Tassal Group Limited's (ASX:TGR) Stock On An Uptrend: Could Fundamentals Be Driving The Momentum?

Tassal Group's's (ASX:TGR) stock is up by a considerable 22% over the past month. As most would know, fundamentals are what usually guide market price movements over the long-term, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. Specifically, we decided to study Tassal Group's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Tassal Group

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Tassal Group is:

8.6% = AU$66m ÷ AU$773m (Based on the trailing twelve months to December 2019).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every A$1 worth of equity, the company was able to earn A$0.09 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Tassal Group's Earnings Growth And 8.6% ROE

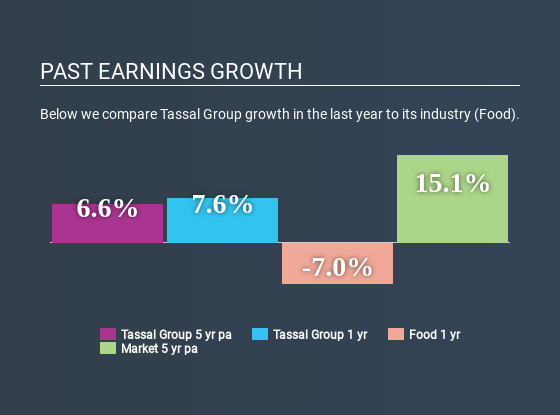

On the face of it, Tassal Group's ROE is not much to talk about. Yet, a closer study shows that the company's ROE is similar to the industry average of 8.5%. On the other hand, Tassal Group reported a moderate 6.6% net income growth over the past five years. Taking into consideration that the ROE is not particularly high, we reckon that there could also be other factors at play which could be influencing the company's growth. For instance, the company has a low payout ratio or is being managed efficiently.

We then performed a comparison between Tassal Group's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 5.5% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Has the market priced in the future outlook for TGR? You can find out in our latest intrinsic value infographic research report.

Is Tassal Group Efficiently Re-investing Its Profits?

Tassal Group has a three-year median payout ratio of 44%, which implies that it retains the remaining 56% of its profits. This suggests that its dividend is well covered, and given the decent growth seen by the company, it looks like management is reinvesting its earnings efficiently.

Additionally, Tassal Group has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to rise to 54% over the next three years. However, the company's ROE is not expected to change by much despite the higher expected payout ratio.

Conclusion

In total, it does look like Tassal Group has some positive aspects to its business. Even in spite of the low rate of return, the company has posted impressive earnings growth as a result of reinvesting heavily into its business. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:TGR

Tassal Group

Tassal Group Limited, together with its subsidiaries, engages in the hatching, farming, processing, marketing, and sale of Atlantic salmon and tiger prawns in Australia.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives