- Australia

- /

- Medical Equipment

- /

- ASX:AHC

3 Promising ASX Penny Stocks With At Least A$50M Market Cap

Reviewed by Simply Wall St

As the Australian market showed signs of recovery with materials leading the charge, investors are keenly watching sectors that might benefit from current economic dynamics. Penny stocks, though often considered a relic of past market eras, continue to captivate investors with their potential for growth at accessible price points. In this article, we explore several promising penny stocks on the ASX that exhibit strong financial foundations and could offer intriguing opportunities for those willing to navigate this unique investment landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.455 | A$130.4M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.68 | A$126.42M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.925 | A$57.6M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.67 | A$410.95M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.14 | A$231.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.042 | A$49.13M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.07 | A$36.87M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.835 | A$398.89M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.24 | A$1.37B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 424 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Argosy Minerals (ASX:AGY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Argosy Minerals Limited, with a market cap of A$79.87 million, is involved in the exploration and development of lithium properties in Argentina and the United States.

Operations: Argosy Minerals Limited has not reported any revenue segments.

Market Cap: A$79.87M

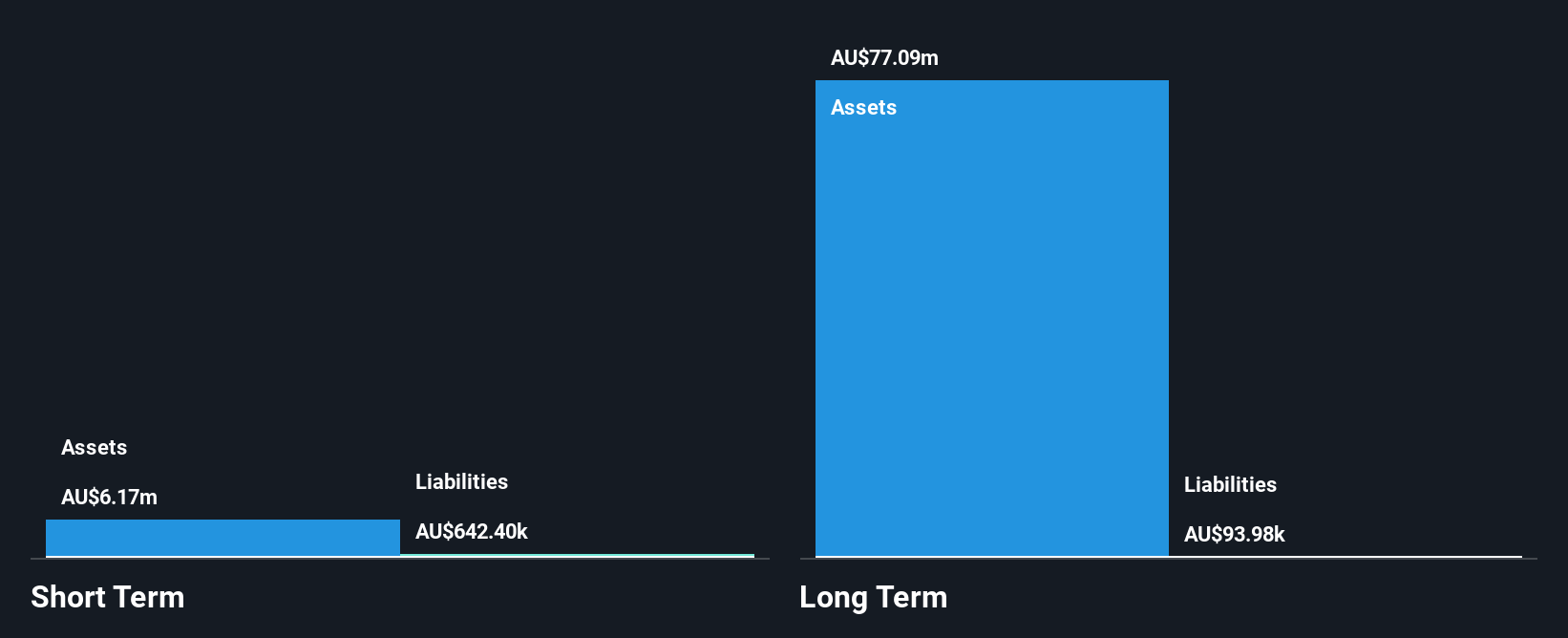

Argosy Minerals, with a market cap of A$79.87 million, is pre-revenue and has recently reported a net loss of A$6.26 million for the half year ended June 30, 2025. Despite this, the company has become profitable in recent years and maintains a strong financial position with short-term assets exceeding both short- and long-term liabilities. Argosy is debt-free and boasts an outstanding Return on Equity of 66.2%, indicating efficient use of its equity base. However, its share price remains highly volatile compared to other Australian stocks, reflecting potential risks associated with investing in penny stocks like Argosy Minerals.

- Click here and access our complete financial health analysis report to understand the dynamics of Argosy Minerals.

- Gain insights into Argosy Minerals' past trends and performance with our report on the company's historical track record.

Austco Healthcare (ASX:AHC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Austco Healthcare Limited develops, manufactures, services, supplies, and distributes healthcare communications equipment and software across Australia, New Zealand, Asia, Europe, and North America with a market cap of A$161.14 million.

Operations: The company's revenue is derived from healthcare communications equipment and software, with A$41.33 million from North America, A$39.42 million from Australia/New Zealand, A$10.84 million from Asia, and A$4.99 million from Europe.

Market Cap: A$161.14M

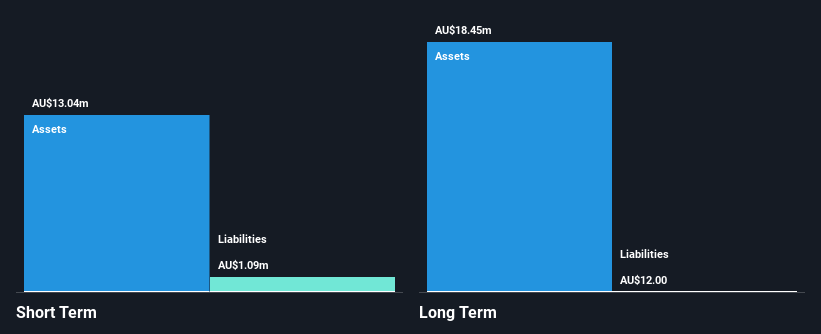

Austco Healthcare, with a market cap of A$161.14 million, reported full-year sales of A$81.41 million, up from A$58.15 million the previous year, yet net income decreased to A$5.93 million from A$7.08 million due to large one-off items impacting results. Despite lower profit margins this year (7.3% vs 12.2%), Austco remains debt-free and its short-term assets surpass both short- and long-term liabilities, indicating a solid financial position for a penny stock investment in Australia. The company trades at good value compared to peers but has faced significant insider selling recently, which may concern potential investors.

- Click here to discover the nuances of Austco Healthcare with our detailed analytical financial health report.

- Learn about Austco Healthcare's future growth trajectory here.

Toro Energy (ASX:TOE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Toro Energy Limited, along with its subsidiaries, is a uranium development and exploration company operating in Australia with a market cap of A$54.13 million.

Operations: The company's revenue is derived entirely from its mineral exploration activities, amounting to A$0.1 million.

Market Cap: A$54.13M

Toro Energy, with a market cap of A$54.13 million, is a pre-revenue uranium exploration company in Australia. Its financials show no debt and short-term assets (A$6.8M) exceeding liabilities, but it has less than a year's cash runway if free cash flow declines persist. The company's management and board are experienced, yet its share price remains volatile and unprofitable with increasing net losses reported at A$9.65 million for the year ending June 2025. Recently, IsoEnergy Ltd announced plans to acquire Toro for A$66.6 million pending shareholder approval by early 2026, potentially impacting future ownership dynamics significantly.

- Take a closer look at Toro Energy's potential here in our financial health report.

- Review our historical performance report to gain insights into Toro Energy's track record.

Next Steps

- Unlock our comprehensive list of 424 ASX Penny Stocks by clicking here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AHC

Austco Healthcare

Engages in the business of development, manufacture, service, supply, and distribution of healthcare communications equipment and software in Australia, New Zealand, Asia, Europe, and North America.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives