- Australia

- /

- Oil and Gas

- /

- ASX:LOT

Lotus Resources (ASX:LOT) Valuation Check as Kayelekera Moves Closer to Steady-State Uranium Production

Reviewed by Simply Wall St

Lotus Resources (ASX:LOT) just confirmed it is moving steadily toward full scale uranium production at its Kayelekera project, with processing ramp up progressing and key sulphuric acid supply bottlenecks now being structurally addressed.

See our latest analysis for Lotus Resources.

The steady operational progress at Kayelekera seems to be nudging sentiment off the lows, with a 1 day share price return of 9.09 percent lifting Lotus to A$0.18, even though the 1 year total shareholder return of negative 23.40 percent still reflects earlier caution. Over five years, however, the 56.52 percent total shareholder return hints that long term investors have been willing to sit through volatility for uranium exposure.

If this kind of turnaround story has your attention, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership

With production now edging closer and the share price still lagging analyst targets, is Lotus quietly offering contrarian value, or has the recent rebound already started to price in the next leg of growth?

Price-to-Book of 2.1x: Is it justified?

On a simple price to book lens, Lotus screens as cheaper than many peers at 2.1 times, even after the latest bounce to A$0.18.

The price to book ratio compares a company’s market value to the book value of its net assets. This is a particularly relevant yardstick for asset heavy resource developers like Lotus with substantial uranium projects but limited current earnings.

Lotus is described as good value on this metric versus its broader peer group, trading at 2.1 times book compared with an average of 5.9 times. This implies investors are paying a materially lower premium for each dollar of net assets than they do for comparable names.

However, within its immediate Australian oil and gas cohort the same 2.1 times multiple actually looks expensive against an industry average of 1.4 times. This underlines how sharply opinions diverge on what its uranium assets and future cash flows might be worth.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 2.1x (ABOUT RIGHT)

However, latent risks remain, including project execution setbacks at Kayelekera and weaker uranium prices, which could quickly cap sentiment and derail the recovery.

Find out about the key risks to this Lotus Resources narrative.

Another View: SWS DCF Signals Deep Value

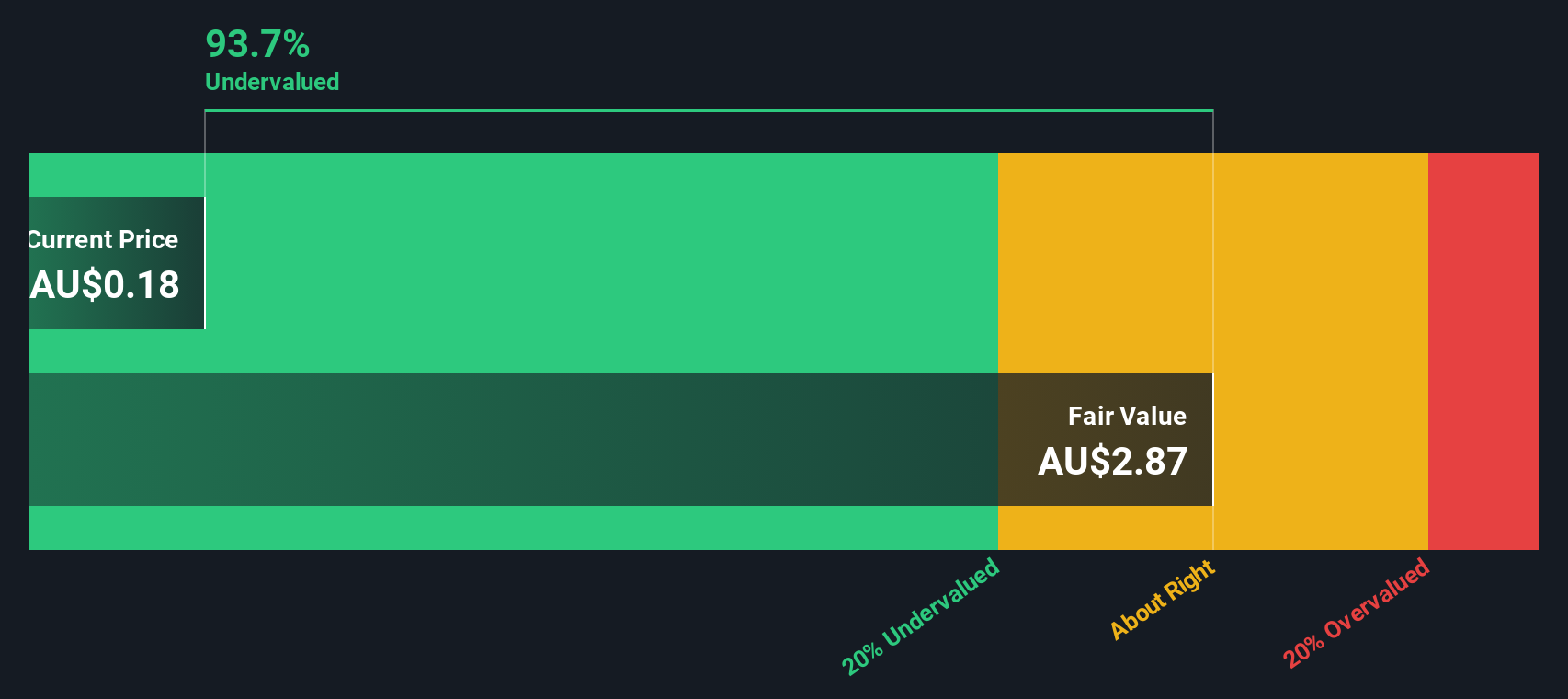

While price to book suggests Lotus is roughly fairly priced, our DCF model paints a very different picture, indicating the shares are trading around 93.7 percent below an estimated fair value of about A$2.87. Is the market missing long term cash flow upside, or are DCF assumptions too generous?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lotus Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lotus Resources Narrative

If you see the numbers differently or want to dig into the assumptions yourself, you can build a personalised view in just minutes: Do it your way

A great starting point for your Lotus Resources research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction opportunities?

Lotus might be compelling, but do not leave potential gains on the table when Simply Wall St can surface fresh, data backed ideas tailored to your strategy.

- Target income potential with these 15 dividend stocks with yields > 3% that offer attractive yields while still clearing key quality and sustainability checks.

- Position for structural growth by reviewing these 30 healthcare AI stocks transforming diagnostics, treatment pathways, and healthcare efficiency.

- Capture innovative themes early with these 81 cryptocurrency and blockchain stocks at the intersection of blockchain, payments, and digital infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LOT

Lotus Resources

Engages in the exploration and development of uranium projects in Africa.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026