- Australia

- /

- Hospitality

- /

- ASX:HLO

Big River Industries And 2 More ASX Penny Stocks With Promising Prospects

Reviewed by Simply Wall St

The Australian share market is poised for a modest uptick, with ASX 200 futures indicating a potential gain amidst global economic fluctuations and local corporate developments. In such conditions, investors often turn their attention to smaller or newer companies, where penny stocks—despite the term's somewhat outdated nature—still present intriguing opportunities. By focusing on those with solid financial foundations and clear growth prospects, these stocks can offer both stability and potential upside in an ever-evolving market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| Regal Partners (ASX:RPL) | A$3.10 | A$1.04B | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.715 | A$80.9M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.33 | A$360.89M | ★★★★★☆ |

| Bisalloy Steel Group (ASX:BIS) | A$3.16 | A$151.38M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.93 | A$242.43M | ★★★★★★ |

| GR Engineering Services (ASX:GNG) | A$2.81 | A$469.8M | ★★★★★★ |

| MotorCycle Holdings (ASX:MTO) | A$1.99 | A$146.87M | ★★★★★★ |

| CTI Logistics (ASX:CLX) | A$1.755 | A$136.91M | ★★★★☆☆ |

| Accent Group (ASX:AX1) | A$1.895 | A$1.07B | ★★★★☆☆ |

Click here to see the full list of 1,011 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Big River Industries (ASX:BRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Big River Industries Limited, with a market cap of A$112.70 million, operates in Australia and New Zealand, focusing on the manufacture, distribution, and retail of timber and building products.

Operations: The company generates revenue from two main segments: Panels, contributing A$130.54 million, and Construction, accounting for A$276.87 million.

Market Cap: A$112.7M

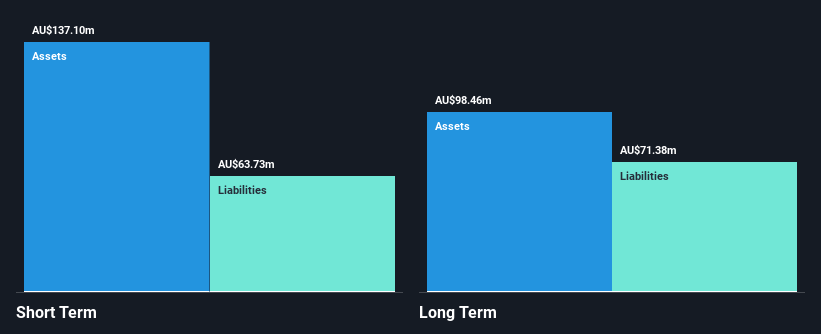

Big River Industries, with a market cap of A$112.70 million, operates within the timber and building products sector across Australia and New Zealand. Despite being unprofitable with a negative return on equity of -16.01%, it trades at good value compared to peers and industry standards. The company's short-term assets exceed both its short-term and long-term liabilities, indicating solid liquidity management. However, earnings have declined recently, reporting a net loss of A$17 million for the half-year ended December 31, 2024. The dividend yield is not well covered by earnings but remains attractive at 3.03%.

- Click here and access our complete financial health analysis report to understand the dynamics of Big River Industries.

- Assess Big River Industries' future earnings estimates with our detailed growth reports.

Helloworld Travel (ASX:HLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Helloworld Travel Limited is a travel distribution company operating in Australia, New Zealand, and internationally, with a market cap of A$274.35 million.

Operations: Helloworld Travel Limited has not reported any specific revenue segments.

Market Cap: A$274.35M

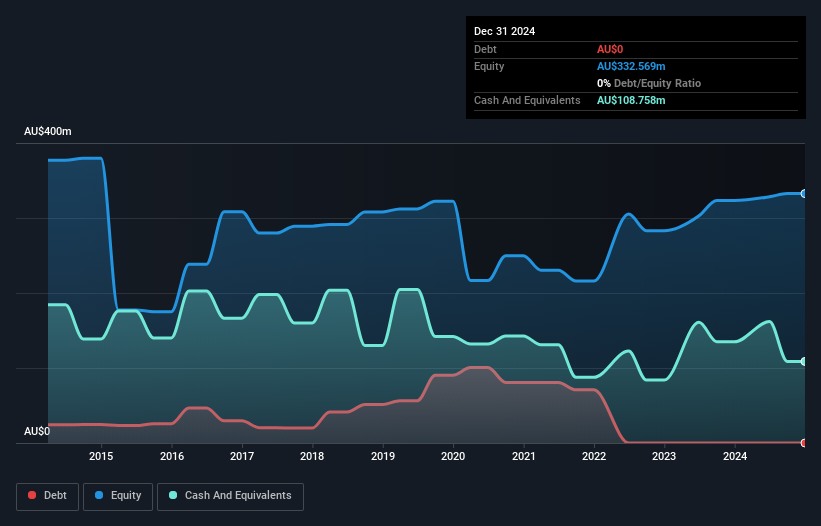

Helloworld Travel Limited, with a market cap of A$274.35 million, has shown mixed financial performance. Despite being debt-free and having short-term assets exceeding liabilities, its net profit margins have declined from 17.1% to 12.2%. The company has experienced negative earnings growth over the past year (-25%), contrasting with its positive five-year trend of 45.1% annual growth in profitability. Trading at a price-to-earnings ratio of 10.8x below the Australian market average, it offers good relative value but faces challenges with dividend sustainability as payouts are not well covered by free cash flows despite an attractive yield of 6.53%.

- Take a closer look at Helloworld Travel's potential here in our financial health report.

- Gain insights into Helloworld Travel's outlook and expected performance with our report on the company's earnings estimates.

Melbana Energy (ASX:MAY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Melbana Energy Limited is involved in oil and gas exploration in Cuba and Australia, with a market cap of A$111.22 million.

Operations: Melbana Energy Limited does not report distinct revenue segments.

Market Cap: A$111.22M

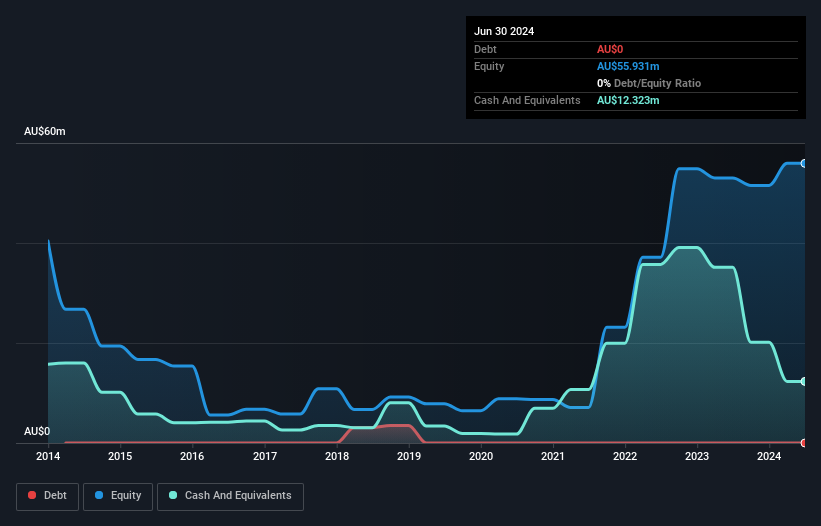

Melbana Energy Limited, with a market cap of A$111.22 million, operates in oil and gas exploration in Cuba and Australia. The company is pre-revenue, generating less than US$1 million annually. Despite this, it has recently turned profitable and boasts no debt or long-term liabilities. Its short-term assets of A$51.3 million exceed liabilities of A$40.4 million, indicating solid financial footing for a penny stock. The management team is experienced with an average tenure of 2.4 years, while the board averages 9.7 years, suggesting stability in leadership amid its transition to profitability amidst high non-cash earnings levels.

- Click to explore a detailed breakdown of our findings in Melbana Energy's financial health report.

- Gain insights into Melbana Energy's past trends and performance with our report on the company's historical track record.

Next Steps

- Explore the 1,011 names from our ASX Penny Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Helloworld Travel, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Helloworld Travel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HLO

Helloworld Travel

Operates as a travel distribution company in Australia, New Zealand, and internationally.

Flawless balance sheet and good value.