The Australian market recently saw the ASX200 close up 0.85% at 8,393 points, with Energy and Utilities sectors leading gains while Information Technology lagged. As investors navigate these shifting dynamics, penny stocks—despite their somewhat outdated moniker—remain an intriguing investment area for those seeking growth opportunities in smaller or newer companies. When backed by strong financial health, these stocks can offer surprising value and potential for significant returns; this article will highlight three such promising examples on the ASX.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$327.26M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.89 | A$239.61M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.53 | A$328.68M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.65 | A$808.63M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.44 | A$86.23M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.155 | A$67.53M | ★★★★★★ |

| West African Resources (ASX:WAF) | A$1.495 | A$1.7B | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.79 | A$472.61M | ★★★★☆☆ |

Click here to see the full list of 1,046 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Stanmore Resources (ASX:SMR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Stanmore Resources Limited is involved in the exploration, development, production, and sale of metallurgical coal in Australia with a market cap of A$2.81 billion.

Operations: The company's revenue is derived from its Metals & Mining segment, specifically coal, amounting to $2.54 billion.

Market Cap: A$2.81B

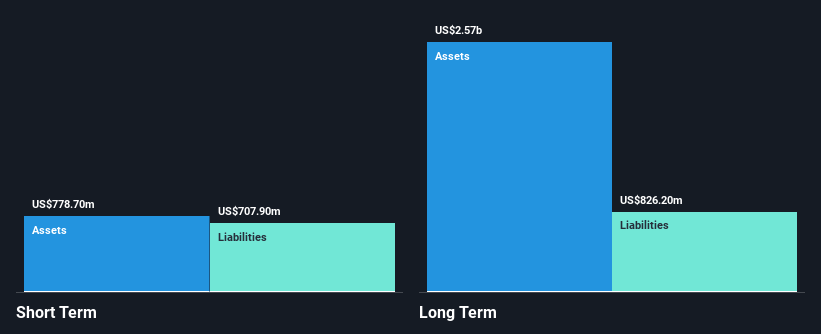

Stanmore Resources, with a market cap of A$2.81 billion, operates in the metallurgical coal sector and has shown significant earnings growth over the past five years. However, recent performance indicates challenges, with earnings declining by 66% last year and profit margins dropping from 25.5% to 10.6%. The company is trading below its estimated fair value but faces potential headwinds with forecasted earnings declines averaging 17% annually for the next three years. Despite these concerns, Stanmore maintains a strong balance sheet with more cash than debt and well-covered interest payments. Recent M&A rumors involve Stanmore as part of a consortium interested in Anglo American's coal assets.

- Click here to discover the nuances of Stanmore Resources with our detailed analytical financial health report.

- Gain insights into Stanmore Resources' outlook and expected performance with our report on the company's earnings estimates.

Southern Cross Gold (ASX:SXG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Southern Cross Gold Ltd is involved in the exploration of natural resources in Australia and has a market cap of A$573.51 million.

Operations: Southern Cross Gold Ltd has not reported any specific revenue segments.

Market Cap: A$573.51M

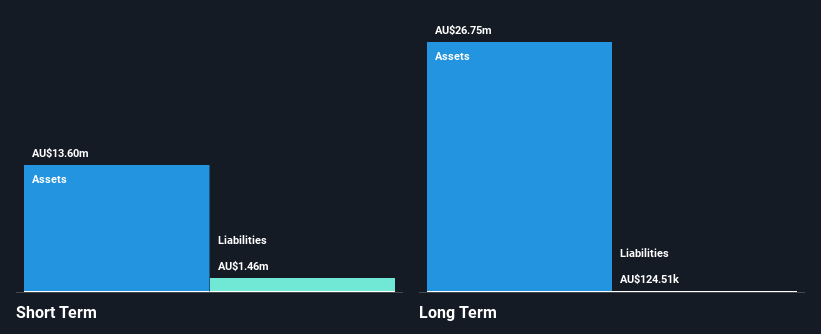

Southern Cross Gold, with a market cap of A$573.51 million, is pre-revenue and focused on mineral exploration in Australia. Recent drilling at the Sunday Creek project revealed promising gold-antimony intersections, enhancing geological confidence and suggesting potential for further discoveries. Despite being debt-free with short-term assets covering liabilities, the company remains unprofitable and has diluted shareholders by 7.8% over the past year. While Southern Cross Gold has sufficient cash runway for over a year based on current free cash flow, its board lacks seasoned experience with an average tenure of 2.8 years.

- Click to explore a detailed breakdown of our findings in Southern Cross Gold's financial health report.

- Review our growth performance report to gain insights into Southern Cross Gold's future.

Wellard (ASX:WLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wellard Limited operates in the supply of livestock and livestock vessels across Australia, Singapore, Brazil, and international markets with a market cap of A$42.50 million.

Operations: The company generates revenue primarily from its Chartering segment, amounting to $34.92 million.

Market Cap: A$42.5M

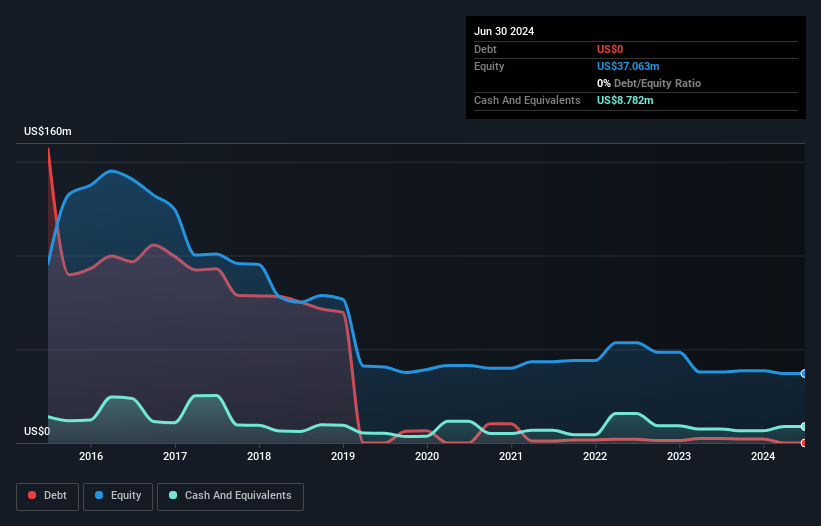

Wellard Limited, with a market cap of A$42.50 million, operates without debt and has experienced leadership, boasting an average board tenure of 7.8 years. Despite being unprofitable, the company reported sales of US$34.94 million for the year ending June 2024 and reduced its net loss significantly from US$15.49 million to US$0.815 million year-over-year. Wellard maintains a strong financial position with short-term assets covering both short-term and long-term liabilities comfortably and possesses a cash runway exceeding three years due to positive free cash flow trends, though these are shrinking annually by 20.5%.

- Unlock comprehensive insights into our analysis of Wellard stock in this financial health report.

- Assess Wellard's previous results with our detailed historical performance reports.

Seize The Opportunity

- Get an in-depth perspective on all 1,046 ASX Penny Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wellard might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WLD

Wellard

Engages in the supply of livestock and livestock vessels in Australia, Singapore, Brazil, and internationally.

Flawless balance sheet unattractive dividend payer.

Market Insights

Community Narratives