- Australia

- /

- Medical Equipment

- /

- ASX:CYC

Cyclopharm (ASX:CYC investor three-year losses grow to 43% as the stock sheds AU$19m this past week

For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term Cyclopharm Limited (ASX:CYC) shareholders, since the share price is down 44% in the last three years, falling well short of the market return of around 42%. And the ride hasn't got any smoother in recent times over the last year, with the price 41% lower in that time. The falls have accelerated recently, with the share price down 21% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

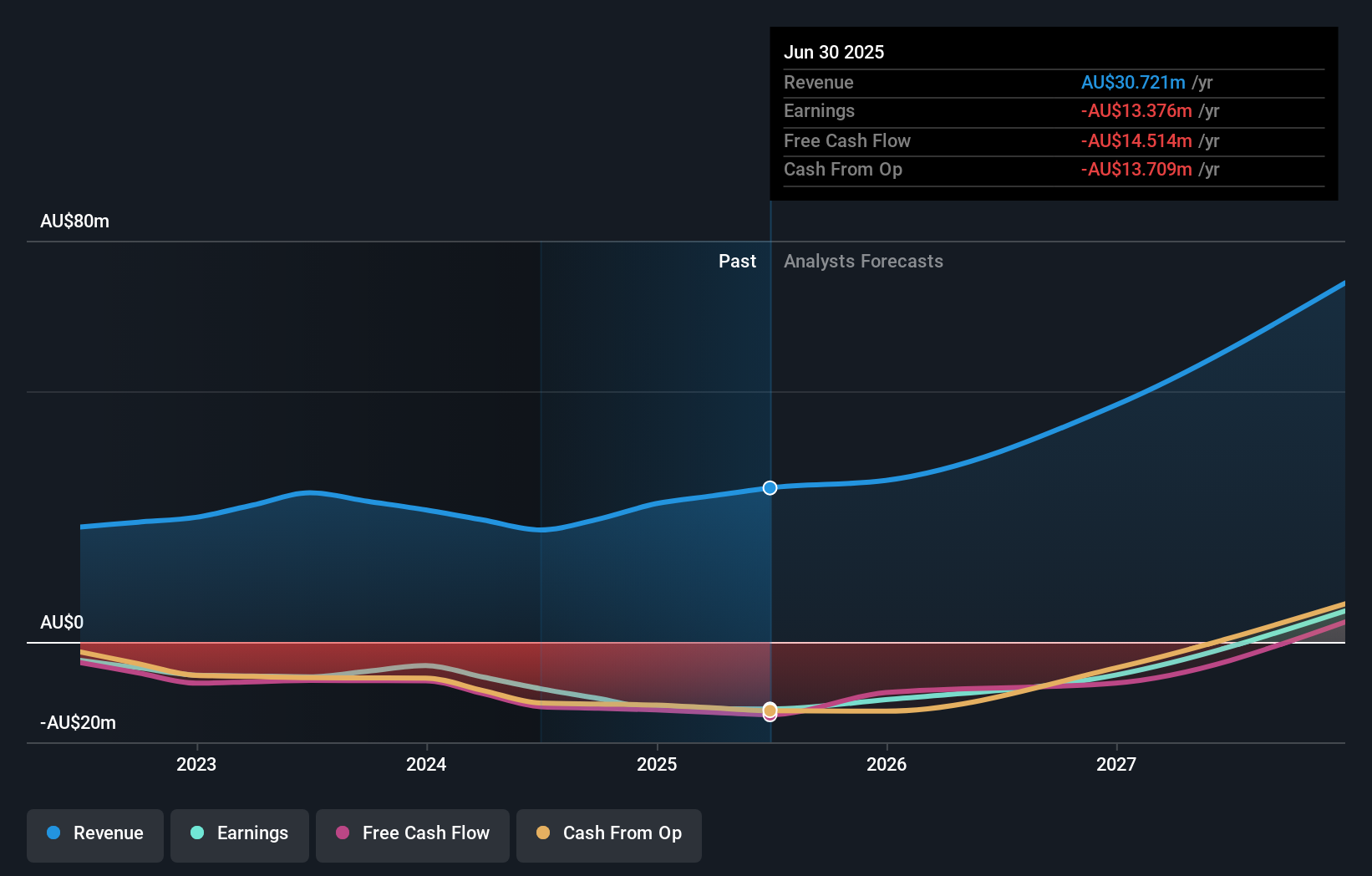

Because Cyclopharm made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Cyclopharm grew revenue at 4.8% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. The stock dropped 13% during that time. Shareholders will probably be hoping growth picks up soon. But the real upside for shareholders will be if the company can start generating profits.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Cyclopharm's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Cyclopharm shareholders are down 41% for the year, but the market itself is up 14%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Cyclopharm better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Cyclopharm you should be aware of.

But note: Cyclopharm may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CYC

Cyclopharm

Cyclopharm Limited manufacture and sells medical equipment and radiopharmaceuticals in the Asia Pacific, Europe, Canada, the United States, and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives