- Australia

- /

- Oil and Gas

- /

- ASX:PDN

Will Paladin Energy’s (ASX:PDN) Canadian Expansion Reshape Its Long-Term Growth Prospects?

Reviewed by Sasha Jovanovic

- Paladin Energy Ltd has released its quarterly activities report and presentation for the three months ended 30 September 2025, providing updated operational and financial information to investors.

- This report marks the first full quarterly update since Paladin's acquisition of Fission Uranium, reflecting the company's expanded footprint in Canada alongside operations in Namibia and Australia.

- We'll explore how new details about Paladin's expanded Canadian operations may influence its future growth trajectory and investment outlook.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

Paladin Energy Investment Narrative Recap

To be a Paladin Energy shareholder, you need to believe that global demand for uranium will drive higher long-term production and pricing, especially as Paladin expands across Canada, Namibia, and Australia. The latest quarterly report and presentation contain key operational updates, but they do not materially shift the near-term catalyst: the ramp-up and stable operation of the Langer Heinrich mine. The most immediate risk for investors remains potential disruptions or underperformance at this site, which could impact revenue and delay the expected profitability turnaround.

Among recent announcements, Paladin's follow-on equity offerings totaling A$261.39 million and an additional A$20 million in September stand out. These strengthen Paladin’s ability to fund development at Patterson Lake South and provide the liquidity needed for both Canadian expansion and ongoing production growth, that directly supports the company’s central catalysts.

By contrast, investors should be aware of new risks associated with substantial share dilution and what that could mean for long-term returns if project timelines slip...

Read the full narrative on Paladin Energy (it's free!)

Paladin Energy's narrative projects $519.5 million revenue and $175.2 million earnings by 2028. This requires 43.0% yearly revenue growth and a $219.8 million earnings increase from the current earnings of $-44.6 million.

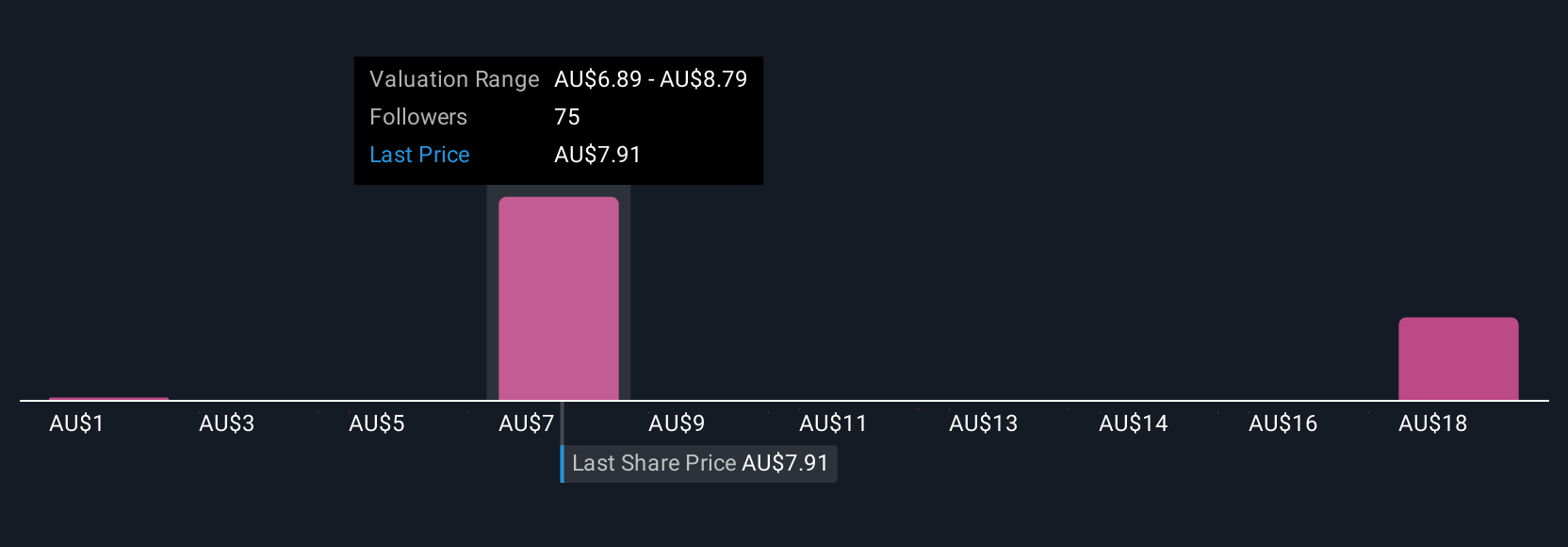

Uncover how Paladin Energy's forecasts yield a A$8.64 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Fifteen different Simply Wall St Community members currently value Paladin shares between A$1.18 and A$13, highlighting real divergence in private investor expectations. As you weigh these viewpoints, remember that funding strategies and the risk of future dilution could have broad consequences for shareholder value.

Explore 15 other fair value estimates on Paladin Energy - why the stock might be worth as much as 35% more than the current price!

Build Your Own Paladin Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Paladin Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Paladin Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Paladin Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PDN

Paladin Energy

Through its subsidiaries, engages in the development and exploration of mineral properties in Australia, Canada, and Namibia.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives