Fresh Equity Raise Might Change the Case for Investing in Cobram Estate Olives (ASX:CBO)

Reviewed by Sasha Jovanovic

- In early October 2025, Cobram Estate Olives Limited completed follow-on equity offerings totaling A$8.09 million, issuing 2,526,830 ordinary shares at A$3.20 per share through direct listings.

- These back-to-back capital raisings highlight the company's efforts to reinforce its balance sheet and fund ongoing operational and expansion initiatives in key markets.

- We'll explore how Cobram Estate Olives’ recent equity fundraising could reshape its investment narrative and future capital allocation priorities.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Cobram Estate Olives Investment Narrative Recap

To be a shareholder of Cobram Estate Olives, you need to believe in the company’s ability to scale production as its groves mature, expand premium olive oil sales across Australia and the US, and maintain operational efficiency despite variable agricultural yields. The recent A$8.09 million equity offerings bolster the balance sheet but are unlikely to change the most important short-term catalyst: successful scaling of US operations. The greatest risk remains production and earnings volatility due to harvest cycles and input cost pressures, and this news does not materially shift that equation.

A recent announcement that stands out alongside these capital raisings is Cobram Estate Olives’ addition to the S&P/ASX 300 and S&P/ASX Small Ordinaries Indexes in September 2025. Index inclusion can increase visibility and liquidity, factors that may support short-term share price momentum, yet the long-term catalyst is still tied to delivering sustained growth as new groves come online in the US and Australia.

However, investors should be aware of the potential for disappointing earnings if expectations prove inconsistent with agricultural yield cycles and the reality of...

Read the full narrative on Cobram Estate Olives (it's free!)

Cobram Estate Olives' narrative projects A$402.7 million revenue and A$43.9 million earnings by 2028. This requires 18.4% yearly revenue growth and a decrease of A$5.7 million in earnings from the current A$49.6 million.

Uncover how Cobram Estate Olives' forecasts yield a A$3.14 fair value, a 7% downside to its current price.

Exploring Other Perspectives

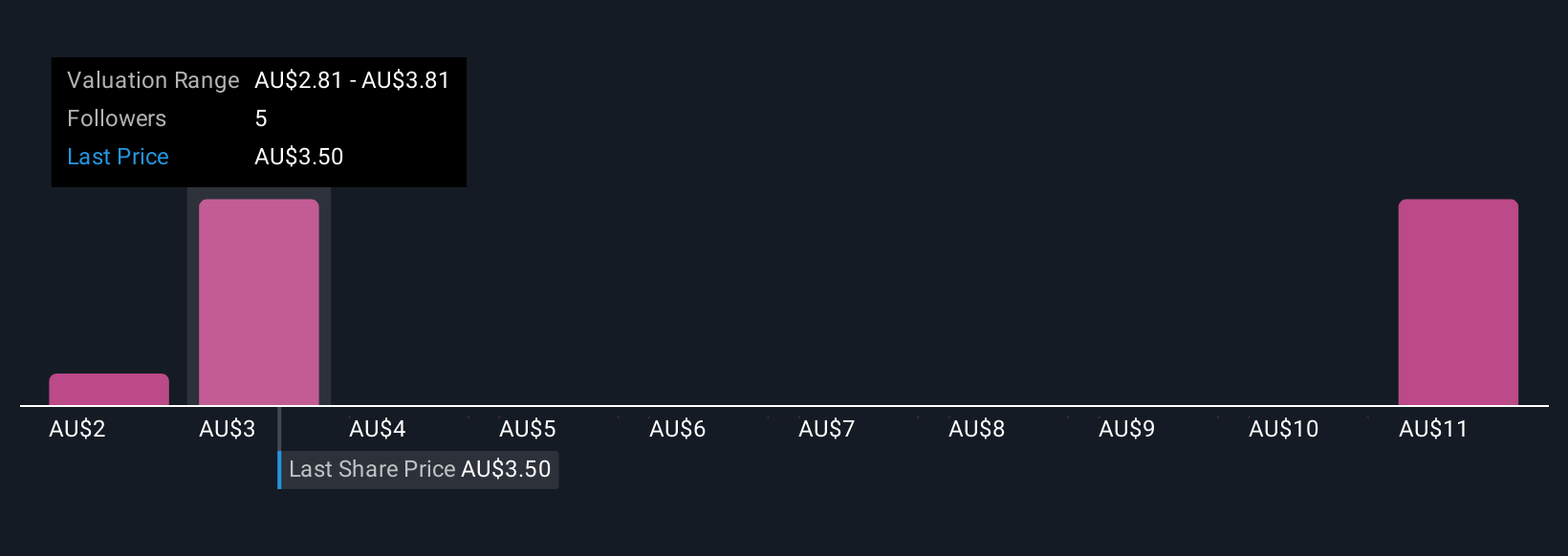

Simply Wall St Community fair value estimates for Cobram Estate Olives range from A$1.81 to A$11.80 across three independent perspectives, revealing wide differences in expectations. While many anticipate earnings growth from maturing groves, these contrasting outlooks remind you that market performance hinges on more than headline figures, explore the full range of opinions before making up your mind.

Explore 3 other fair value estimates on Cobram Estate Olives - why the stock might be worth over 3x more than the current price!

Build Your Own Cobram Estate Olives Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cobram Estate Olives research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cobram Estate Olives research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cobram Estate Olives' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CBO

Cobram Estate Olives

Engages in production and marketing of olive oil in Australia, the United States, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives