- Australia

- /

- Oil and Gas

- /

- ASX:PEN

Peninsula Energy Limited's (ASX:PEN) Share Price Could Signal Some Risk

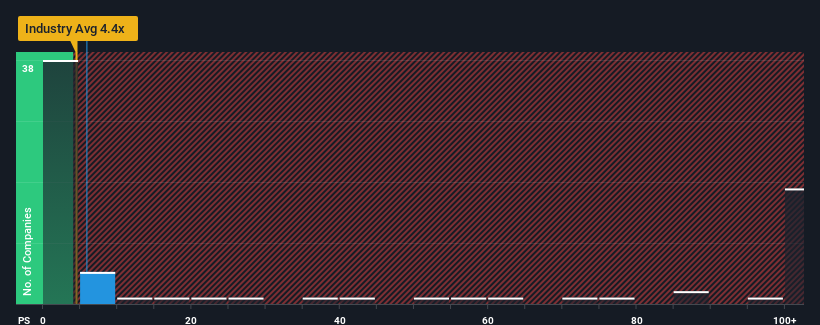

Peninsula Energy Limited's (ASX:PEN) price-to-sales (or "P/S") ratio of 5.8x might make it look like a sell right now compared to the Oil and Gas industry in Australia, where around half of the companies have P/S ratios below 4.4x and even P/S below 1.8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Peninsula Energy

How Has Peninsula Energy Performed Recently?

Recent times have been pleasing for Peninsula Energy as its revenue has risen in spite of the industry's average revenue going into reverse. The P/S ratio is probably high because investors think the company will continue to navigate the broader industry headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Peninsula Energy.Is There Enough Revenue Growth Forecasted For Peninsula Energy?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Peninsula Energy's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 87% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 52% per annum over the next three years. That's shaping up to be materially lower than the 179% per annum growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Peninsula Energy's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Peninsula Energy's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Peninsula Energy, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - Peninsula Energy has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PEN

Peninsula Energy

Operates as a uranium exploration company in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives