- Australia

- /

- Food and Staples Retail

- /

- ASX:GNC

ASX Dividend Stocks To Watch GrainCorp And 2 Top Picks

Reviewed by Simply Wall St

The Australian market has seen a mixed performance recently, with the ASX200 closing up 0.3% at 8,099.9 points, driven by strength in the Materials sector but held back by a decline in Financials. As investors navigate these fluctuating conditions, dividend stocks like GrainCorp and others offer potential stability and income through regular payouts.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 7.69% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.32% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.43% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.65% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.83% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.71% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.51% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 3.98% | ★★★★★☆ |

| Ricegrowers (ASX:SGLLV) | 6.40% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.52% | ★★★★☆☆ |

Click here to see the full list of 35 stocks from our Top ASX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

GrainCorp (ASX:GNC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GrainCorp Limited is an agribusiness and processing company with operations spanning Australasia, Asia, North America, Europe, the Middle East, North Africa, and other international markets; it has a market cap of approximately A$2.01 billion.

Operations: GrainCorp Limited's revenue from its agribusiness segment is A$6.82 billion.

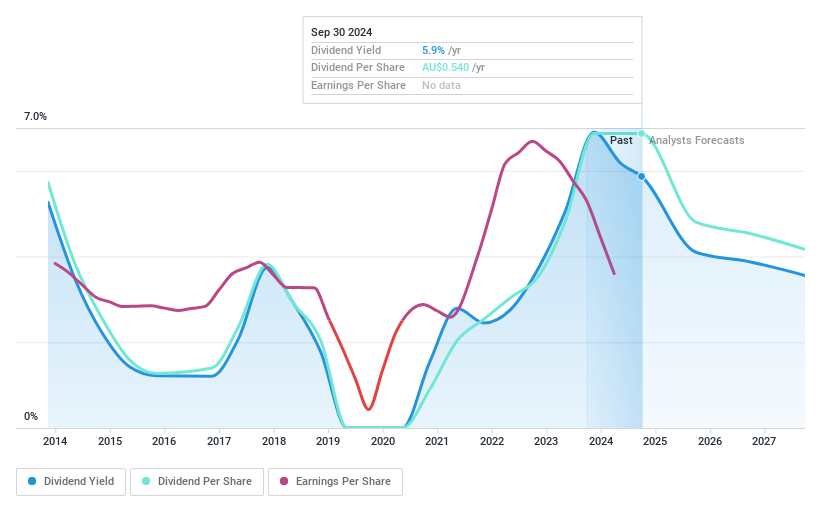

Dividend Yield: 6%

GrainCorp's dividend yield (5.95%) is slightly below the top 25% of Australian dividend payers, but its dividends are well-covered by both earnings (63.4% payout ratio) and free cash flows (37.4% cash payout ratio). However, the company's profit margins have declined from 3.9% to 1.4%, and its interest payments are not well covered by earnings. Recent strategic alliances with IFM Investors and Ampol aim to establish an integrated renewable fuels industry in Australia, potentially impacting future profitability positively.

- Dive into the specifics of GrainCorp here with our thorough dividend report.

- Upon reviewing our latest valuation report, GrainCorp's share price might be too optimistic.

Lycopodium (ASX:LYL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lycopodium Limited (ASX:LYL) offers engineering and project delivery services in the resources, rail infrastructure, and industrial processes sectors in Australia, with a market cap of A$484.64 million.

Operations: Lycopodium Limited generates revenue from three primary segments: Resources (A$366.49 million), Process Industries (A$11.45 million), and Rail Infrastructure (A$10.21 million).

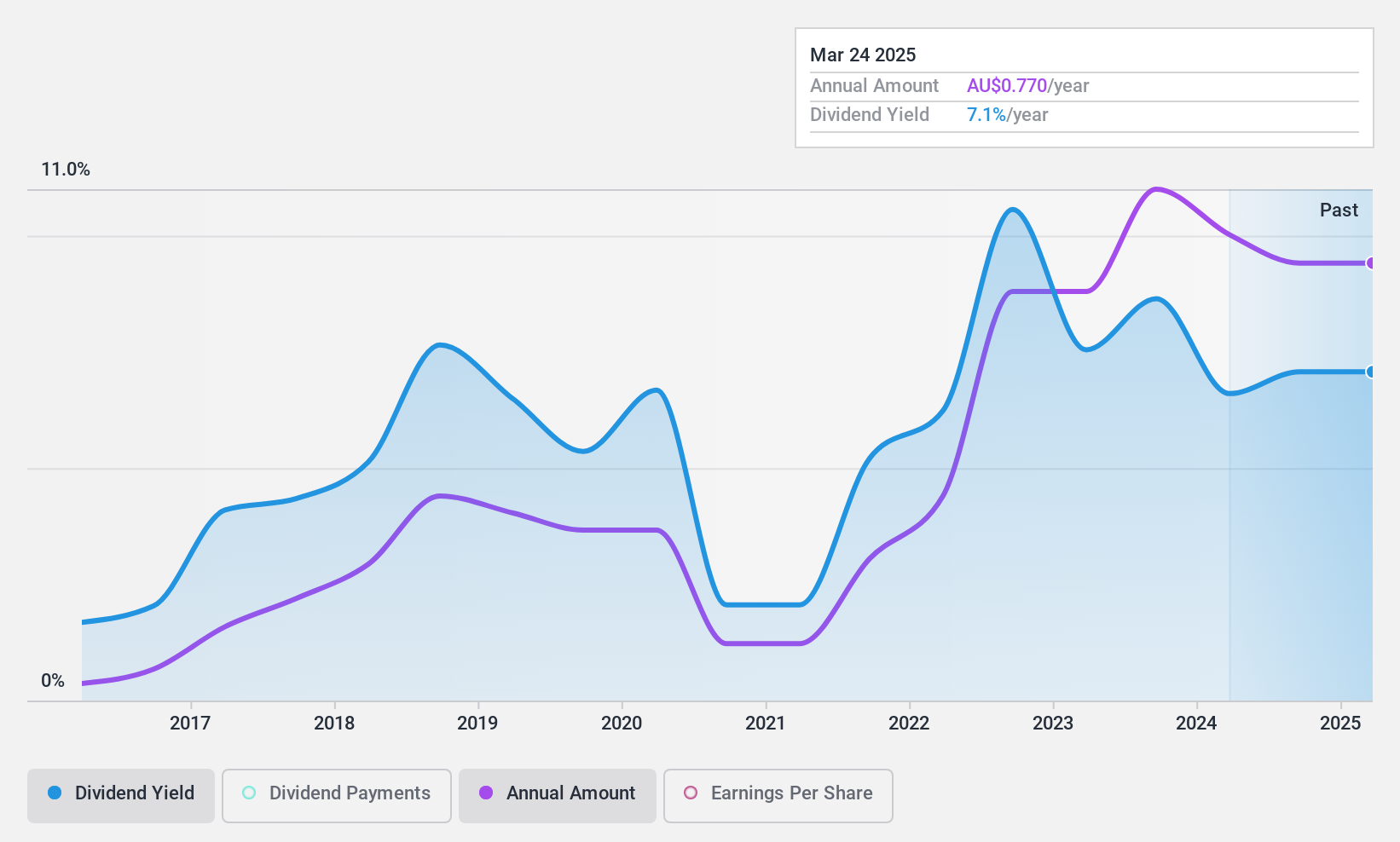

Dividend Yield: 6.2%

Lycopodium Limited reported an increase in annual revenue to A$348.88 million and net income to A$50.71 million for the year ending June 30, 2024. Despite a reasonable payout ratio of 60.3%, its dividend payments are not well covered by free cash flows, with a high cash payout ratio of 122.9%. While the company declared a fully franked final dividend of 40 cents per share, bringing the full-year dividend to 77 cents per share, its dividends have been volatile and unreliable over the past decade.

- Click here and access our complete dividend analysis report to understand the dynamics of Lycopodium.

- Our valuation report unveils the possibility Lycopodium's shares may be trading at a premium.

New Hope (ASX:NHC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Hope Corporation Limited explores, develops, produces, and processes coal as well as oil and gas properties, with a market cap of A$3.64 billion.

Operations: New Hope Corporation Limited generates revenue primarily from its Coal Mining NSW segment, which accounts for A$1.88 billion, and its Coal Mining QLD (including Treasury and Investments) segment, contributing A$48.15 million.

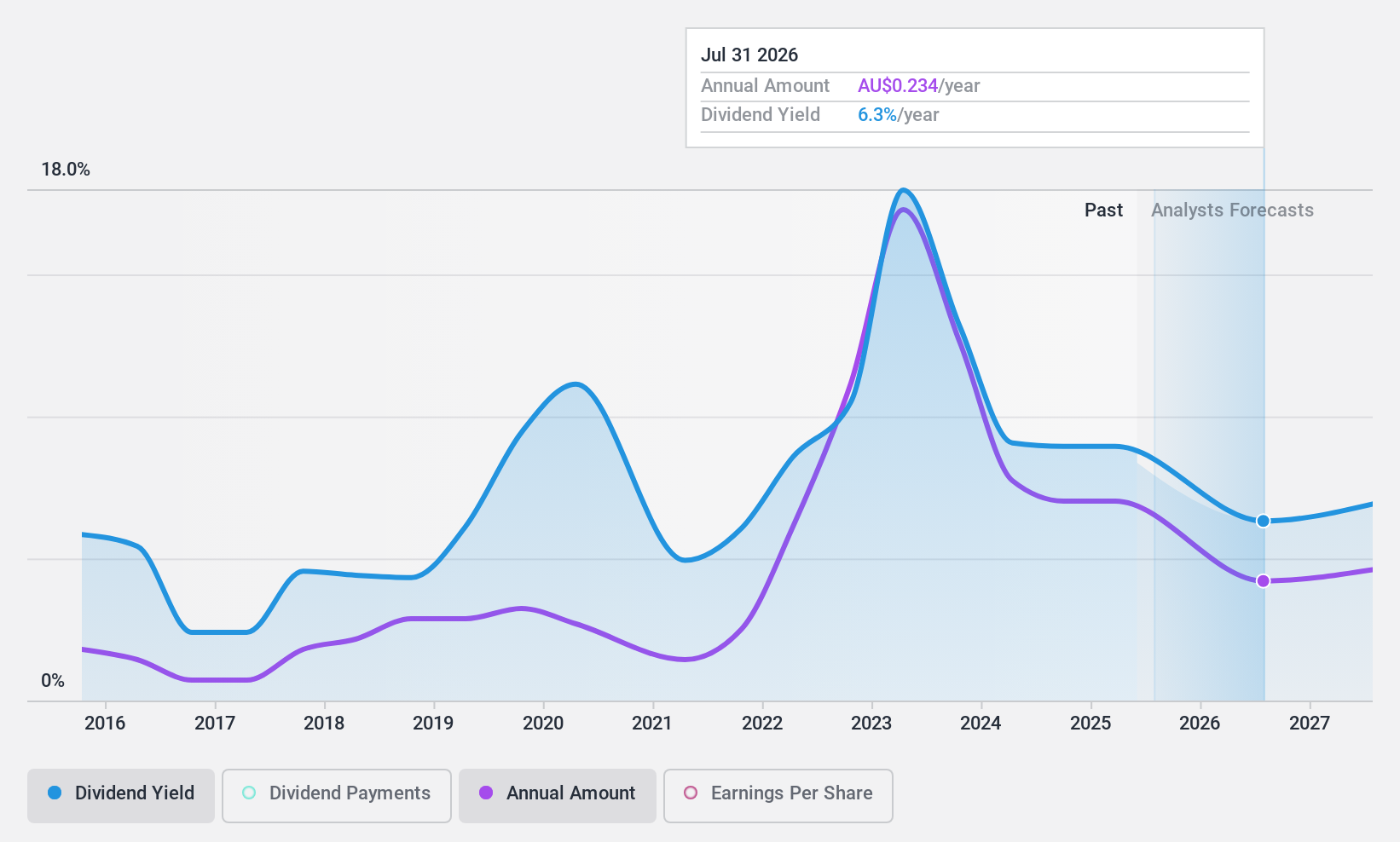

Dividend Yield: 10%

New Hope Corporation's dividend yield of 9.98% ranks in the top 25% of Australian dividend payers, supported by a low payout ratio of 48.4%. However, its dividends have been volatile and are not well covered by free cash flows, with a high cash payout ratio of 90.2%. Recent production guidance indicates robust coal output for fiscal year 2024, and the company completed an A$300 million fixed-income offering to bolster financial stability.

- Click here to discover the nuances of New Hope with our detailed analytical dividend report.

- The valuation report we've compiled suggests that New Hope's current price could be quite moderate.

Make It Happen

- Dive into all 35 of the Top ASX Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GNC

GrainCorp

Operates as an agribusiness and processing company in Australasia, Asia, North America, and Europe.

Adequate balance sheet and fair value.