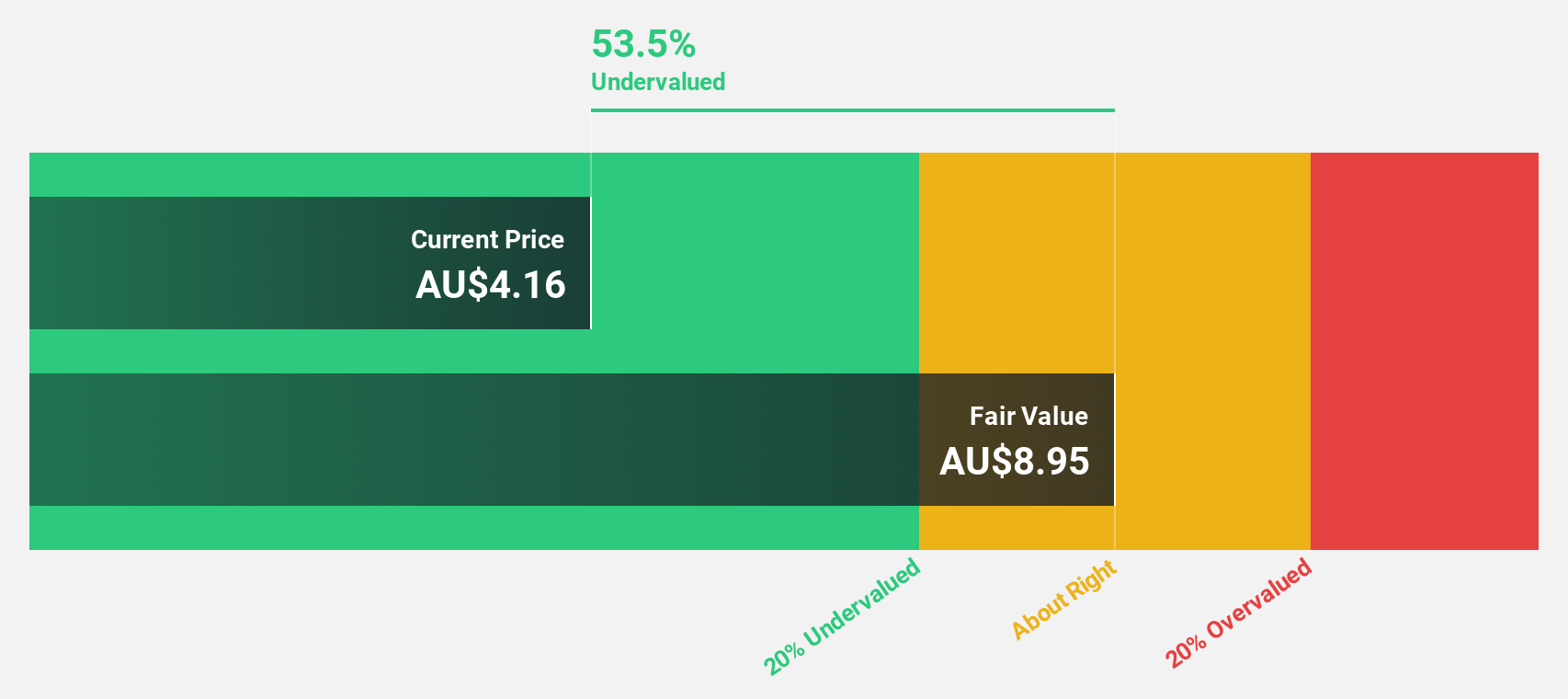

Integral Diagnostics (ASX:IDX)

Overview: Integral Diagnostics Limited is a healthcare services company that provides diagnostic imaging services to medical professionals and their patients in Australia and New Zealand, with a market cap of A$1.13 billion.

Operations: The company generates revenue of A$469.70 million from its diagnostic imaging facilities operations in Australia and New Zealand.

Estimated Discount To Fair Value: 49.4%

Integral Diagnostics is trading at A$3.12, significantly below its estimated fair value of A$6.17, suggesting it's undervalued by over 49% based on discounted cash flow analysis. Revenue growth is forecasted at 15.5% annually, surpassing the Australian market average of 6%. However, the firm faces challenges like low return on equity forecasts and recent shareholder dilution. Recent board changes include new non-executive directors and a permanent company secretary appointment.

- In light of our recent growth report, it seems possible that Integral Diagnostics' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Integral Diagnostics' balance sheet health report.

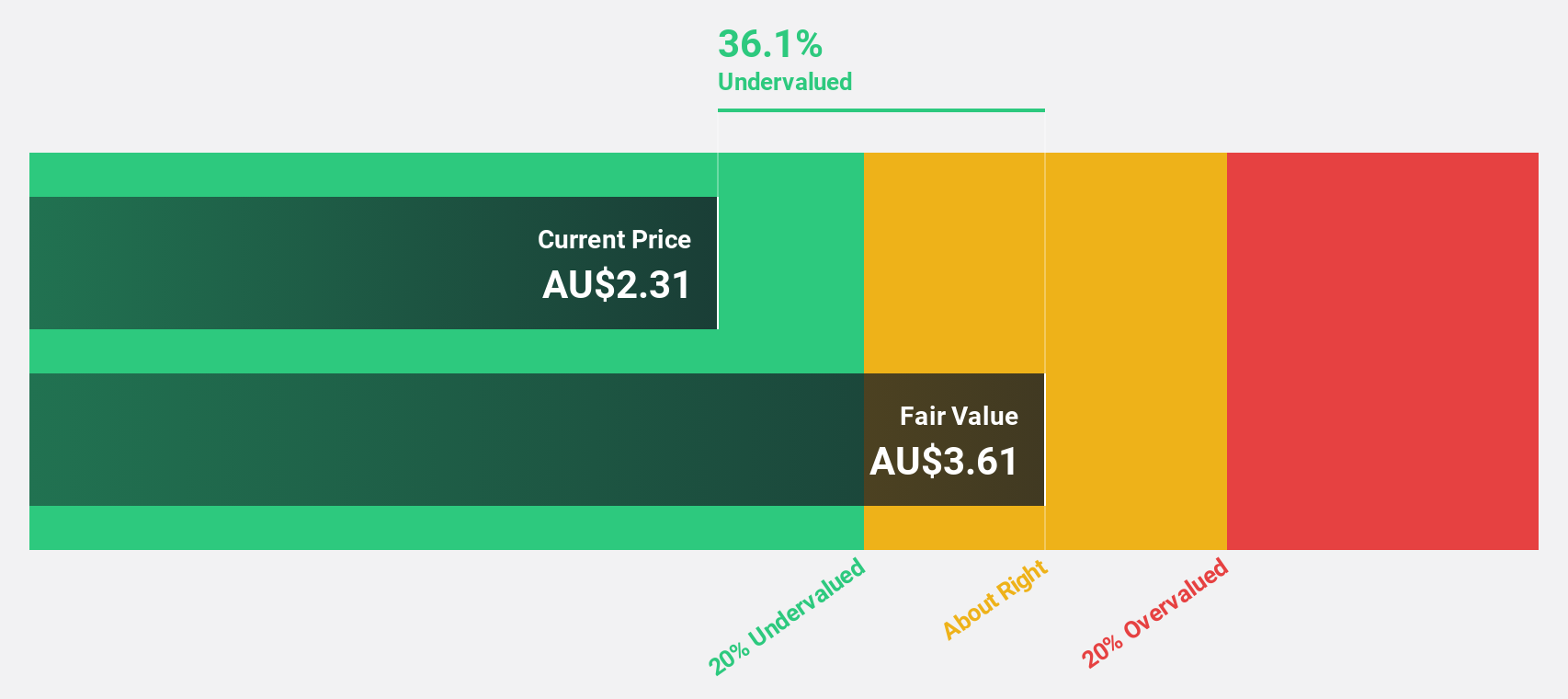

Select Harvests (ASX:SHV)

Overview: Select Harvests Limited is an Australian company involved in the cultivation, processing, packaging, and sale of almonds and their by-products with a market capitalization of A$652.27 million.

Operations: The company generates revenue primarily from its almond segment, amounting to A$337.29 million.

Estimated Discount To Fair Value: 30.5%

Select Harvests is trading at A$4.64, below its estimated fair value of A$6.68, indicating it's undervalued by over 30% based on cash flow analysis. The company has returned to profitability with annual earnings growth expected at 36.08%, outpacing the Australian market's forecasted growth. Recent executive changes include Liam Nolan as CFO and Mark Rhys Davies as Joint Company Secretary, enhancing financial leadership amidst improving financial performance and revenue growth forecasts of 8.5% annually.

- Our growth report here indicates Select Harvests may be poised for an improving outlook.

- Get an in-depth perspective on Select Harvests' balance sheet by reading our health report here.

Seize The Opportunity

- Explore the 48 names from our Undervalued ASX Stocks Based On Cash Flows screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IDX

Integral Diagnostics

A healthcare services company, engages in the provision of diagnostic imaging services to general practitioners, medical specialists, and allied health professionals and their patients in Australia and New Zealand.

Reasonable growth potential and fair value.

Market Insights

Community Narratives