- Australia

- /

- Healthcare Services

- /

- ASX:CAJ

Capitol Health Limited's (ASX:CAJ) Popularity With Investors Is Clear

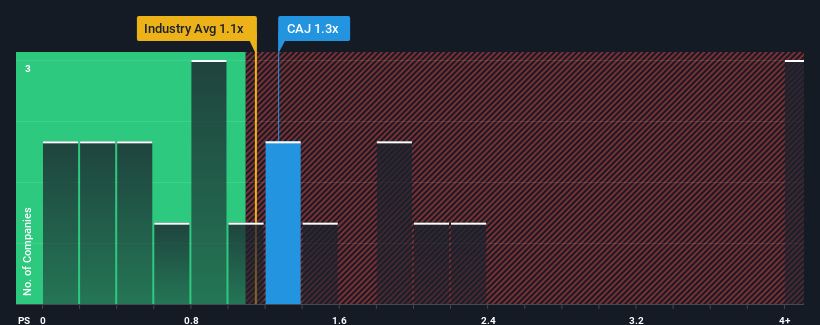

With a median price-to-sales (or "P/S") ratio of close to 1.1x in the Healthcare industry in Australia, you could be forgiven for feeling indifferent about Capitol Health Limited's (ASX:CAJ) P/S ratio of 1.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Capitol Health

How Capitol Health Has Been Performing

Capitol Health certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Capitol Health will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Capitol Health?

The only time you'd be comfortable seeing a P/S like Capitol Health's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. This was backed up an excellent period prior to see revenue up by 36% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 7.5% per annum as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 7.2% each year, which is not materially different.

In light of this, it's understandable that Capitol Health's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Capitol Health's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Capitol Health that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CAJ

Capitol Health

Provides diagnostic imaging modalities and related services to the healthcare market in Australia.

Reasonable growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives