The Market Doesn't Like What It Sees From Farm Pride Foods Limited's (ASX:FRM) Revenues Yet As Shares Tumble 26%

Farm Pride Foods Limited (ASX:FRM) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 73% in the last year.

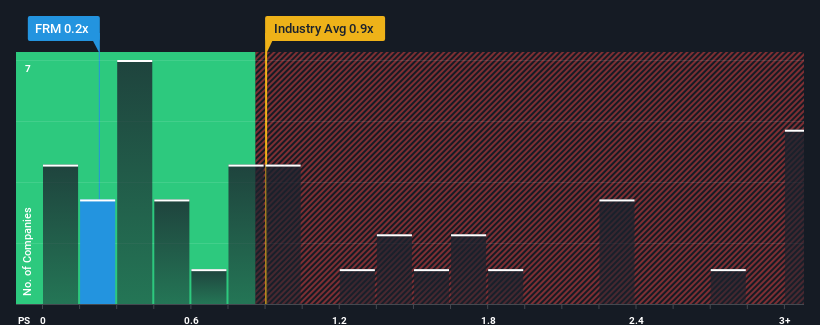

After such a large drop in price, when close to half the companies operating in Australia's Food industry have price-to-sales ratios (or "P/S") above 0.9x, you may consider Farm Pride Foods as an enticing stock to check out with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Farm Pride Foods

How Farm Pride Foods Has Been Performing

The revenue growth achieved at Farm Pride Foods over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Farm Pride Foods will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Farm Pride Foods' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 8.2% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 6.0% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that Farm Pride Foods is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Farm Pride Foods' P/S

Farm Pride Foods' recently weak share price has pulled its P/S back below other Food companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Farm Pride Foods revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Farm Pride Foods (at least 3 which make us uncomfortable), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FRM

Farm Pride Foods

Produces, processes, manufactures, and sells eggs and egg products in Australia.

Flawless balance sheet and good value.

Market Insights

Community Narratives