- Australia

- /

- Oil and Gas

- /

- ASX:CTP

3 ASX Penny Stocks With Market Caps Starting At A$7M

Reviewed by Simply Wall St

The ASX200 is set to open 0.44% higher today, even as global markets react to comments from US Federal Reserve Chair Jerome Powell suggesting that interest rates will remain steady for the foreseeable future. In such a climate, investors often look beyond established giants to explore opportunities in lesser-known areas of the market. Penny stocks, despite being an older term, continue to capture interest by offering potential growth in smaller or emerging companies; we've identified three such stocks on the ASX that present intriguing prospects amidst current economic conditions.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.615 | A$71.21M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$140.36M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.985 | A$314.24M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$341.08M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.61 | A$806.18M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.175 | A$1.08B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.16 | A$67.53M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$5.00 | A$499.25M | ★★★★☆☆ |

Click here to see the full list of 1,039 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Central Petroleum (ASX:CTP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Central Petroleum Limited is involved in the development, production, processing, and marketing of hydrocarbons in Australia with a market cap of A$39.50 million.

Operations: The company generates revenue from its Producing Assets segment, amounting to A$37.15 million.

Market Cap: A$39.5M

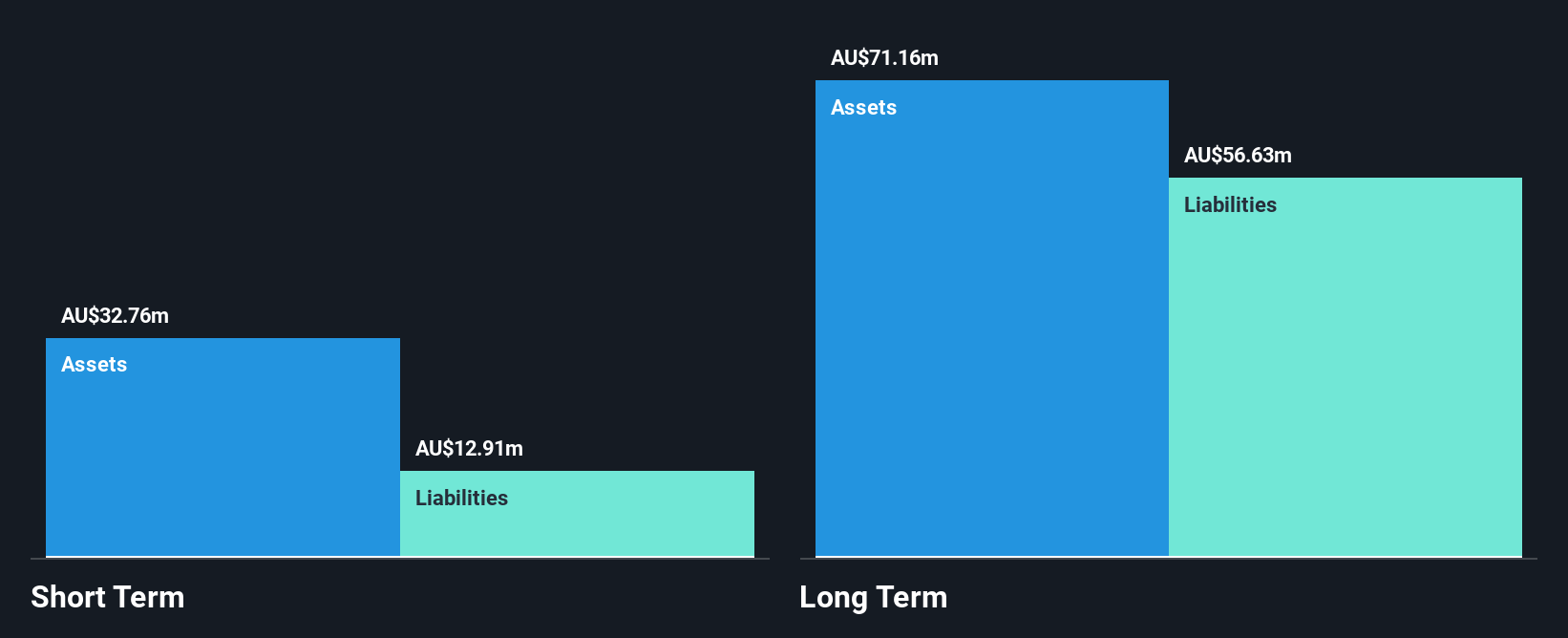

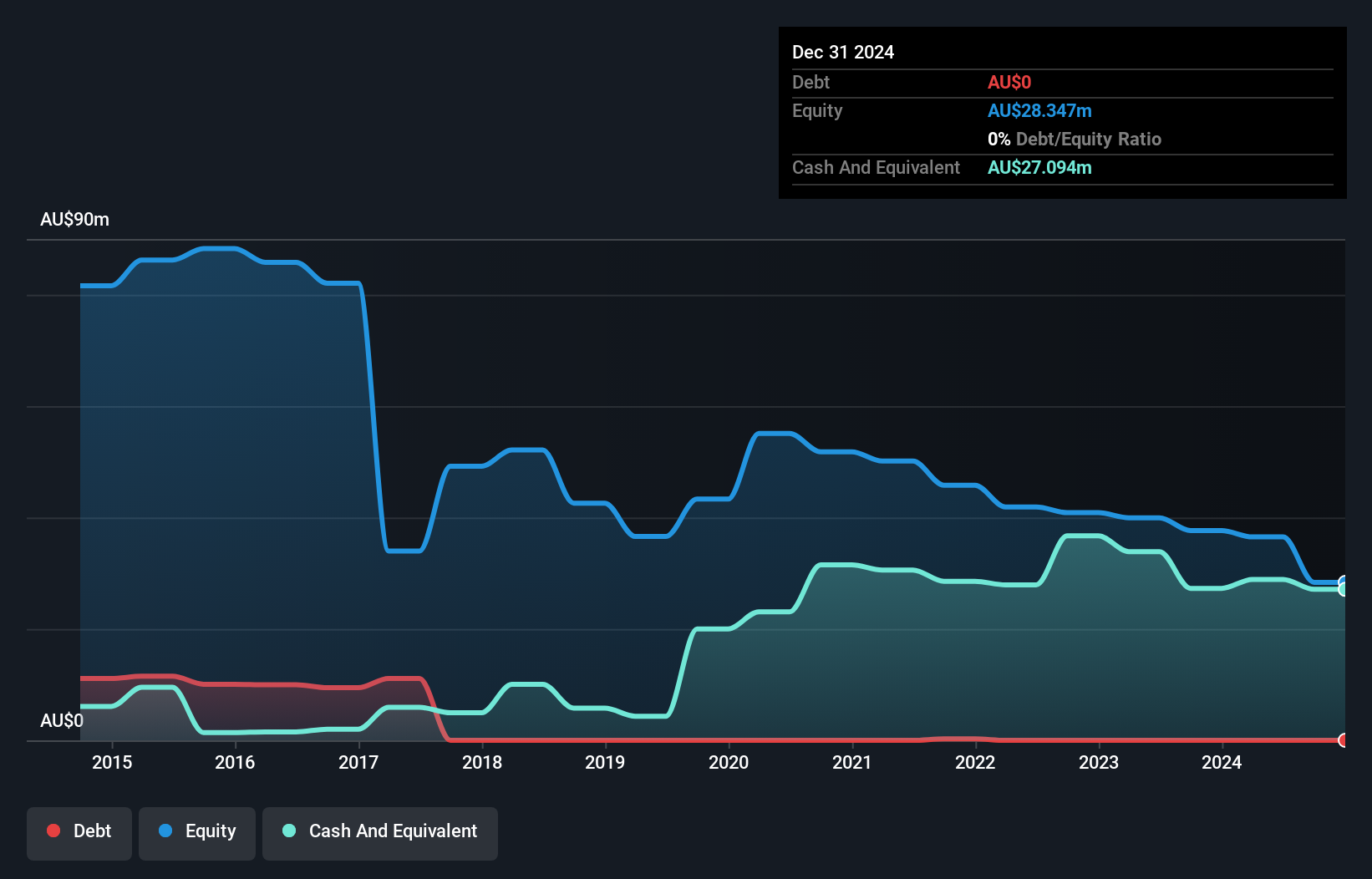

Central Petroleum Limited, with a market cap of A$39.50 million, has shown significant financial improvements, transitioning from negative to positive shareholder equity over the past five years. The company reported a net income of A$12.42 million for the year ending June 2024, marking its shift to profitability. Despite having more cash than debt and trading well below estimated fair value, Central Petroleum faces challenges with interest coverage and long-term liabilities exceeding short-term assets. Its experienced management team and board contribute positively to its stability amidst high non-cash earnings and stable weekly volatility.

- Jump into the full analysis health report here for a deeper understanding of Central Petroleum.

- Evaluate Central Petroleum's prospects by accessing our earnings growth report.

Kingsrose Mining (ASX:KRM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kingsrose Mining Limited, with a market cap of A$27.13 million, is a mineral exploration company operating in Norway and Finland.

Operations: The company does not report specific revenue segments.

Market Cap: A$27.13M

Kingsrose Mining Limited, with a market cap of A$27.13 million, is pre-revenue and currently unprofitable. Despite reporting a net loss of A$2.95 million for the year ended June 2024, this marks an improvement from the previous year's larger loss. The company has no debt and holds sufficient cash to cover more than three years of operations at current burn rates. Recent developments include advancing its interest in the Råna Nickel-Copper-Cobalt Project to 51%, with plans to increase it further by meeting additional expenditure milestones. Kingsrose's exploration efforts have identified promising mineralisation prospects at Råna.

- Click here and access our complete financial health analysis report to understand the dynamics of Kingsrose Mining.

- Explore historical data to track Kingsrose Mining's performance over time in our past results report.

Visioneering Technologies (ASX:VTI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Visioneering Technologies, Inc. is a medical device company that designs, manufactures, sells, and distributes contact lenses across North America, Europe, and the Asia-Pacific region with a market cap of A$7.74 million.

Operations: The company generates revenue of $8.64 million from its medical optical supplies segment.

Market Cap: A$7.74M

Visioneering Technologies, Inc., with a market cap of A$7.74 million, operates in the medical optical supplies segment and reported half-year sales of US$4.64 million. Despite being unprofitable with a net loss of US$1.82 million for this period, the company has managed to reduce its losses over the past five years by 30.9% annually. It remains debt-free but faces challenges with less than one year of cash runway available at its current burn rate. Recent executive departures may impact strategic continuity as it navigates high share price volatility and shareholder dilution issues from increased shares outstanding by 7.8%.

- Click here to discover the nuances of Visioneering Technologies with our detailed analytical financial health report.

- Gain insights into Visioneering Technologies' past trends and performance with our report on the company's historical track record.

Where To Now?

- Click through to start exploring the rest of the 1,036 ASX Penny Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTP

Central Petroleum

Engages in the development, production, processing, and marketing of hydrocarbons in Australia.

Undervalued with reasonable growth potential.