- Australia

- /

- Metals and Mining

- /

- ASX:BRL

Bathurst Resources Leads These 3 ASX Penny Stocks To Consider

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 closing up 1.38% at 8,327 points amid a backdrop of steady unemployment figures and strong sector performances in Financials and Real Estate. As investors navigate these conditions, identifying stocks with solid financial foundations becomes crucial. Penny stocks, despite their outdated moniker, can still offer surprising value when backed by robust fundamentals; this article explores three such opportunities that might appeal to those seeking under-the-radar investments with potential for growth.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.95 | A$242.1M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.99 | A$111.58M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.98 | A$319.94M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.89 | A$104.27M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$242.07M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.265 | A$109.71M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.97 | A$485.43M | ★★★★☆☆ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Bathurst Resources (ASX:BRL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bathurst Resources Limited focuses on the exploration, development, and production of coal in New Zealand, with a market capitalization of A$141.61 million.

Operations: The company's revenue is derived from two main segments: Export, contributing NZ$340.55 million, and Domestic sales, generating NZ$133.38 million.

Market Cap: A$141.61M

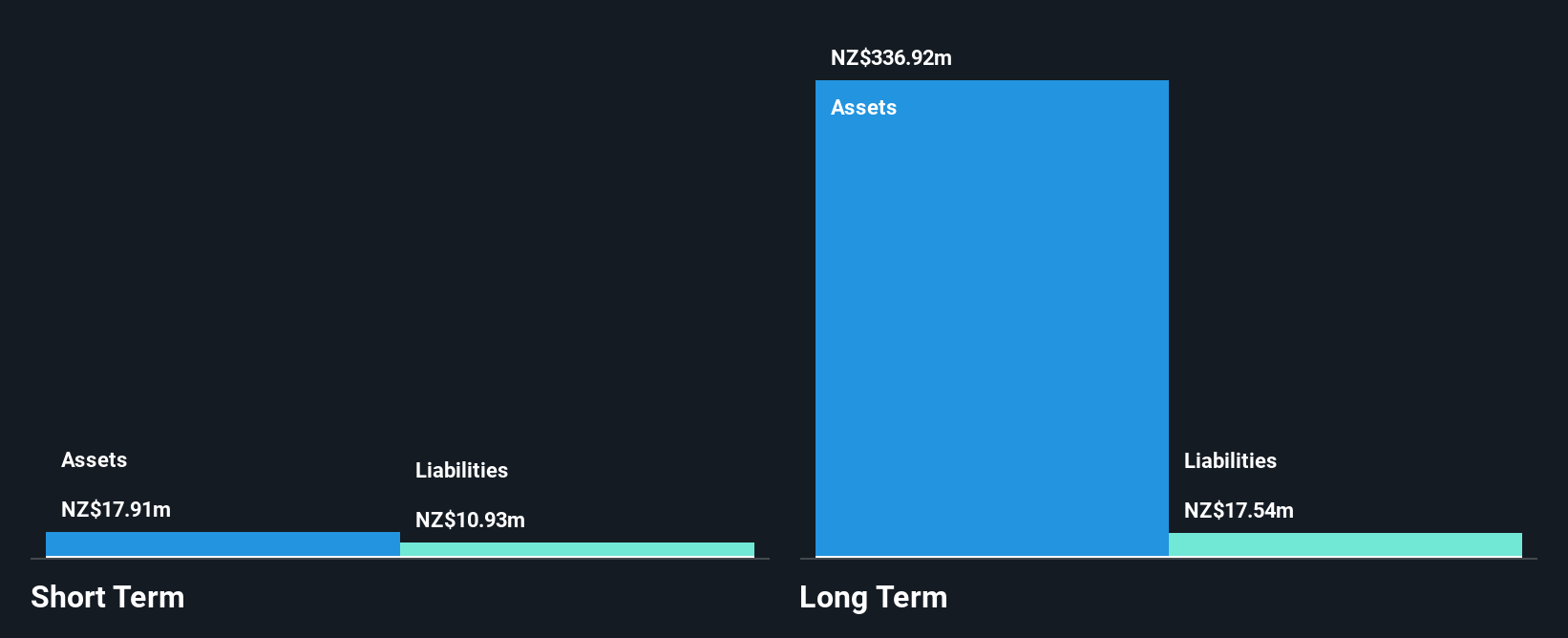

Bathurst Resources Limited, with a market capitalization of A$141.61 million, derives significant revenue from export (NZ$340.55 million) and domestic sales (NZ$133.38 million). The company boasts a low Price-To-Earnings ratio of 4.1x compared to the Australian market average of 19x, indicating potential value for investors. It is debt-free, enhancing financial stability; however, its short-term assets do not cover long-term liabilities (NZ$17.9M). Despite seasoned management and board teams, Bathurst experienced negative earnings growth (-57.4%) over the past year and lower profit margins than previously reported at 88.9%.

- Unlock comprehensive insights into our analysis of Bathurst Resources stock in this financial health report.

- Gain insights into Bathurst Resources' past trends and performance with our report on the company's historical track record.

Iltani Resources (ASX:ILT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Iltani Resources Limited is involved in the exploration and development of metal projects in Australia, with a market cap of A$10.88 million.

Operations: Iltani Resources Limited has not reported any revenue segments.

Market Cap: A$10.88M

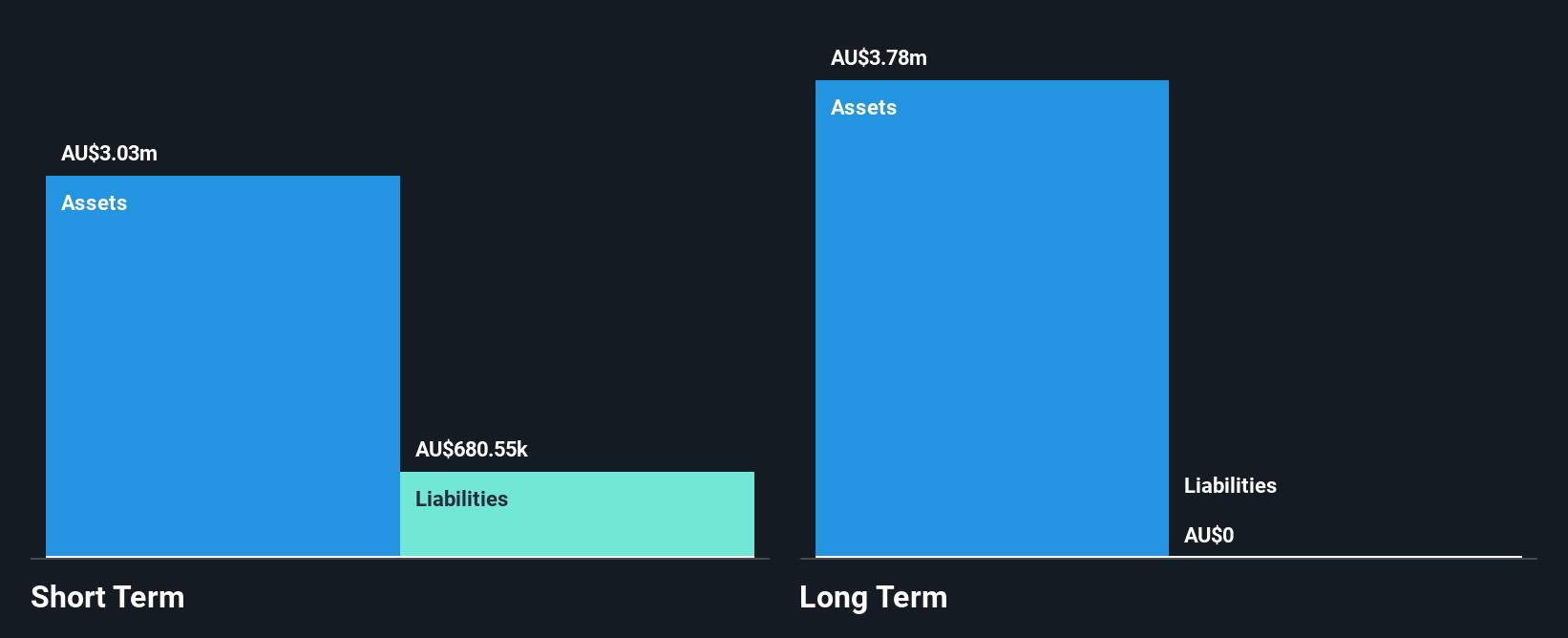

Iltani Resources Limited, with a market cap of A$10.88 million, is a pre-revenue company focused on metal exploration and development in Australia. The company is debt-free and has no long-term liabilities, but its cash runway based on free cash flow estimates suggests it can sustain operations for over a year following recent capital raises. Despite having short-term assets of A$2.8 million that exceed its short-term liabilities of A$521,000, Iltani's share price remains highly volatile and shareholders have experienced dilution over the past year. The board is relatively experienced with an average tenure of 3.3 years.

- Take a closer look at Iltani Resources' potential here in our financial health report.

- Learn about Iltani Resources' historical performance here.

Next Science (ASX:NXS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Next Science Limited focuses on researching, developing, and commercializing technologies to combat biofilms and infections caused by bacteria, fungus, and viruses in North America, Australia, and New Zealand with a market cap of A$37.98 million.

Operations: The company generates revenue primarily from its Pharmaceuticals segment, which amounts to $23.31 million.

Market Cap: A$37.98M

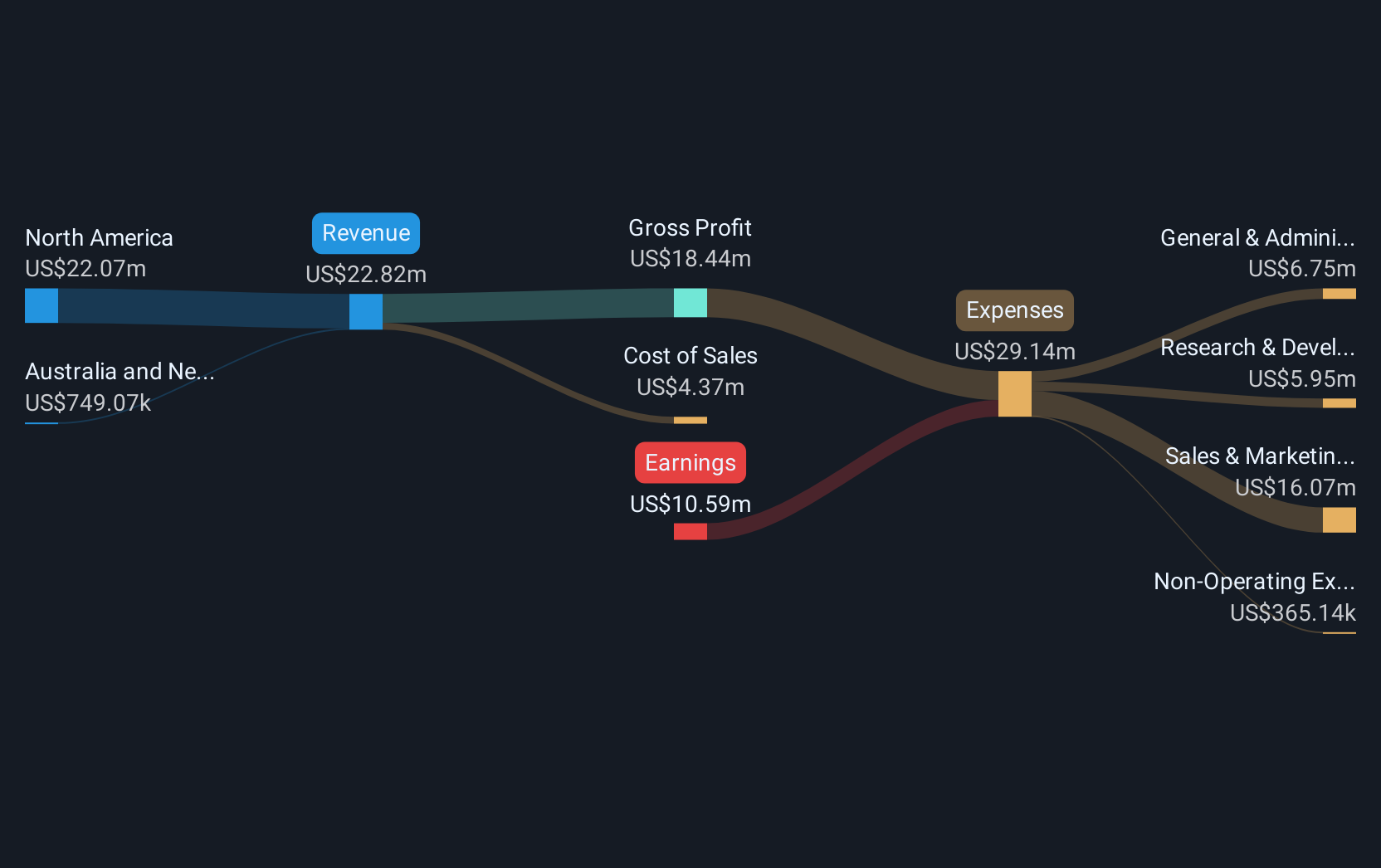

Next Science Limited, with a market cap of A$37.98 million, focuses on biofilm and infection technologies but remains unprofitable with revenue primarily from its Pharmaceuticals segment at US$23.31 million. Short-term assets of US$8.2 million cover both short and long-term liabilities, yet the company faces financial challenges with less than a year of cash runway and high volatility in share price. Recent legal disputes have arisen involving former employees alleging mismanagement and product safety concerns, though Next Science maintains FDA approval for its products. The board's average tenure is 1.5 years, indicating relatively new leadership amidst ongoing litigation.

- Click here and access our complete financial health analysis report to understand the dynamics of Next Science.

- Review our growth performance report to gain insights into Next Science's future.

Key Takeaways

- Unlock our comprehensive list of 1,027 ASX Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bathurst Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BRL

Bathurst Resources

Engages in the exploration, development, and production of bituminous and coking coal in New Zealand and Canada.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion