- Australia

- /

- Oil and Gas

- /

- ASX:VEA

3 ASX Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

As the Australian market navigates a period of adjustment, with the ASX200 closing down 0.83% and inflation reaching its lowest in three years, investors are keenly observing how these shifts influence stock valuations. Amidst this landscape, identifying stocks trading below their intrinsic value becomes crucial for those looking to capitalize on potential long-term gains.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ansell (ASX:ANN) | A$30.37 | A$58.74 | 48.3% |

| Telix Pharmaceuticals (ASX:TLX) | A$21.10 | A$41.48 | 49.1% |

| Westgold Resources (ASX:WGX) | A$3.23 | A$6.24 | 48.3% |

| MLG Oz (ASX:MLG) | A$0.60 | A$1.15 | 47.8% |

| Ingenia Communities Group (ASX:INA) | A$4.81 | A$9.40 | 48.9% |

| Genesis Minerals (ASX:GMD) | A$2.44 | A$4.77 | 48.9% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Audinate Group (ASX:AD8) | A$9.11 | A$17.76 | 48.7% |

| IDP Education (ASX:IEL) | A$14.11 | A$27.40 | 48.5% |

| Energy One (ASX:EOL) | A$5.60 | A$11.03 | 49.2% |

Let's explore several standout options from the results in the screener.

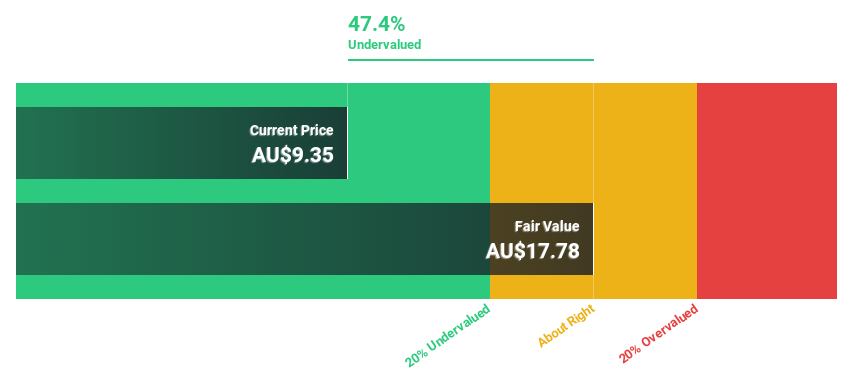

Audinate Group (ASX:AD8)

Overview: Audinate Group Limited develops and sells digital audio visual networking solutions in Australia and internationally, with a market cap of A$755.08 million.

Operations: The company generates revenue of A$91.48 million from its Contract Electronics Manufacturing Services segment.

Estimated Discount To Fair Value: 48.7%

Audinate Group is trading at A$9.11, significantly below its estimated fair value of A$17.76, suggesting it may be undervalued based on cash flows. Despite a volatile share price recently, the company's earnings are forecast to grow substantially at 22.4% annually over the next three years, outpacing both its revenue growth and the broader Australian market's profit growth rate. The recent appointment of experienced CFO Chris Rollinson could enhance financial management and strategic initiatives.

- The analysis detailed in our Audinate Group growth report hints at robust future financial performance.

- Take a closer look at Audinate Group's balance sheet health here in our report.

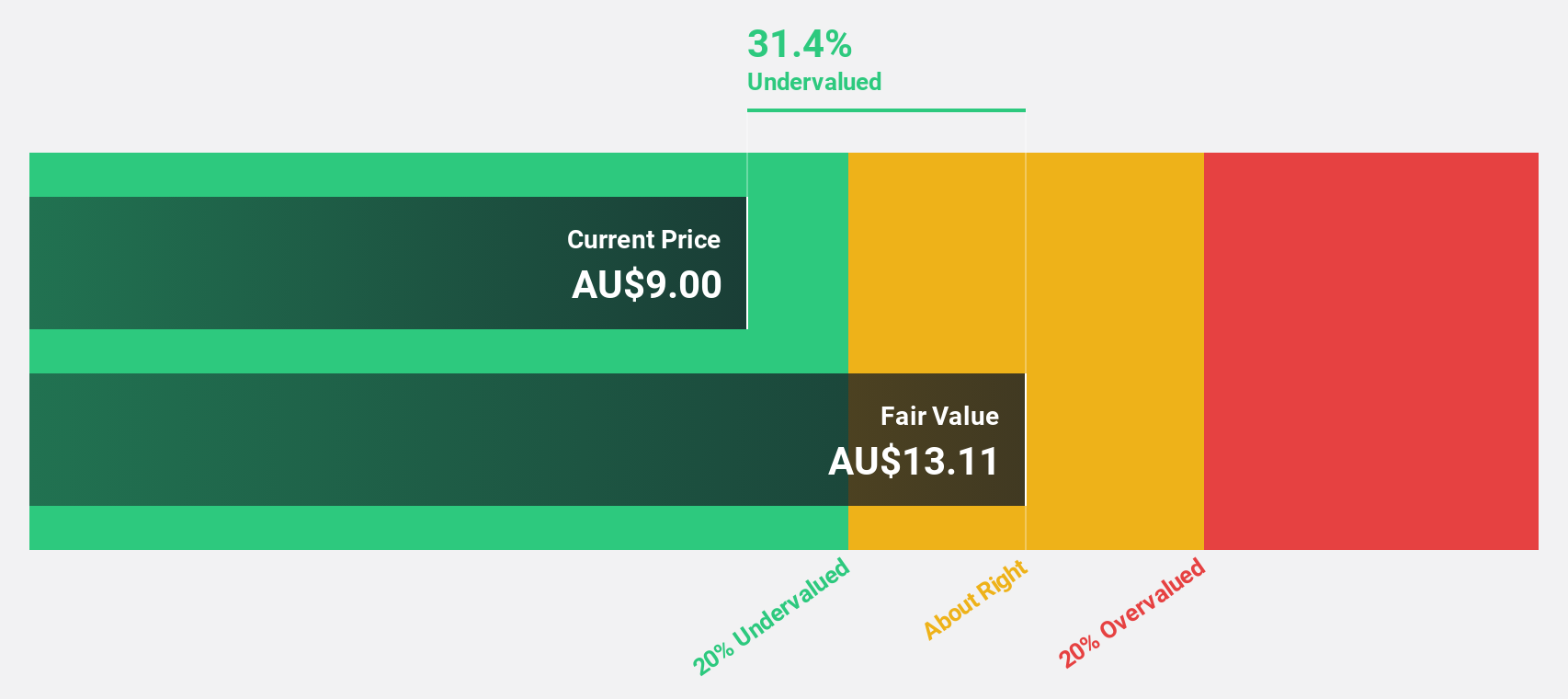

Lynas Rare Earths (ASX:LYC)

Overview: Lynas Rare Earths Limited, with a market cap of A$7.23 billion, is involved in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia.

Operations: The company's revenue is primarily derived from its Rare Earth Operations, totaling A$463.29 million.

Estimated Discount To Fair Value: 41%

Lynas Rare Earths is trading at A$7.65, below its estimated fair value of A$12.96, highlighting potential undervaluation based on cash flows. Despite a decrease in production and sales volumes, revenue is forecast to grow 27.2% annually, surpassing the Australian market's growth rate. However, recent financial results show a decline in net income and profit margins compared to the previous year, which may impact investor sentiment despite strong future earnings growth projections.

- Our comprehensive growth report raises the possibility that Lynas Rare Earths is poised for substantial financial growth.

- Get an in-depth perspective on Lynas Rare Earths' balance sheet by reading our health report here.

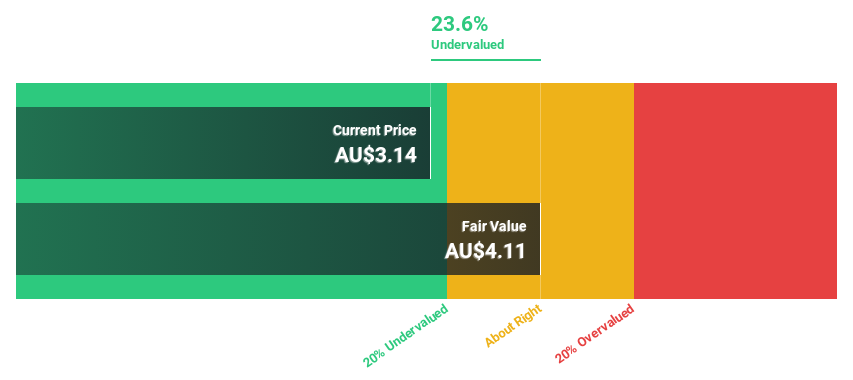

Viva Energy Group (ASX:VEA)

Overview: Viva Energy Group Limited is an energy company operating in Australia, Singapore, and Papua New Guinea with a market cap of A$4.29 billion.

Operations: The company's revenue segments consist of Convenience & Mobility at A$11.43 billion, Commercial & Industrial at A$16.97 billion, and Energy & Infrastructure at A$7.92 billion.

Estimated Discount To Fair Value: 14.1%

Viva Energy Group is trading at A$2.65, below its estimated fair value of A$3.09, indicating potential undervaluation based on cash flows. The company reported a net income of A$80 million for the first half of 2024, recovering from a loss last year. However, revenue growth lags behind the market at 2.2% annually, and dividend sustainability is questionable due to insufficient earnings coverage and recent insider selling activity.

- Our earnings growth report unveils the potential for significant increases in Viva Energy Group's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Viva Energy Group.

Where To Now?

- Click this link to deep-dive into the 47 companies within our Undervalued ASX Stocks Based On Cash Flows screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VEA

Viva Energy Group

Operates as an energy company in Australia, Singapore, and Papua New Guinea.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives