- Australia

- /

- Metals and Mining

- /

- ASX:PRN

3 ASX Penny Stocks With Market Caps Over A$100M

Reviewed by Simply Wall St

The Australian market showed resilience today, with the ASX 200 climbing 0.9% to reach 8,245 points as investors temporarily set aside concerns about upcoming U.S. tariffs. For those looking beyond large-cap stocks, penny stocks offer intriguing possibilities, particularly when they exhibit solid financial foundations and growth potential. Despite being considered an outdated term by some, penny stocks continue to attract attention for their ability to uncover hidden value in smaller or newer companies with promising prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.79 | A$84.44M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.545 | A$107.02M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.38 | A$368.64M | ★★★★★☆ |

| Bisalloy Steel Group (ASX:BIS) | A$3.30 | A$158.08M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.96 | A$244.91M | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.28 | A$1.2B | ★★★★★★ |

| Regal Partners (ASX:RPL) | A$3.34 | A$1.12B | ★★★★★★ |

| NRW Holdings (ASX:NWH) | A$2.98 | A$1.36B | ★★★★★☆ |

| Accent Group (ASX:AX1) | A$2.02 | A$1.14B | ★★★★☆☆ |

| CTI Logistics (ASX:CLX) | A$1.75 | A$136.52M | ★★★★☆☆ |

Click here to see the full list of 1,015 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Conrad Asia Energy (ASX:CRD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Conrad Asia Energy Ltd. is an energy company focused on the exploration, appraisal, and development of natural gas projects in Southeast Asia, with a market cap of A$139.80 million.

Operations: Conrad Asia Energy Ltd. has not reported any specific revenue segments.

Market Cap: A$139.8M

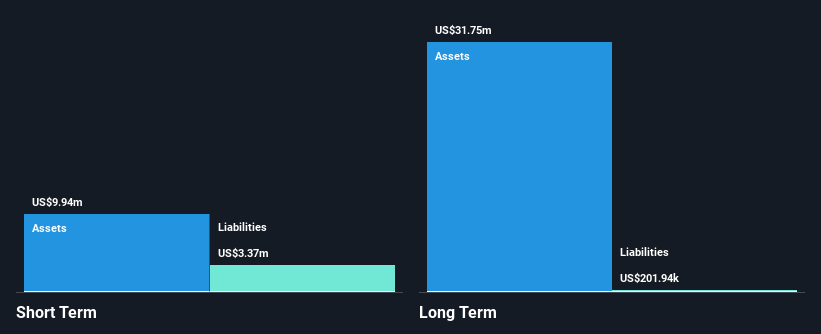

Conrad Asia Energy Ltd., with a market cap of A$139.80 million, is pre-revenue and currently unprofitable, making it challenging to compare its growth to the industry. The company has seen increased losses over the past five years at 12.9% annually. Despite being debt-free and having short-term assets of US$9.9 million that cover both its long-term liabilities (US$201,900) and short-term liabilities (US$3.4 million), Conrad faces financial constraints with less than a year of cash runway based on current free cash flow trends. Earnings are forecasted to grow significantly by 53.35% per year, though risks remain high given its financial position and volatility stability over the past year at 6%.

- Click to explore a detailed breakdown of our findings in Conrad Asia Energy's financial health report.

- Understand Conrad Asia Energy's earnings outlook by examining our growth report.

Omni Bridgeway (ASX:OBL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Omni Bridgeway Limited provides dispute and litigation finance services across multiple regions including Australia, the United States, and Europe, with a market cap of A$394.20 million.

Operations: Omni Bridgeway Limited does not report specific revenue segments.

Market Cap: A$394.2M

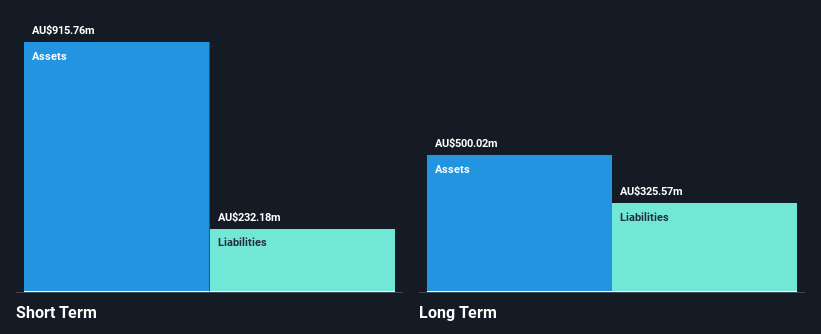

Omni Bridgeway Limited, with a market cap of A$394.20 million, reported half-year revenue of A$92.54 million, down from A$135.84 million the previous year, but sales increased significantly to A$39.74 million from A$12.23 million. The company remains unprofitable with a net loss of A$32.61 million; however, its short-term assets (A$915.8M) cover both short-term (A$232.2M) and long-term liabilities (A$325.6M). Despite high volatility and increased debt-to-equity ratio over five years, Omni Bridgeway has not diluted shareholders recently and maintains an experienced management team with sufficient cash runway for over a year based on current free cash flow trends.

- Click here and access our complete financial health analysis report to understand the dynamics of Omni Bridgeway.

- Explore Omni Bridgeway's analyst forecasts in our growth report.

Perenti (ASX:PRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perenti Limited is a global mining services company with a market capitalization of A$1.20 billion.

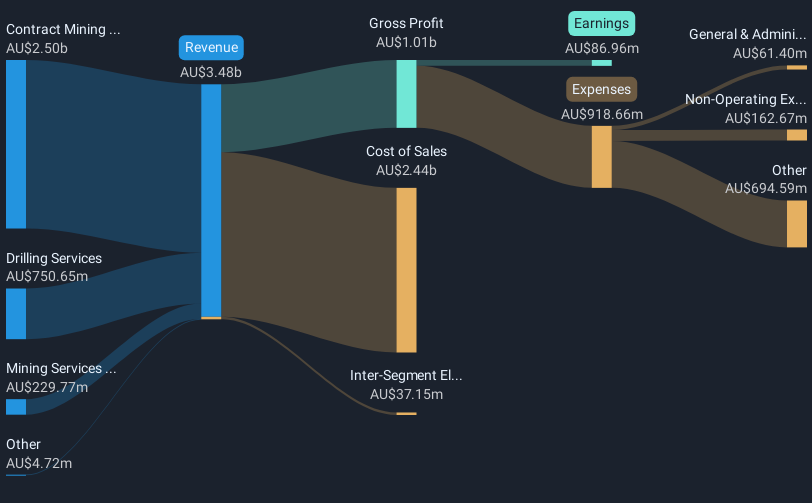

Operations: The company's revenue is primarily derived from Contract Mining Services, generating A$2.50 billion, followed by Drilling Services at A$750.65 million and Mining Services and Idoba contributing A$229.77 million.

Market Cap: A$1.2B

Perenti Limited, with a market cap of A$1.20 billion, shows mixed performance as a penny stock. Its revenue primarily stems from contract mining services at A$2.50 billion, yet recent earnings declined with net income dropping to A$56.28 million for the half-year ending December 2024 from A$78.5 million previously. Despite this, the company increased its dividend to 3 cents per share, reflecting confidence in cash flow strength for FY2025 and beyond. While debt levels are satisfactory and covered by operating cash flow, profit margins have decreased to 2.5%. Earnings growth is forecasted at 24% annually despite past volatility challenges.

- Unlock comprehensive insights into our analysis of Perenti stock in this financial health report.

- Gain insights into Perenti's future direction by reviewing our growth report.

Key Takeaways

- Explore the 1,015 names from our ASX Penny Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PRN

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives