- Australia

- /

- Medical Equipment

- /

- ASX:CQT

Shareholders Are Thrilled That The CardieX (ASX:CDX) Share Price Increased 169%

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right business to buy shares in, you can make more than you can lose. Take, for example CardieX Limited (ASX:CDX). Its share price is already up an impressive 169% in the last twelve months. And in the last month, the share price has gained 9.9%. Looking back further, the stock price is 111% higher than it was three years ago.

Check out our latest analysis for CardieX

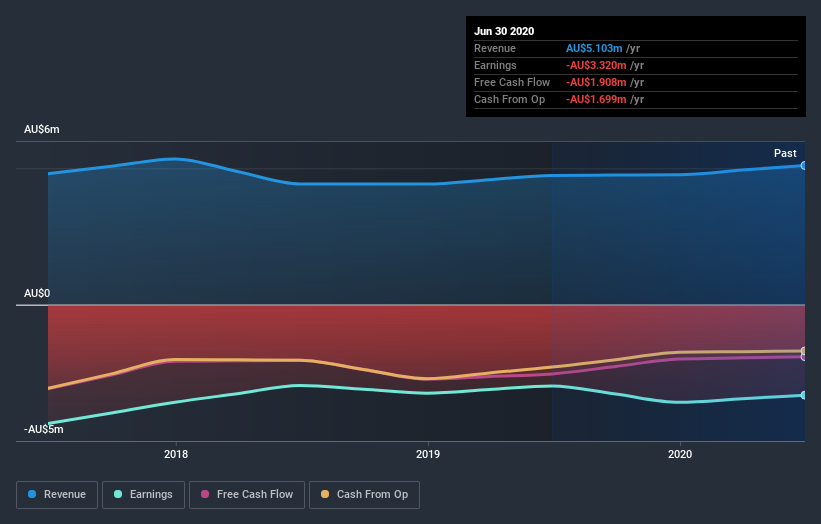

Because CardieX made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

CardieX grew its revenue by 7.7% last year. That's not great considering the company is losing money. So we wouldn't have expected the share price to rise by 169%. We're happy that investors have made money, though we wonder if the increase will be sustained. We're not so sure that revenue growth is driving the market optimism about the stock.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on CardieX's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that CardieX shareholders have received a total shareholder return of 169% over the last year. That certainly beats the loss of about 10% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - CardieX has 4 warning signs we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you’re looking to trade CardieX, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:CQT

CONNEQT Health

Engages in the design, manufacture, and marketing of medical devices used in cardiovascular health management in the Americas, Europe, and the Asia Pacific.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives