- Australia

- /

- Oil and Gas

- /

- ASX:IKW

Does Ikwezi Mining's (ASX:IKW) Statutory Profit Adequately Reflect Its Underlying Profit?

Broadly speaking, profitable businesses are less risky than unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. In this article, we'll look at how useful this year's statutory profit is, when analysing Ikwezi Mining (ASX:IKW).

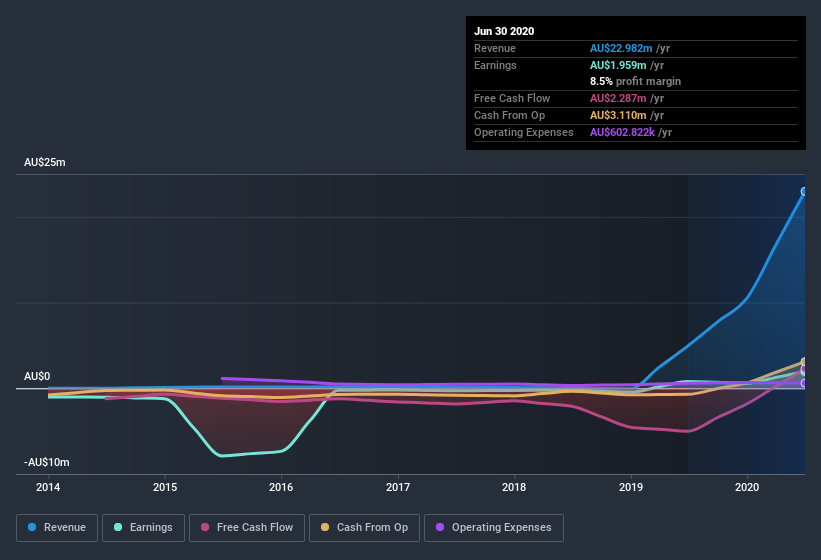

It's good to see that over the last twelve months Ikwezi Mining made a profit of AU$1.96m on revenue of AU$23.0m. The chart below shows that revenue has improved over the last three years, and, even better, the company has moved from unprofitable to profitable.

See our latest analysis for Ikwezi Mining

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Ikwezi Mining.

Our Take On Ikwezi Mining's Profit Performance

Because of this, we think that it may be that Ikwezi Mining's statutory profits are better than its underlying earnings power. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Case in point: We've spotted 3 warning signs for Ikwezi Mining you should be aware of.

Our examination of Ikwezi Mining has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Ikwezi Mining, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:IKW

Ikwezi Mining

Ikwezi Mining Limited engages in the coal mining and development activities in South Africa.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026