Despite a strong performance on Wall Street driven by Big Tech earnings, the ASX200 is poised to open slightly lower, reflecting cautious sentiment in the Australian market. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for investors seeking reliable returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Bisalloy Steel Group (ASX:BIS) | 9.85% | ★★★★★☆ |

| IPH (ASX:IPH) | 7.53% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.90% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.28% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.85% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.85% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.94% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.31% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.06% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.65% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

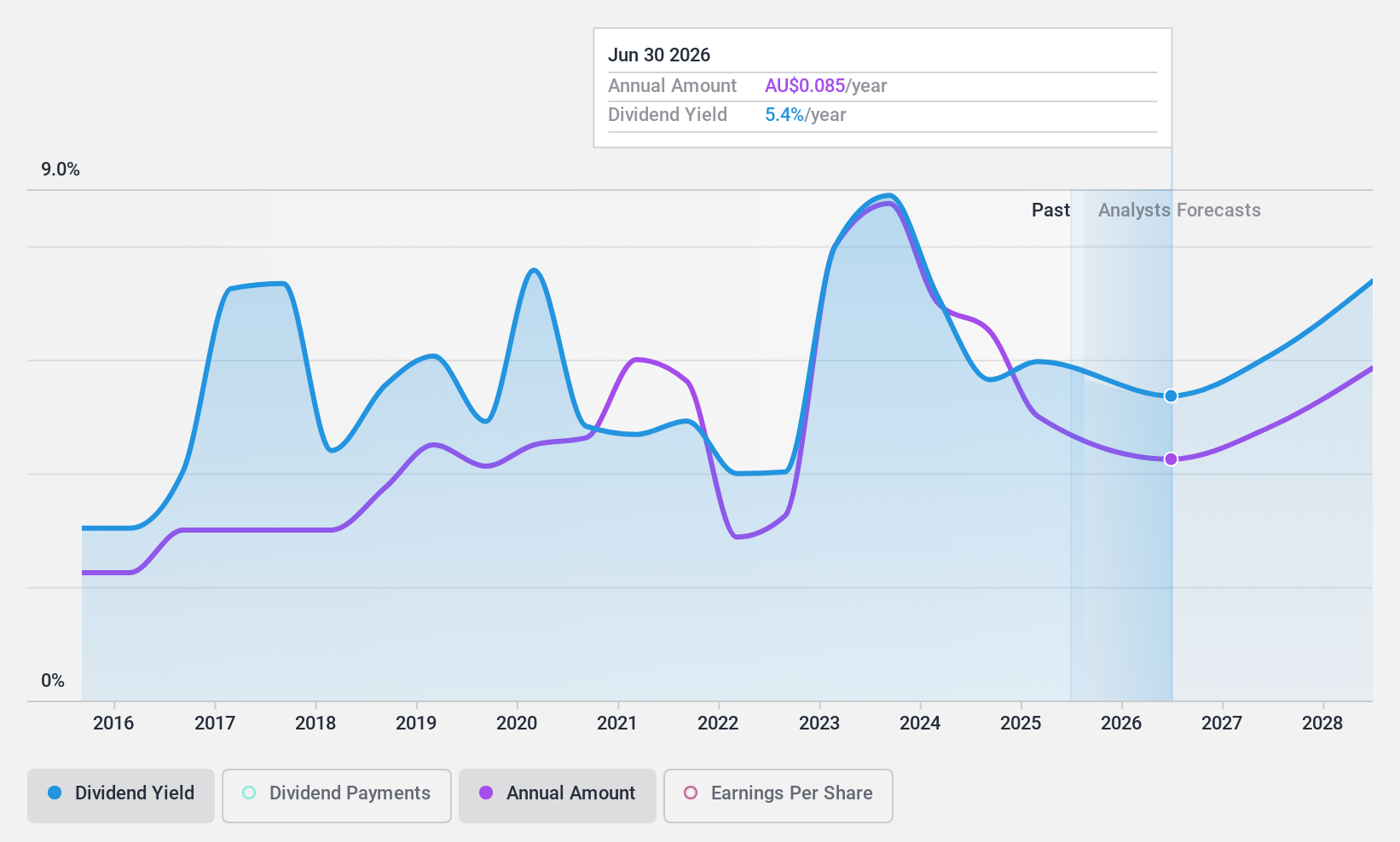

Accent Group (ASX:AX1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market cap of A$1.07 billion.

Operations: Accent Group Limited generates revenue through its Retail segment, which accounts for A$1.30 billion, and its Wholesale segment, contributing A$475.92 million.

Dividend Yield: 6.9%

Accent Group's dividend yield is among the top 25% in Australia, supported by a payout ratio of 87.5%, indicating coverage by earnings and strong cash flow with a cash payout ratio of 38.2%. However, its dividend history has been volatile over the past decade. The recent strategic partnership with Frasers Group provides growth opportunities through expanded retail operations in Australasia, potentially bolstering future revenue streams and supporting dividend sustainability.

- Navigate through the intricacies of Accent Group with our comprehensive dividend report here.

- Our valuation report unveils the possibility Accent Group's shares may be trading at a discount.

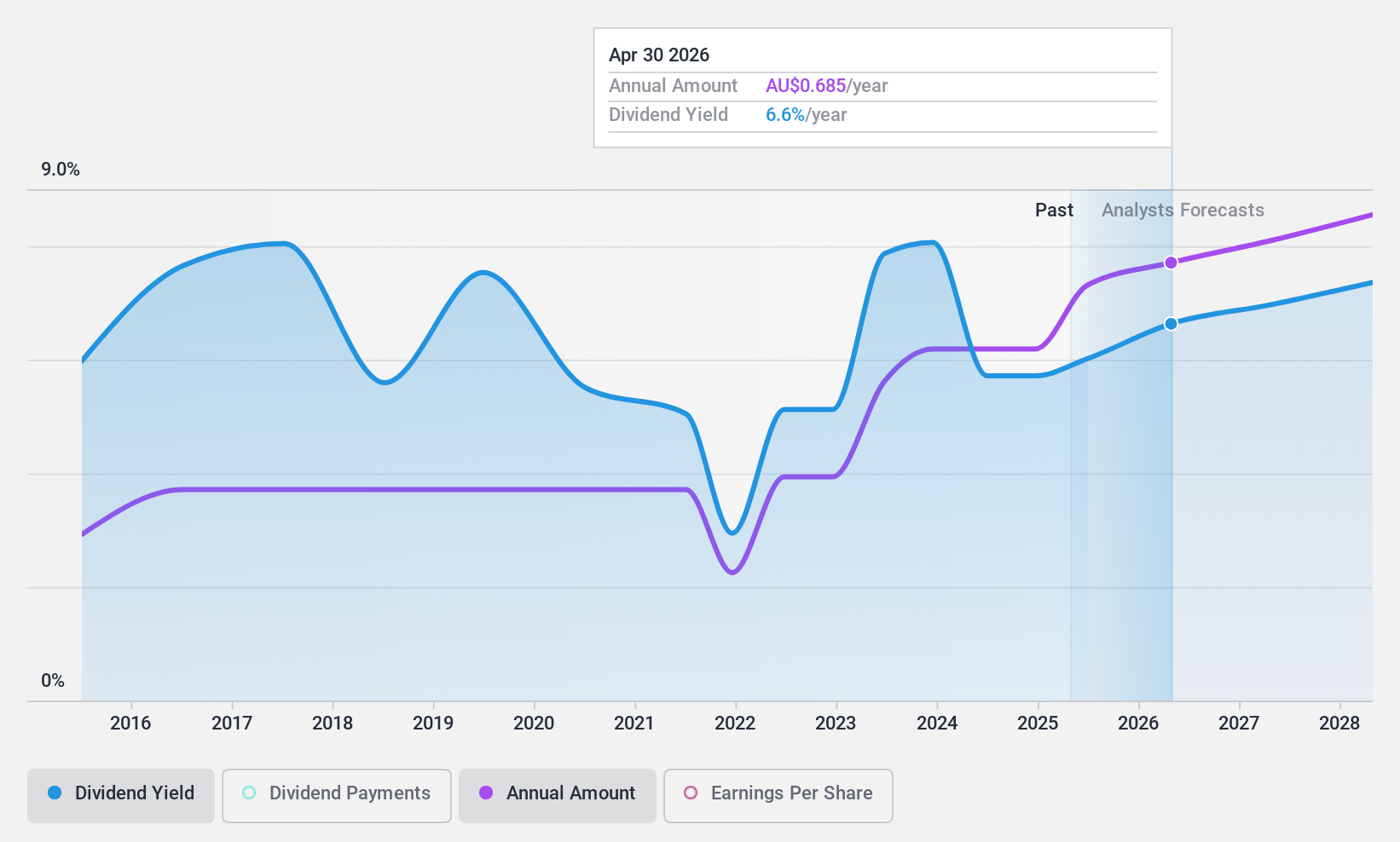

Fleetwood (ASX:FWD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fleetwood Limited, with a market cap of A$261.92 million, operates in Australia and New Zealand focusing on the design, manufacture, sale, and installation of modular accommodation and buildings.

Operations: Fleetwood Limited generates revenue through its RV Solutions segment with A$71.51 million, Building Solutions segment with A$340.12 million, and Community Solutions segment with A$50.02 million in Australia and New Zealand.

Dividend Yield: 8.2%

Fleetwood's dividend yield of 8.19% ranks in the top 25% of Australian payers, but sustainability concerns arise due to a high payout ratio of 286.1%, indicating dividends are not well covered by earnings. Despite a recent increase to A$0.115 per share, dividends have been volatile over the past decade. The company's recent buyback and improved half-year results with sales at A$271.94 million show positive momentum, yet profit margins remain slim at 1%.

- Unlock comprehensive insights into our analysis of Fleetwood stock in this dividend report.

- The valuation report we've compiled suggests that Fleetwood's current price could be inflated.

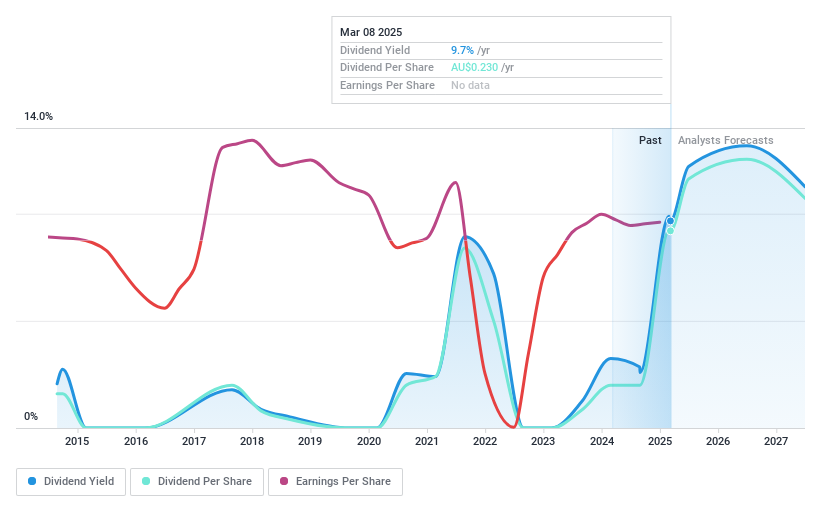

Ricegrowers (ASX:SGLLV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ricegrowers Limited is a rice food company with operations in Australia, New Zealand, the Pacific Islands, the Middle East, and the United States, and has a market cap of A$713.24 million.

Operations: Ricegrowers Limited generates revenue from several segments, including Riviana (A$228.15 million), Cop Rice (A$249.32 million), Rice Food (A$127.76 million), Rice Pool (A$477.65 million), Corporate Segment (A$41.03 million), and International Rice (A$892 million).

Dividend Yield: 5%

Ricegrowers' dividend yield of 5% falls short of Australia's top 25% payers. Despite its dividends being covered by earnings and cash flows, with a payout ratio of 56.3% and cash payout at 41%, the payments have been volatile over the past decade. Trading at good value, Ricegrowers is priced significantly below its estimated fair value, but an unstable dividend track record may concern income-focused investors seeking reliability.

- Click here to discover the nuances of Ricegrowers with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Ricegrowers is trading behind its estimated value.

Seize The Opportunity

- Access the full spectrum of 29 Top ASX Dividend Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SGLLV

Ricegrowers

Operates as a rice food company in Australia, New Zealand, the Pacific Islands, the Middle East, the United States, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives