- Australia

- /

- Professional Services

- /

- ASX:SIQ

3 Undervalued Small Caps In Australia With Insider Buying

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has dropped 1.7%, yet it remains up 10% over the past year with earnings forecasted to grow by 12% annually. In this context, identifying stocks that are undervalued and have insider buying can be particularly appealing for investors looking to capitalize on potential growth opportunities.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| IVE Group | 11.7x | 0.3x | 22.22% | ★★★★★☆ |

| Magellan Financial Group | 6.7x | 4.2x | 45.38% | ★★★★★☆ |

| Corporate Travel Management | 19.3x | 2.3x | 9.96% | ★★★★★☆ |

| GWA Group | 15.6x | 1.5x | 44.86% | ★★★★★☆ |

| Beach Energy | NA | 1.4x | 38.99% | ★★★★★☆ |

| Tabcorp Holdings | NA | 0.4x | 31.81% | ★★★★★☆ |

| Bapcor | NA | 0.8x | 49.25% | ★★★★☆☆ |

| Eagers Automotive | 10.0x | 0.2x | 41.57% | ★★★★☆☆ |

| Dicker Data | 20.5x | 0.7x | -67.56% | ★★★☆☆☆ |

| BSP Financial Group | 7.7x | 2.7x | 3.63% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

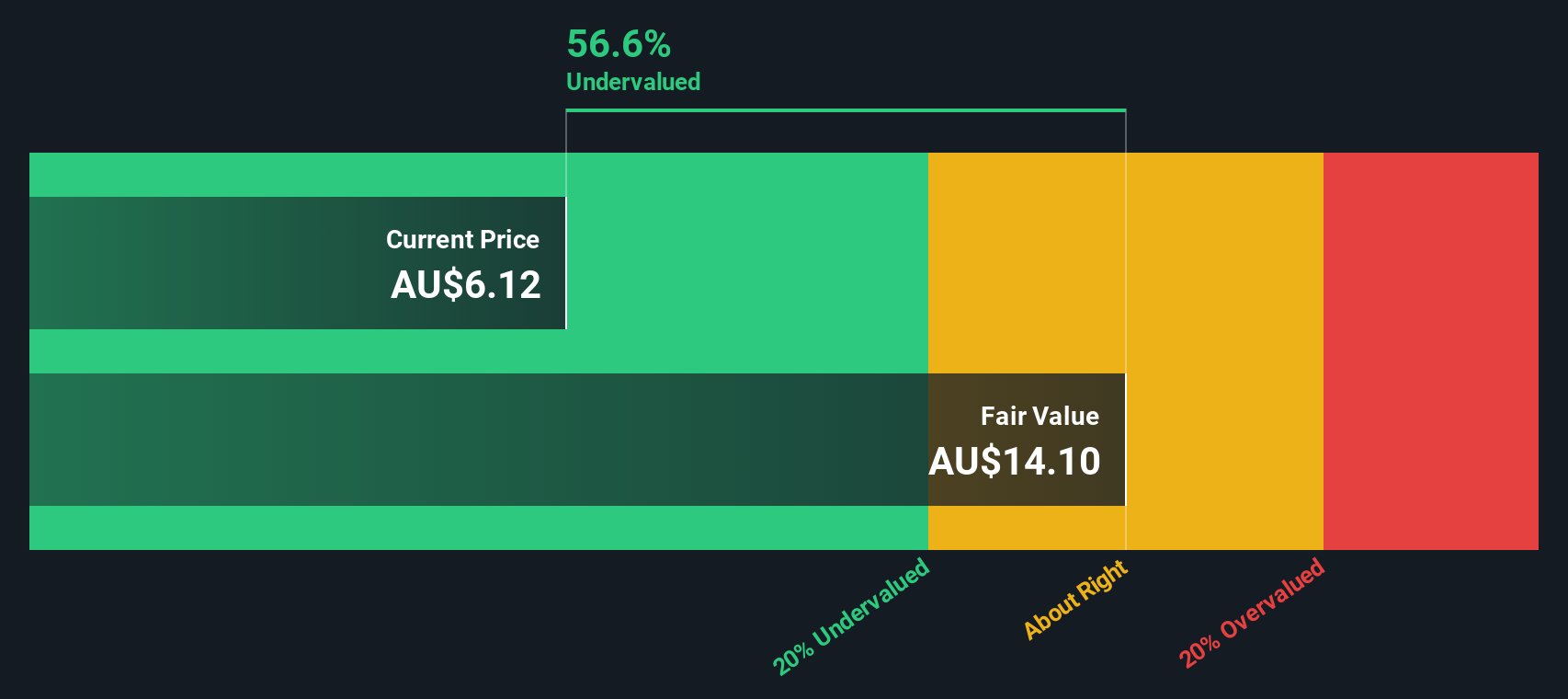

Elders (ASX:ELD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Elders operates in agribusiness, providing products and services through its branch network, wholesale products, and feed and processing services, with a market cap of A$1.78 billion.

Operations: Branch Network generates the highest revenue at A$2.54 billion, followed by Wholesale Products at A$341.19 million and Feed and Processing Services at A$120.14 million. The company has seen fluctuations in its net income margin, reaching a high of 7.08% in September 2017 and dropping to 2.12% by March 2024.

PE: 23.0x

Elders, a small Australian company, is currently viewed as undervalued. Despite a high debt level and reliance on external borrowing, earnings are forecasted to grow by 22.8% annually. Profit margins have decreased from 3.4% to 2.1%. Insider confidence is evident with recent purchases in the past year. The appointment of Glenn Davis as a non-executive director starting November 2024 adds significant expertise to the board, potentially enhancing strategic direction and governance for future growth prospects in A$.

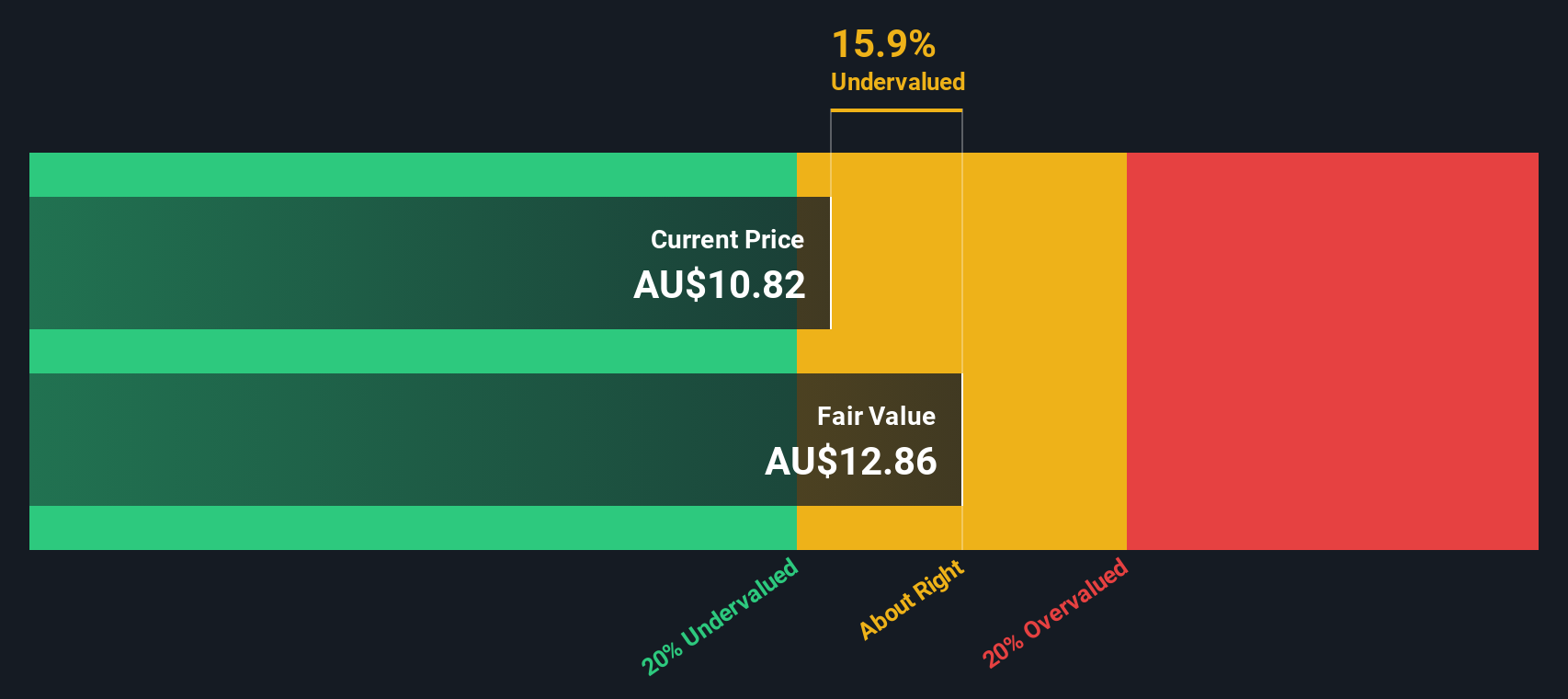

Lycopodium (ASX:LYL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lycopodium is an engineering and project management consultancy firm specializing in resources, process industries, and rail infrastructure, with a market cap of A$0.34 billion.

Operations: Lycopodium generates revenue primarily from the Resources segment, followed by Process Industries and Rail Infrastructure. The company's gross profit margin has shown variability, reaching as high as 33.28% and as low as 10.81%. Operating expenses have also fluctuated, affecting net income margins which have ranged from -1.61% to 16.73%.

PE: 9.4x

Lycopodium's recent financial performance highlights its potential as an undervalued stock in Australia. For the fiscal year ending June 30, 2024, sales reached A$344.55 million, up from A$323.88 million the previous year, and net income rose to A$50.71 million from A$46.78 million. Notably, Steven Chadwick's purchase of 8,000 shares for approximately A$97,572 indicates insider confidence in the company's prospects. Despite relying on external borrowing for funding, Lycopodium maintains high-quality earnings with a full-year dividend of 77 cents per share approved for distribution.

- Click here and access our complete valuation analysis report to understand the dynamics of Lycopodium.

Assess Lycopodium's past performance with our detailed historical performance reports.

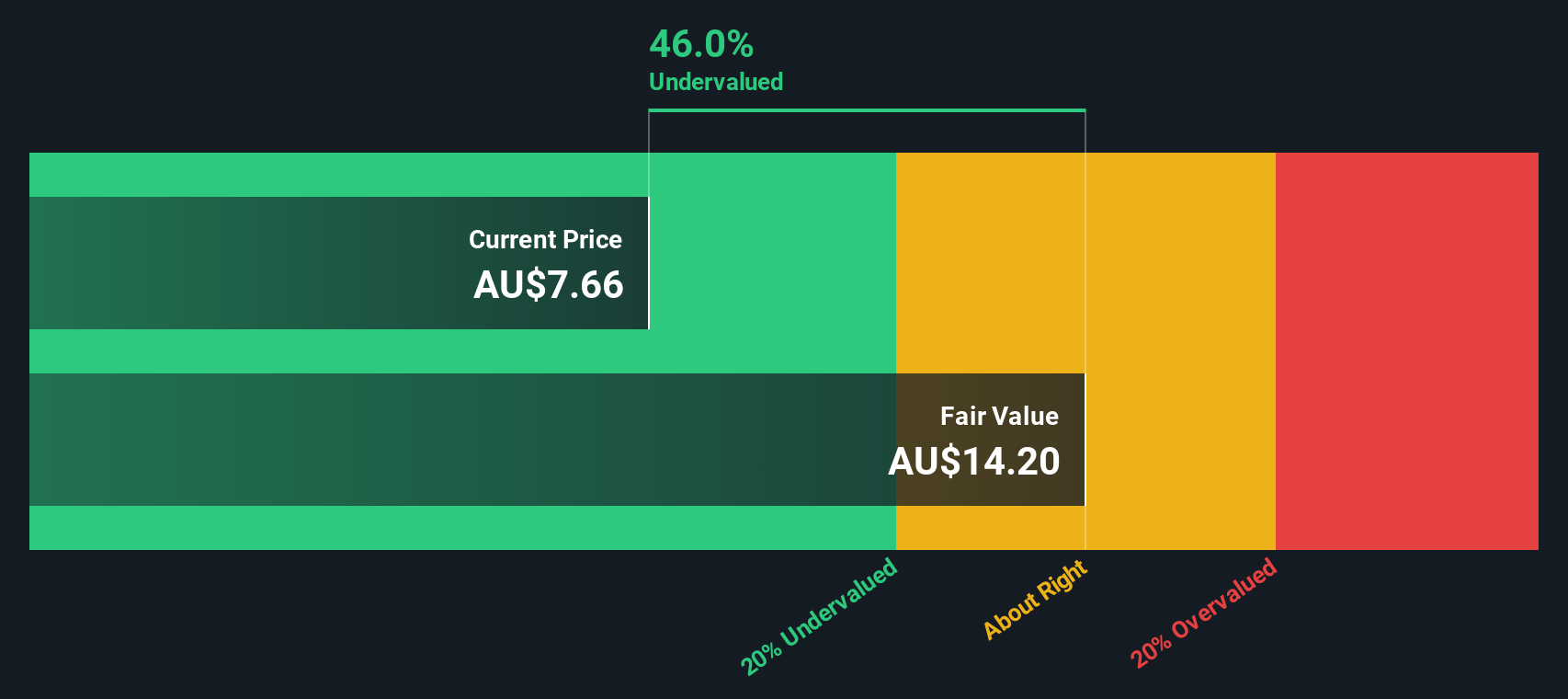

Smartgroup (ASX:SIQ)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Smartgroup provides outsourced administration, vehicle services, and software distribution and group services, with a market cap of A$0.89 billion.

Operations: Smartgroup generates revenue primarily from Outsourced Administration (A$263.07M), Software, Distribution and Group Services (A$41.02M), and Vehicle Services (A$19.53M). The company has seen its net income margin peak at 27.24% in Q1 2022 while the gross profit margin reached up to 61.33% in Q4 2018. Operating expenses have fluctuated, with a notable increase to A$57M by mid-2024, impacting profitability trends over time.

PE: 16.8x

Smartgroup has shown promising financial performance, reporting A$148.49 million in sales for the half-year ending June 30, 2024, up from A$116.62 million a year ago. Net income rose to A$34.26 million compared to A$28.94 million previously, with basic earnings per share increasing to A$0.264 from A$0.223 last year. Notably, insider confidence is evident with recent purchases in the past six months, suggesting optimism about future growth despite reliance on external borrowing for funding.

- Navigate through the intricacies of Smartgroup with our comprehensive valuation report here.

Explore historical data to track Smartgroup's performance over time in our Past section.

Taking Advantage

- Click here to access our complete index of 31 Undervalued ASX Small Caps With Insider Buying.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SIQ

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives