- Australia

- /

- Oil and Gas

- /

- ASX:KAR

Karoon Energy (ASX:KAR) Is Down 6.5% After Profit Rises and Guidance Upgraded Despite Lower Sales

Reviewed by Simply Wall St

- Karoon Energy announced its half-year results for 2025 with net income rising to US$71 million and production reaching 5.30 million barrels of oil equivalent, despite sales dropping to US$308.3 million year-over-year; the company also introduced an interim dividend of A$0.024 per share, payable at the end of September.

- An interesting takeaway is that Karoon updated full-year production guidance upwards, signaling stronger operational confidence even as sales declined from the prior period.

- We'll examine how the increased net income and upgraded production outlook are now impacting Karoon Energy's broader investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Karoon Energy Investment Narrative Recap

To be a Karoon Energy shareholder, you'd likely need to believe in the company's ability to drive production efficiency and extend field life at its core assets, particularly Baúna, despite periodic sales fluctuations and operational hazards. The recent upgrade to full-year production guidance bolsters the view that operational reliability is a near-term catalyst, while the main risk remains potential cost overruns or technical setbacks in Brazil. These results suggest improved confidence in production stability, but are not material enough to shift the primary risk profile for now.

Among recent updates, the upward revision to 2025 production guidance stands out as especially relevant. This supports the case for improved output visibility, which is important for both near-term revenue predictability and for offsetting the inherently high operational risks tied to concentrated, mature assets in Brazil. For shareholders, these events reinforce production momentum as a central theme for the months ahead.

However, it's worth considering that recurring technical challenges in maintaining FPSO reliability could still meaningfully disrupt cash flows and lead to ...

Read the full narrative on Karoon Energy (it's free!)

Karoon Energy's outlook anticipates $612.7 million in revenue and $123.8 million in earnings by 2028. This projection assumes a yearly revenue decline of 3.2% and a $12.9 million decrease in earnings from the current level of $136.7 million.

Uncover how Karoon Energy's forecasts yield a A$2.20 fair value, a 34% upside to its current price.

Exploring Other Perspectives

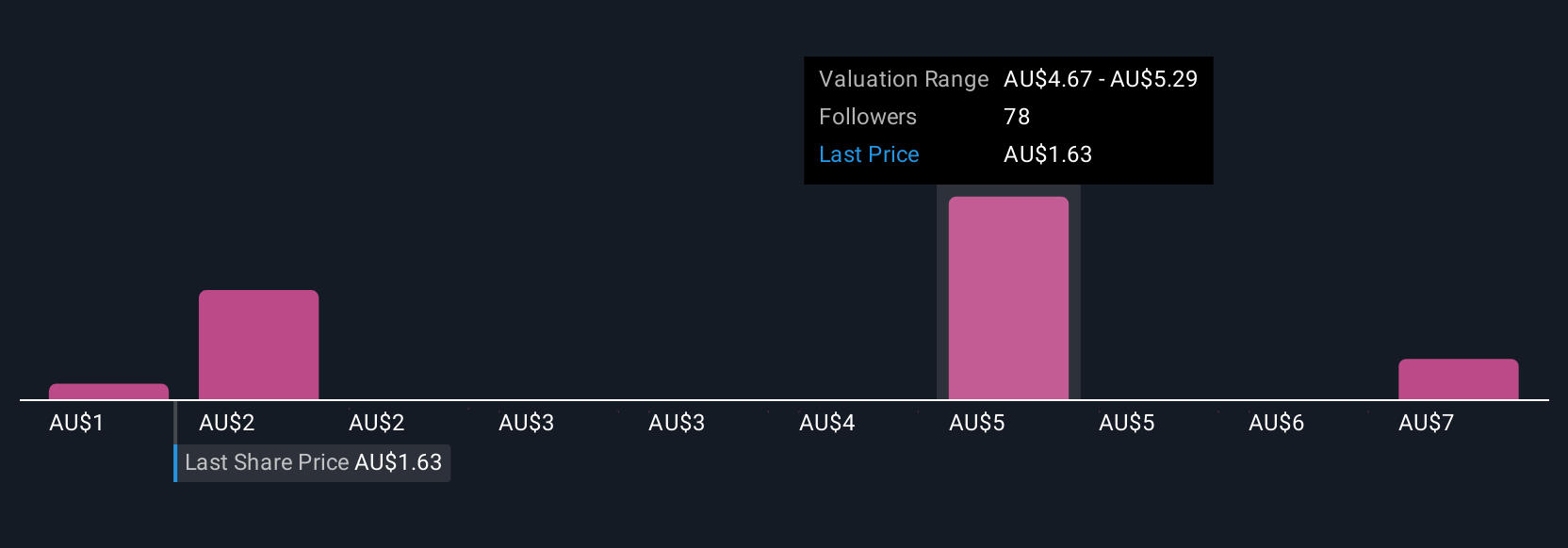

Simply Wall St Community members have provided 11 fair value estimates for Karoon Energy, spanning from A$1.01 to A$7.16 per share. While many expect operational improvements to drive predictable output, recurring technical risks with Baúna's FPSO remain a concern for many investors.

Explore 11 other fair value estimates on Karoon Energy - why the stock might be worth 39% less than the current price!

Build Your Own Karoon Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Karoon Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Karoon Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Karoon Energy's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karoon Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KAR

Karoon Energy

Operates as an oil and gas exploration and production company in Brazil, the United States, and Australia.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives