3 ASX Stocks Estimated To Be Up To 49.8% Below Intrinsic Value

Reviewed by Simply Wall St

The Australian market has recently experienced significant volatility, with tariff-driven panic selling affecting most sectors and energy stocks being particularly hard hit due to a drop in Brent Crude prices. Amidst these challenging conditions, identifying undervalued stocks can present opportunities for investors looking to capitalize on price discrepancies relative to intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LaserBond (ASX:LBL) | A$0.335 | A$0.66 | 49.2% |

| Dusk Group (ASX:DSK) | A$0.965 | A$1.63 | 40.9% |

| Nick Scali (ASX:NCK) | A$15.29 | A$28.61 | 46.6% |

| Medical Developments International (ASX:MVP) | A$0.455 | A$0.89 | 48.9% |

| James Hardie Industries (ASX:JHX) | A$32.23 | A$60.47 | 46.7% |

| Deep Yellow (ASX:DYL) | A$0.785 | A$1.56 | 49.8% |

| Polymetals Resources (ASX:POL) | A$0.71 | A$1.41 | 49.7% |

| Integral Diagnostics (ASX:IDX) | A$2.13 | A$4.01 | 46.9% |

| Pantoro (ASX:PNR) | A$2.55 | A$4.93 | 48.2% |

| Select Harvests (ASX:SHV) | A$5.13 | A$9.62 | 46.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Deep Yellow (ASX:DYL)

Overview: Deep Yellow Limited, with a market cap of A$763.46 million, operates as a uranium exploration company in Namibia and Australia through its subsidiaries.

Operations: Revenue Segments (in millions of A$): null

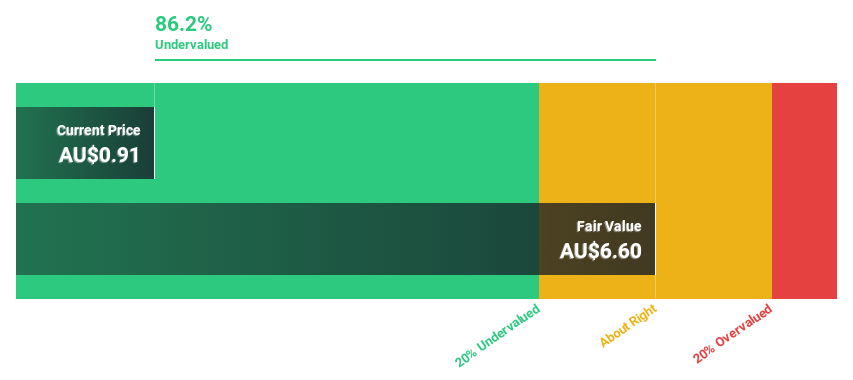

Estimated Discount To Fair Value: 49.8%

Deep Yellow is trading at A$0.79, significantly below its estimated fair value of A$1.56, suggesting it may be undervalued based on cash flows. The company reported a substantial revenue increase to A$6.29 million for the half-year ended December 2024, though it remains unprofitable with a net loss of A$2.47 million. Expected revenue growth of 137.6% annually outpaces the market average, supporting its potential as an undervalued opportunity despite current losses.

- In light of our recent growth report, it seems possible that Deep Yellow's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Deep Yellow's balance sheet health report.

Lynas Rare Earths (ASX:LYC)

Overview: Lynas Rare Earths Limited operates in the exploration, development, mining, extraction, and processing of rare earth minerals primarily in Australia and Malaysia, with a market capitalization of A$7.19 billion.

Operations: Lynas generates revenue from its rare earth operations, amounting to A$482.82 million.

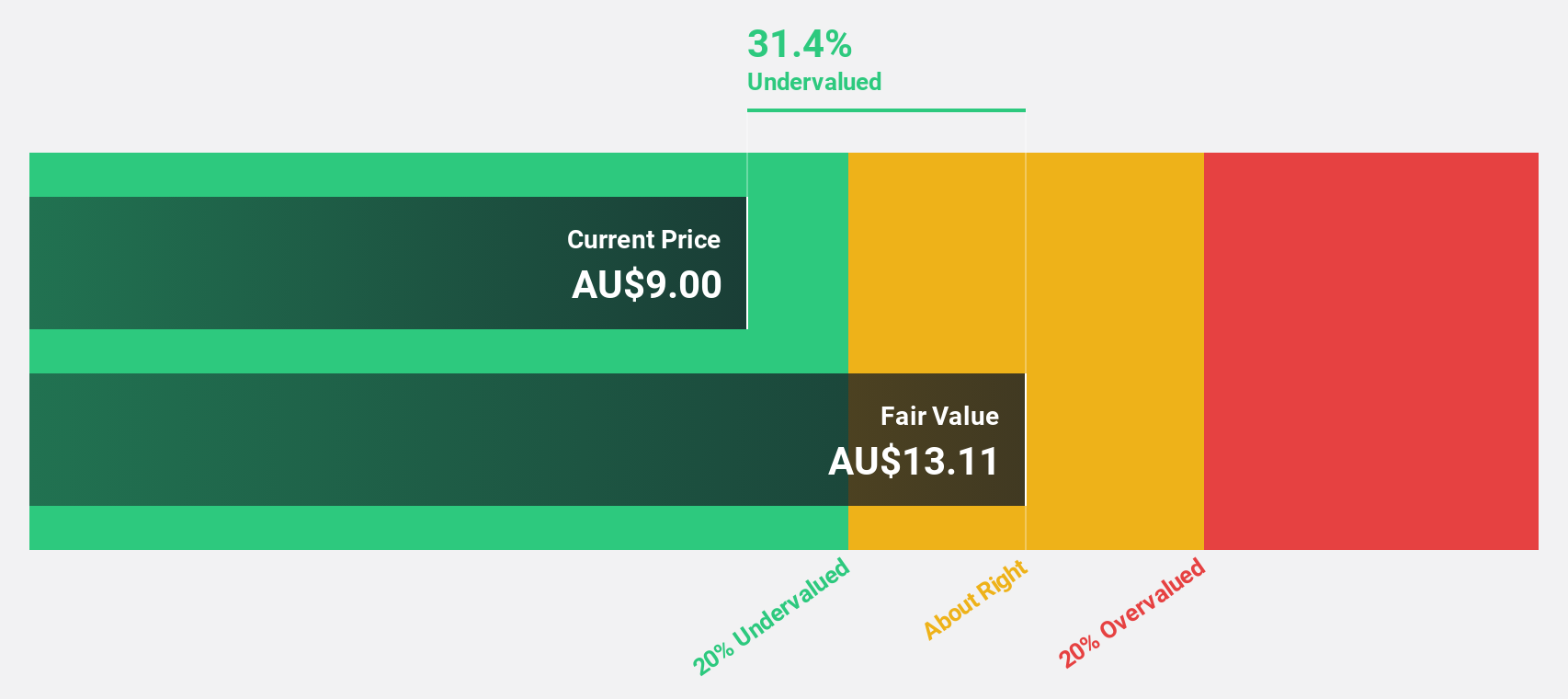

Estimated Discount To Fair Value: 12.3%

Lynas Rare Earths is trading at A$7.69, slightly below its estimated fair value of A$8.77, indicating potential undervaluation based on cash flows. Recent earnings show a decline in net income to A$5.85 million from A$39.54 million year-on-year, reflecting lower profit margins of 10.5% compared to 33.2%. Despite this, revenue and earnings are forecasted to grow significantly faster than the market average, highlighting growth prospects amidst current financial challenges.

- Our expertly prepared growth report on Lynas Rare Earths implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Lynas Rare Earths.

Megaport (ASX:MP1)

Overview: Megaport Limited offers on-demand interconnection and internet exchange services to enterprises and service providers across regions including Australia, New Zealand, Asia, North America, and Europe, with a market cap of A$1.44 billion.

Operations: The company's revenue segments are as follows: Europe generated A$33.85 million, Asia-Pacific contributed A$55.29 million, and North America accounted for A$117.77 million.

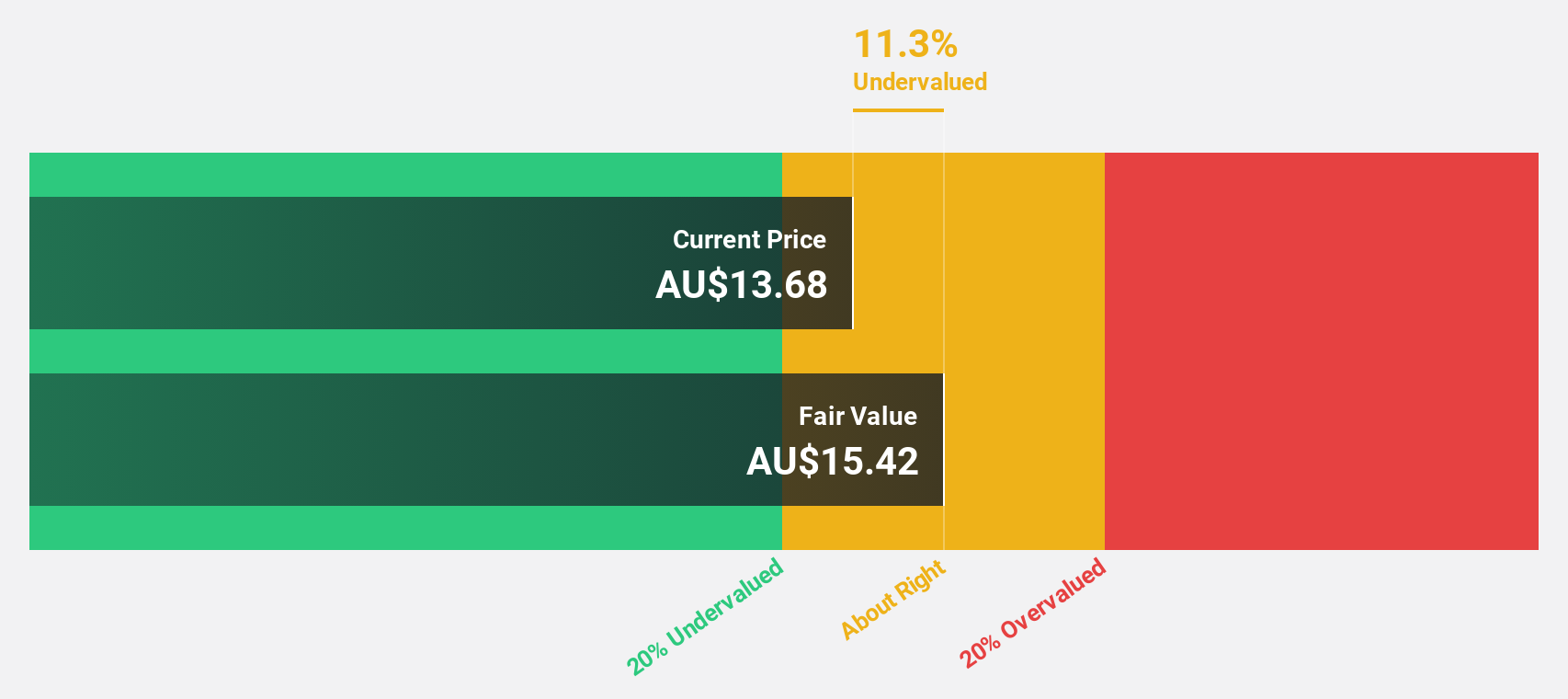

Estimated Discount To Fair Value: 24.9%

Megaport is trading at A$8.96, below its estimated fair value of A$11.94, suggesting undervaluation based on cash flows. Despite a decline in net income to A$0.89 million from A$4.45 million year-on-year, earnings are forecasted to grow significantly faster than the market average at 40.3% annually. Recent partnerships, such as with Aviatrix for enhanced network security and CloudFirst Europe for expanded global reach, further bolster its strategic positioning and potential revenue growth amidst evolving cybersecurity demands.

- The growth report we've compiled suggests that Megaport's future prospects could be on the up.

- Click here to discover the nuances of Megaport with our detailed financial health report.

Key Takeaways

- Embark on your investment journey to our 34 Undervalued ASX Stocks Based On Cash Flows selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MP1

Megaport

Provides on-demand interconnection and internet exchange services to the enterprises and service providers in Australia, New Zealand, Hong Kong, Singapore, Japan, North America, Italy, and rest of Europe.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives