- Australia

- /

- Oil and Gas

- /

- ASX:COI

Discovering Comet Ridge And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

As the Australian market wraps up the year with a modest gain, investors are keeping an eye on sectors like Real Estate and Healthcare, which have shown resilience amidst ongoing inflation concerns. In such a climate, identifying promising stocks can be challenging yet rewarding, especially when exploring lesser-known opportunities. Penny stocks, often representing smaller or newer companies, continue to offer potential for growth at accessible price points; when these companies boast solid financials and fundamentals, they may provide significant upside potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.89 | A$307.73M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.625 | A$796.38M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.915 | A$107.42M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.87 | A$237.96M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$193.32M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.89 | A$482.47M | ★★★★☆☆ |

Click here to see the full list of 1,054 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Comet Ridge (ASX:COI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Comet Ridge Limited is involved in oil and gas exploration, appraisal, and development activities in Australia with a market cap of A$161.03 million.

Operations: Comet Ridge Limited does not report any specific revenue segments.

Market Cap: A$161.03M

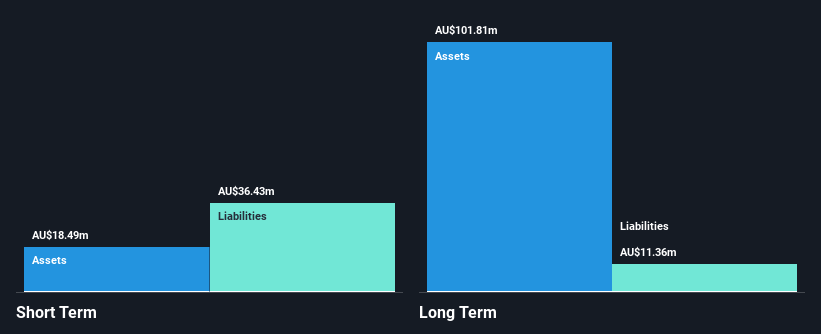

Comet Ridge Limited, with a market cap of A$161.03 million, remains pre-revenue and unprofitable, reporting a net loss of A$7.17 million for the year ending June 2024. Despite stable weekly volatility at 7%, the company faces challenges as short-term assets (A$18.5M) do not cover short-term liabilities (A$36.4M). However, it has more cash than total debt and recently raised A$12.03 million through equity offerings to bolster its cash runway beyond four months based on free cash flow estimates. Analysts are optimistic about future price appreciation by 77.6%, though profitability is not expected in the near term.

- Click here to discover the nuances of Comet Ridge with our detailed analytical financial health report.

- Assess Comet Ridge's future earnings estimates with our detailed growth reports.

West Wits Mining (ASX:WWI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: West Wits Mining Limited is involved in the exploration, development, and production of mineral properties in South Africa and Australia, with a market cap of A$38.13 million.

Operations: The company generates revenue from its Mining & Exploration segment, amounting to A$0.03 million.

Market Cap: A$38.13M

West Wits Mining Limited, with a market cap of A$38.13 million, is pre-revenue and unprofitable, reporting a net loss of A$1.68 million for the year ending June 2024. The company has experienced management and board teams but faces liquidity challenges as short-term assets (A$1.5M) do not cover short-term liabilities (A$2.4M). Despite shareholder dilution over the past year, West Wits has reduced its debt-to-equity ratio from 1.2% to 0.2% over five years and maintains more cash than total debt. Recent capital raising efforts aim to extend its cash runway beyond six months amidst high share price volatility.

- Navigate through the intricacies of West Wits Mining with our comprehensive balance sheet health report here.

- Evaluate West Wits Mining's historical performance by accessing our past performance report.

Xanadu Mines (ASX:XAM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Xanadu Mines Limited is involved in the exploration and development of mineral projects in Mongolia, with a market cap of A$84.57 million.

Operations: Xanadu Mines Limited has not reported any revenue segments.

Market Cap: A$84.57M

Xanadu Mines Limited, with a market cap of A$84.57 million, is pre-revenue and currently unprofitable. The company has recently announced promising copper assay results from its Sant Tolgoi Project in Mongolia, identifying four high-priority targets for exploration. Despite not generating revenue, Xanadu remains debt-free and has managed to cover its short-term liabilities with assets totaling A$5.4 million against liabilities of A$461K. The recent follow-on equity offering raised A$5.5 million, which should help extend its cash runway beyond the current two months based on free cash flow estimates amidst ongoing project developments and potential future profitability.

- Take a closer look at Xanadu Mines' potential here in our financial health report.

- Learn about Xanadu Mines' future growth trajectory here.

Turning Ideas Into Actions

- Click here to access our complete index of 1,054 ASX Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:COI

Comet Ridge

Engages in the oil and gas exploration, appraisal, and development activities in Australia.

Adequate balance sheet and fair value.