- Australia

- /

- Construction

- /

- ASX:SXE

ASX Dividend Stocks Featuring New Hope And Two More

Reviewed by Simply Wall St

As Christmas approaches, the Australian market has shown modest gains with the ASX200 up 0.25% at 8335 points, driven by strong performances in the Real Estate and Industrials sectors. In this environment, dividend stocks like New Hope and others offer investors potential stability and income, making them an attractive consideration amid fluctuating sector performances.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 4.36% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.54% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.70% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.94% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.02% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.64% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.21% | ★★★★★☆ |

| New Hope (ASX:NHC) | 7.86% | ★★★★☆☆ |

| Grange Resources (ASX:GRR) | 8.89% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.49% | ★★★★☆☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

New Hope (ASX:NHC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Hope Corporation Limited engages in the exploration, development, production, and processing of coal as well as oil and gas properties, with a market capitalization of A$4.19 billion.

Operations: New Hope Corporation Limited's revenue primarily comes from its Coal Mining operations in NSW, generating A$1.56 billion, and Coal Mining in QLD (including Treasury and Investments), contributing A$166.52 million.

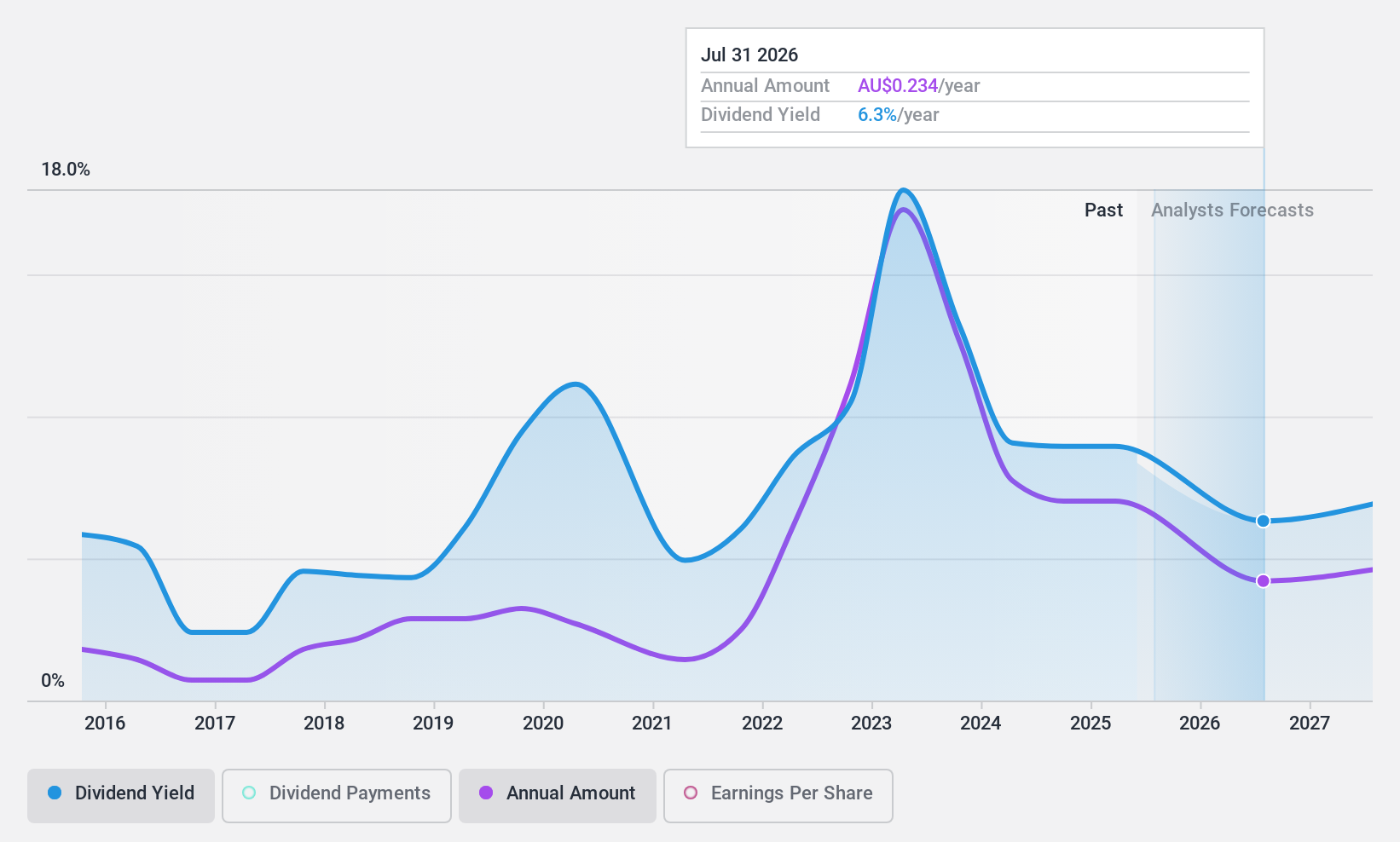

Dividend Yield: 7.9%

New Hope Corporation's dividend yield of 7.86% ranks in the top 25% among Australian dividend payers, yet its dividends have been volatile over the past decade. The payout ratio of 69.3% suggests coverage by earnings, but free cash flow coverage is weak with a cash payout ratio of 113.7%. Although trading below estimated fair value and offering good relative value, profit margins have declined from last year’s levels. Recent production results indicate stable operations amidst these financial dynamics.

- Unlock comprehensive insights into our analysis of New Hope stock in this dividend report.

- Our valuation report here indicates New Hope may be undervalued.

Servcorp (ASX:SRV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services with a market cap of A$485.43 million.

Operations: Servcorp Limited generates revenue from its Real Estate - Rental segment, amounting to A$314.89 million.

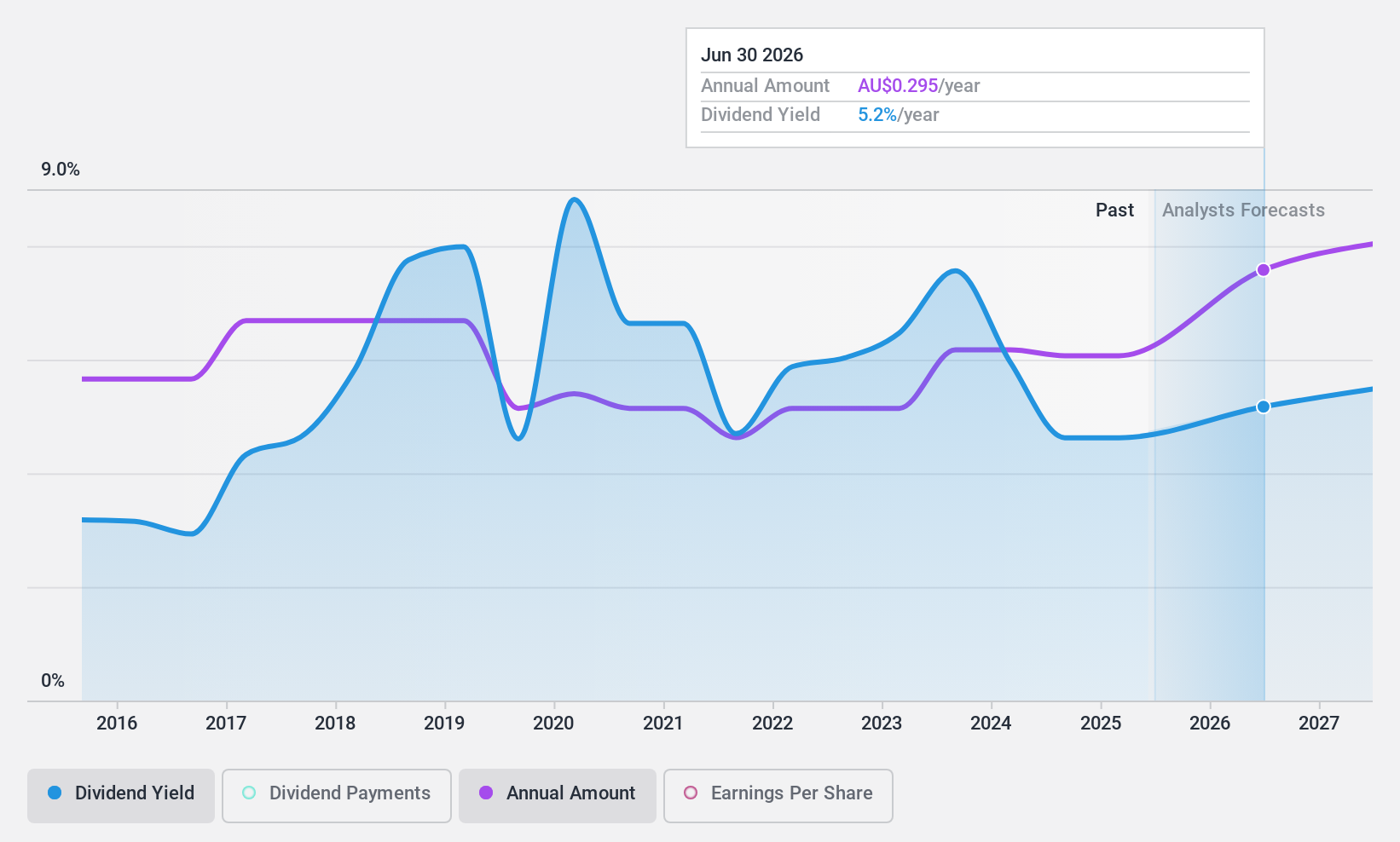

Dividend Yield: 4.8%

Servcorp's dividend yield of 4.8% is below the top quartile of Australian dividend payers, but dividends are well-covered by earnings and cash flows with payout ratios of 59.7% and 14.2%, respectively. Despite a history of volatility in dividend payments, recent earnings growth and trading at a significant discount to estimated fair value suggest potential for stability. The upcoming AGM will address financial performance and director re-elections, potentially impacting future dividends.

- Get an in-depth perspective on Servcorp's performance by reading our dividend report here.

- According our valuation report, there's an indication that Servcorp's share price might be on the cheaper side.

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering Limited offers electrical, instrumentation, communications, security, and maintenance services to the resources, commercial, and infrastructure sectors in Australia with a market cap of A$389.80 million.

Operations: Southern Cross Electrical Engineering Limited generates revenue of A$551.87 million from its electrical services segment, catering to the resources, commercial, and infrastructure sectors in Australia.

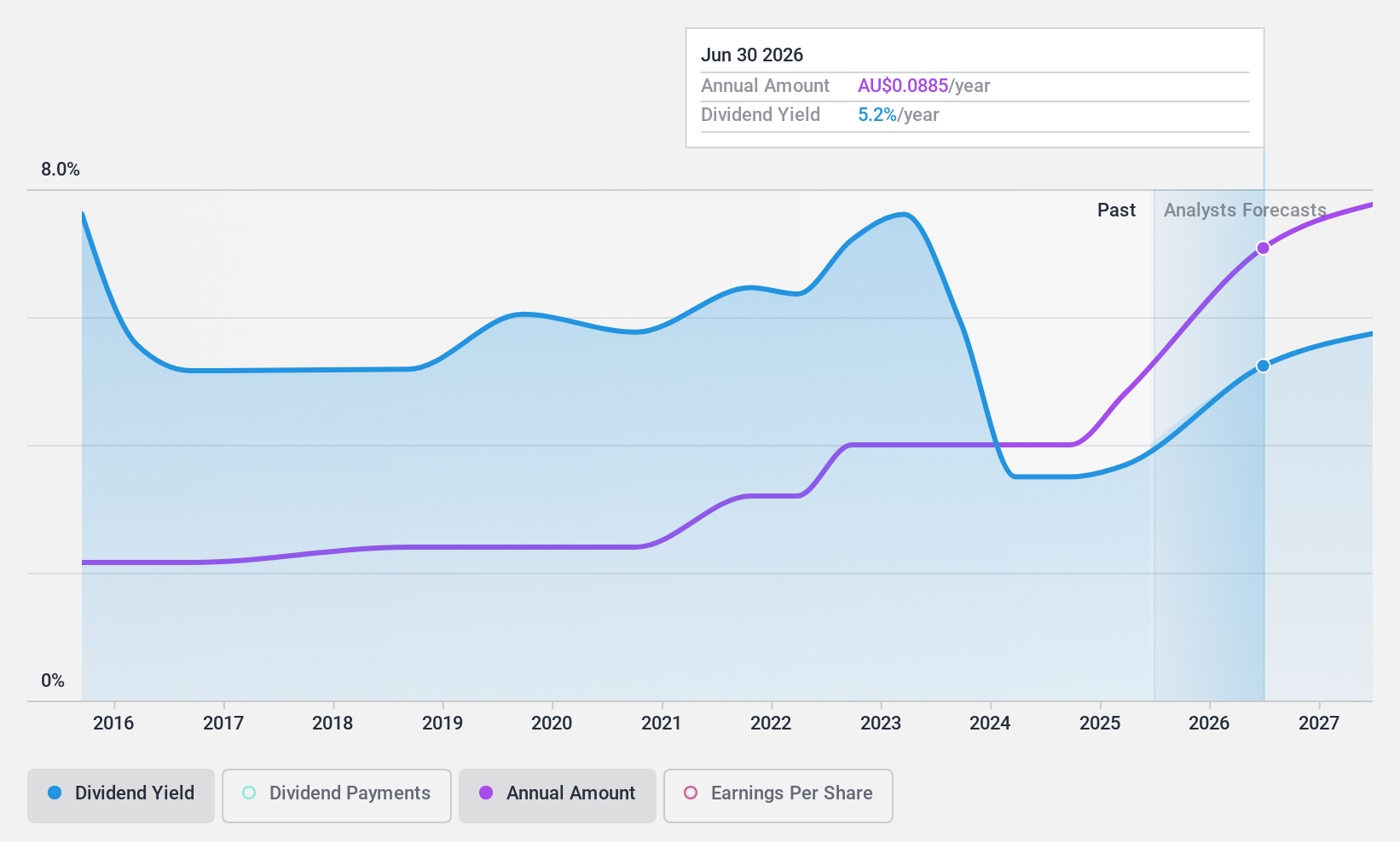

Dividend Yield: 4.1%

Southern Cross Electrical Engineering's dividend yield of 4.07% is below Australia's top quartile, but dividends are covered by earnings and cash flows with payout ratios of 72% and 46.7%, respectively. Despite past volatility in dividend payments, recent inclusion in the S&P Global BMI Index may enhance visibility. Trading at a discount to estimated fair value suggests potential for capital appreciation, although its unstable dividend history poses risks for income-focused investors.

- Click to explore a detailed breakdown of our findings in Southern Cross Electrical Engineering's dividend report.

- Our valuation report unveils the possibility Southern Cross Electrical Engineering's shares may be trading at a discount.

Taking Advantage

- Navigate through the entire inventory of 30 Top ASX Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SXE

Southern Cross Electrical Engineering

Provides electrical, instrumentation, communications, security, and maintenance services and products to resources, commercial, and infrastructure sectors in Australia.

Flawless balance sheet, good value and pays a dividend.