- Australia

- /

- Hospitality

- /

- ASX:RCT

ASX Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

As the Australian market braces for a potential downturn, with ASX 200 futures indicating a significant drop following global market unrest, investors are keeping a close eye on upcoming earnings reports and economic data. In such volatile conditions, identifying stocks with strong financial health becomes crucial. Penny stocks, often representing smaller or newer companies, continue to attract attention for their potential value and growth opportunities. Despite the term's dated connotation, these stocks can offer compelling prospects when backed by robust fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.795 | A$145.87M | ★★★★☆☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.985 | A$93.64M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.445 | A$275.96M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$2.06 | A$335.4M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.525 | A$103.1M | ★★★★★★ |

| Bisalloy Steel Group (ASX:BIS) | A$3.20 | A$153.29M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.055 | A$65.69M | ★★★★★★ |

| MotorCycle Holdings (ASX:MTO) | A$1.85 | A$136.54M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.20 | A$340.76M | ★★★★☆☆ |

| Lindsay Australia (ASX:LAU) | A$0.70 | A$220.39M | ★★★★☆☆ |

Click here to see the full list of 1,036 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

MaxiPARTS (ASX:MXI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MaxiPARTS Limited, with a market cap of A$105.65 million, distributes and sells commercial truck and trailer parts in Australia through its subsidiaries.

Operations: MaxiPARTS Limited does not report distinct revenue segments.

Market Cap: A$105.65M

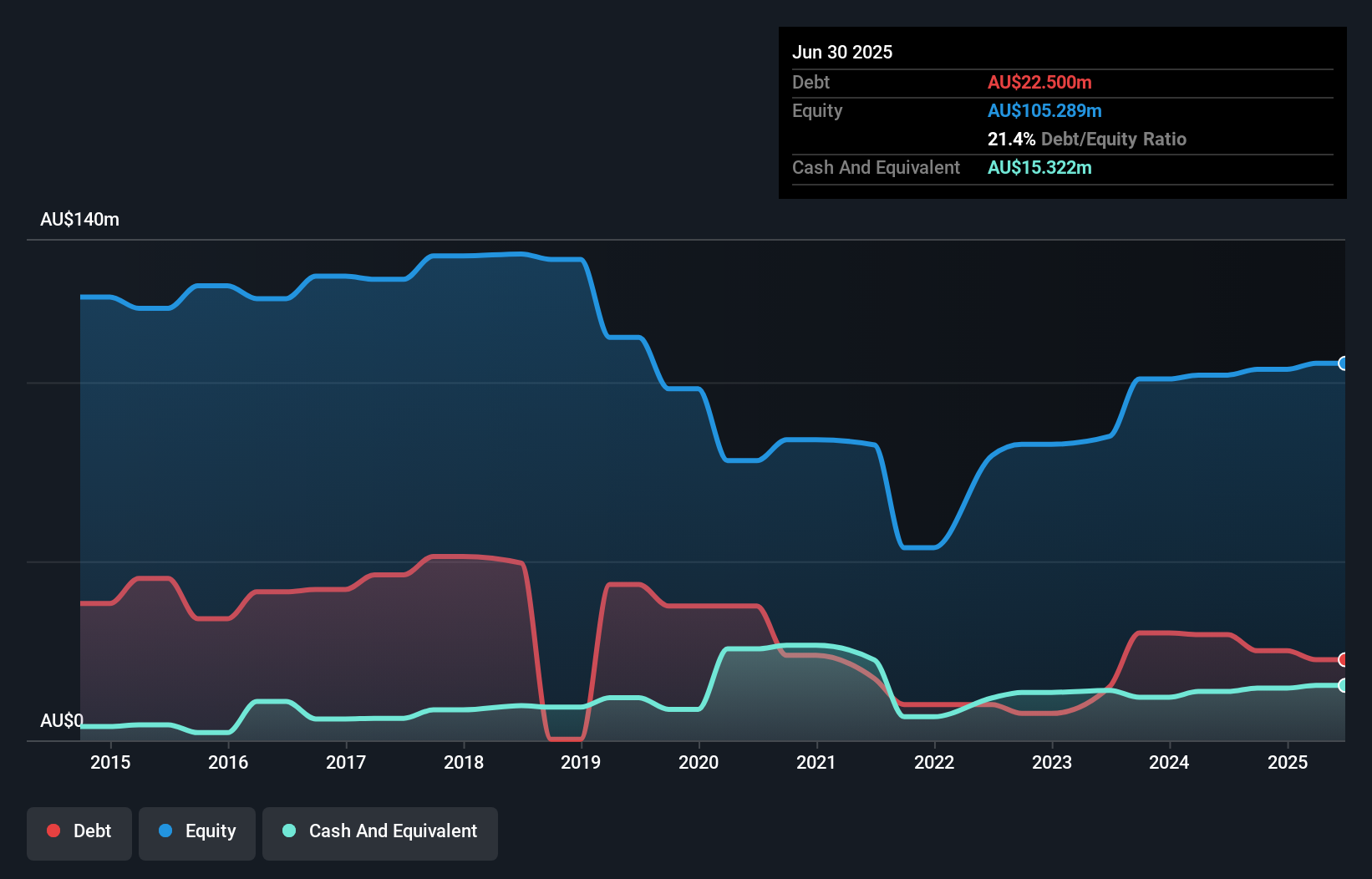

MaxiPARTS Limited, with a market cap of A$105.65 million, has shown promising financial health for a penny stock. Its net debt to equity ratio is satisfactory at 10%, and interest payments are well covered by EBIT, indicating manageable debt levels. The company's earnings have grown significantly over the past five years, increasing by 54.5% annually, although recent growth slowed to 9.5%. Despite this deceleration, earnings are forecasted to grow by 18.16% per year moving forward. Recent half-year results showed substantial improvement in net income from A$0.396 million to A$3.72 million year-on-year, reflecting operational progress.

- Dive into the specifics of MaxiPARTS here with our thorough balance sheet health report.

- Evaluate MaxiPARTS' prospects by accessing our earnings growth report.

Reef Casino Trust (ASX:RCT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Reef Casino Trust operates as an owner and lessor of the Reef Hotel Casino complex in Cairns, North Queensland, Australia, with a market cap of A$67.73 million.

Operations: Reef Casino Trust has not reported any specific revenue segments.

Market Cap: A$67.73M

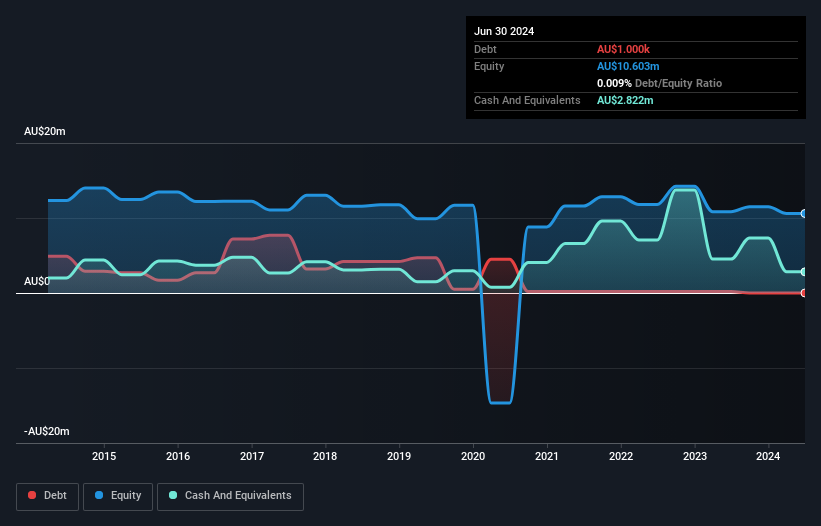

Reef Casino Trust, with a market cap of A$67.73 million, presents a mixed picture as a penny stock. Its recent earnings report showed slight declines in revenue and net income compared to the previous year, with sales at A$25.52 million and net income at A$5.08 million. The company's debt situation is favorable, having more cash than total debt and significantly reduced its debt-to-equity ratio over five years to 0.01%. However, interest coverage by EBIT remains low at 2x, indicating potential financial strain if profits decrease further. Additionally, short-term assets cover liabilities well but long-term liabilities remain uncovered by current assets.

- Unlock comprehensive insights into our analysis of Reef Casino Trust stock in this financial health report.

- Review our historical performance report to gain insights into Reef Casino Trust's track record.

3D Energi (ASX:TDO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 3D Energi Limited is engaged in the exploration and development of upstream oil and gas assets in Australia, with a market cap of A$35.01 million.

Operations: 3D Energi Limited has not reported any specific revenue segments.

Market Cap: A$35.01M

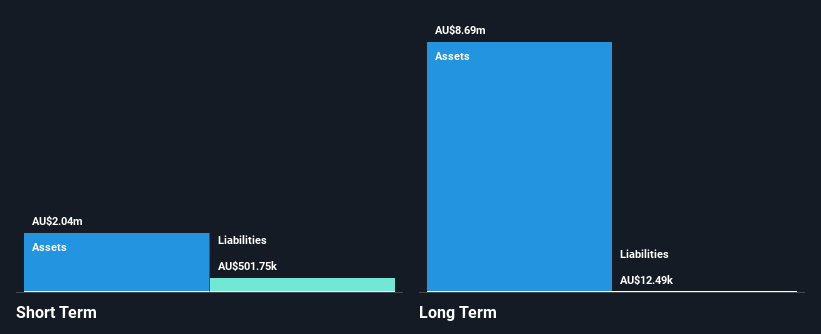

3D Energi Limited, with a market cap of A$35.01 million, is currently pre-revenue and unprofitable but has been reducing its losses by 42% annually over the past five years. The company is debt-free and maintains positive short-term liquidity, as its assets (A$3.3M) exceed both short-term (A$650.6K) and long-term liabilities (A$11.1K). Shareholders have not faced significant dilution recently, which can be appealing for investors wary of equity erosion in penny stocks. The board of directors brings substantial experience with an average tenure exceeding ten years, potentially providing stable governance amid ongoing financial challenges.

- Jump into the full analysis health report here for a deeper understanding of 3D Energi.

- Evaluate 3D Energi's historical performance by accessing our past performance report.

Seize The Opportunity

- Access the full spectrum of 1,036 ASX Penny Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RCT

Reef Casino Trust

Operates as an owner and lessor of the Reef Hotel Casino complex located in Cairns in North Queensland, Australia.

Adequate balance sheet and fair value.

Market Insights

Community Narratives