Exploring High Growth Tech Stocks In Australia December 2024

Reviewed by Simply Wall St

As the Australian market wraps up the year with a modest gain in the ASX 200, closing at 8,217 points, investors are keeping a close eye on economic indicators such as inflation rates that remain higher than desired by the Reserve Bank of Australia. In this environment, identifying high-growth tech stocks requires careful consideration of companies that demonstrate resilience and innovation amidst fluctuating market conditions and sector-specific challenges.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.38% | 26.16% | ★★★★★☆ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| Telix Pharmaceuticals | 21.55% | 38.32% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| AVA Risk Group | 25.54% | 77.32% | ★★★★★★ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Mesoblast | 45.80% | 62.78% | ★★★★★★ |

| Wrkr | 37.21% | 98.46% | ★★★★★★ |

| Opthea | 52.73% | 63.45% | ★★★★★★ |

| SiteMinder | 18.83% | 60.52% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our ASX High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Data#3 (ASX:DTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Data#3 Limited is an IT solutions and services provider operating in Australia, Fiji, and the Pacific Islands with a market capitalization of A$1.01 billion.

Operations: The company's primary revenue stream comes from its role as a value-added IT reseller and IT solutions provider, generating A$805.75 million. The business focuses on delivering comprehensive IT services across Australia, Fiji, and the Pacific Islands.

Data#3, a notable entity in Australia's tech landscape, is demonstrating robust growth dynamics, with revenue expected to surge by 23.8% annually, outpacing the broader Australian market's 5.8%. This growth is complemented by an earnings increase of 17% over the past year, although its projected annual earnings growth of 9.6% slightly trails the national average of 12.5%. The recent appointment of Bronwyn Morris to its board underscores a strategic bolstering in governance that could enhance corporate oversight and risk management strategies. Moreover, Data#3's commitment to innovation is evident from its significant R&D investment relative to revenue, ensuring it remains at the forefront of technological advancements and maintains competitive advantage within the IT sector.

- Click here to discover the nuances of Data#3 with our detailed analytical health report.

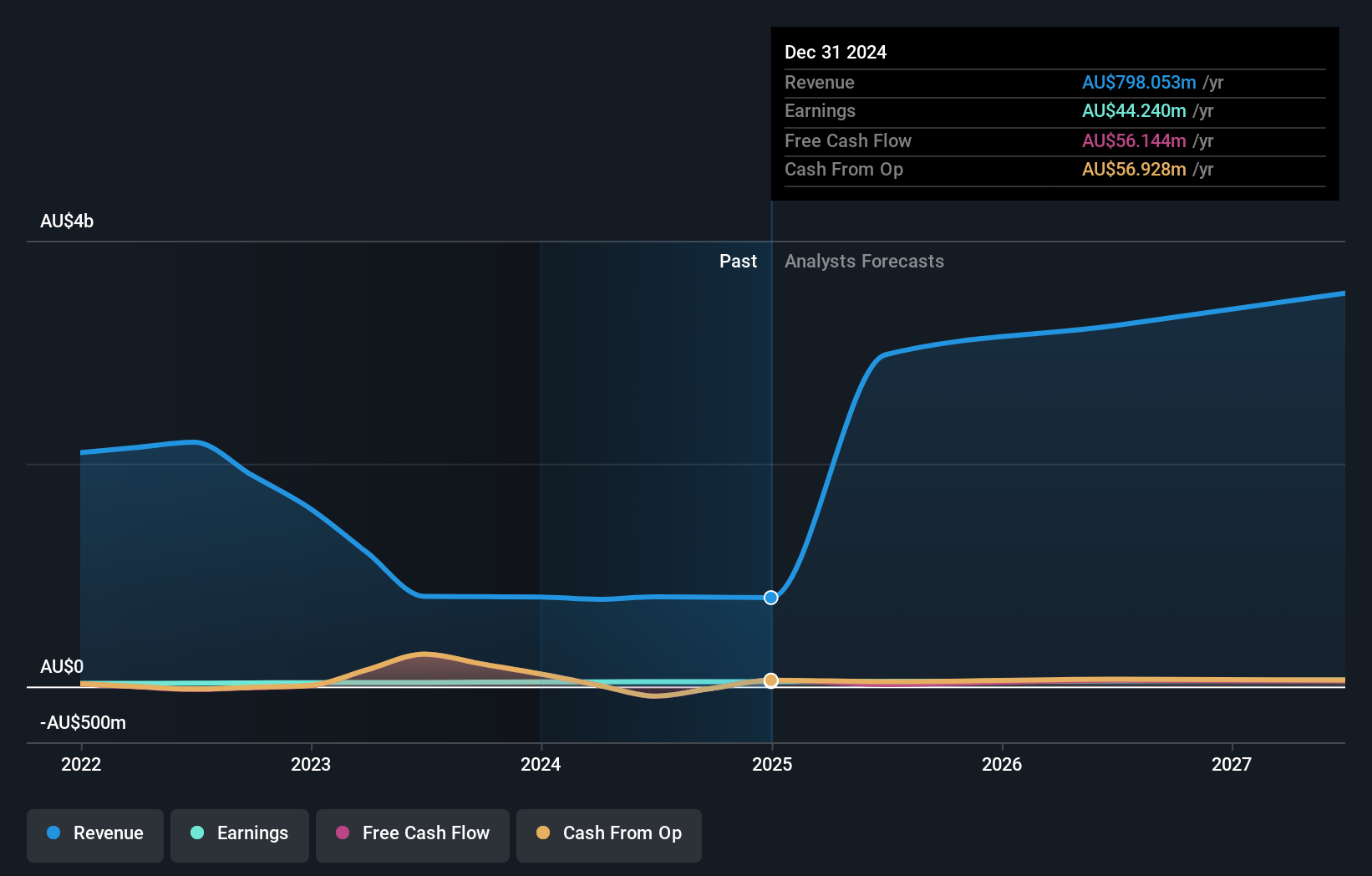

Gain insights into Data#3's past trends and performance with our Past report.

Iress (ASX:IRE)

Simply Wall St Growth Rating: ★★★★☆☆

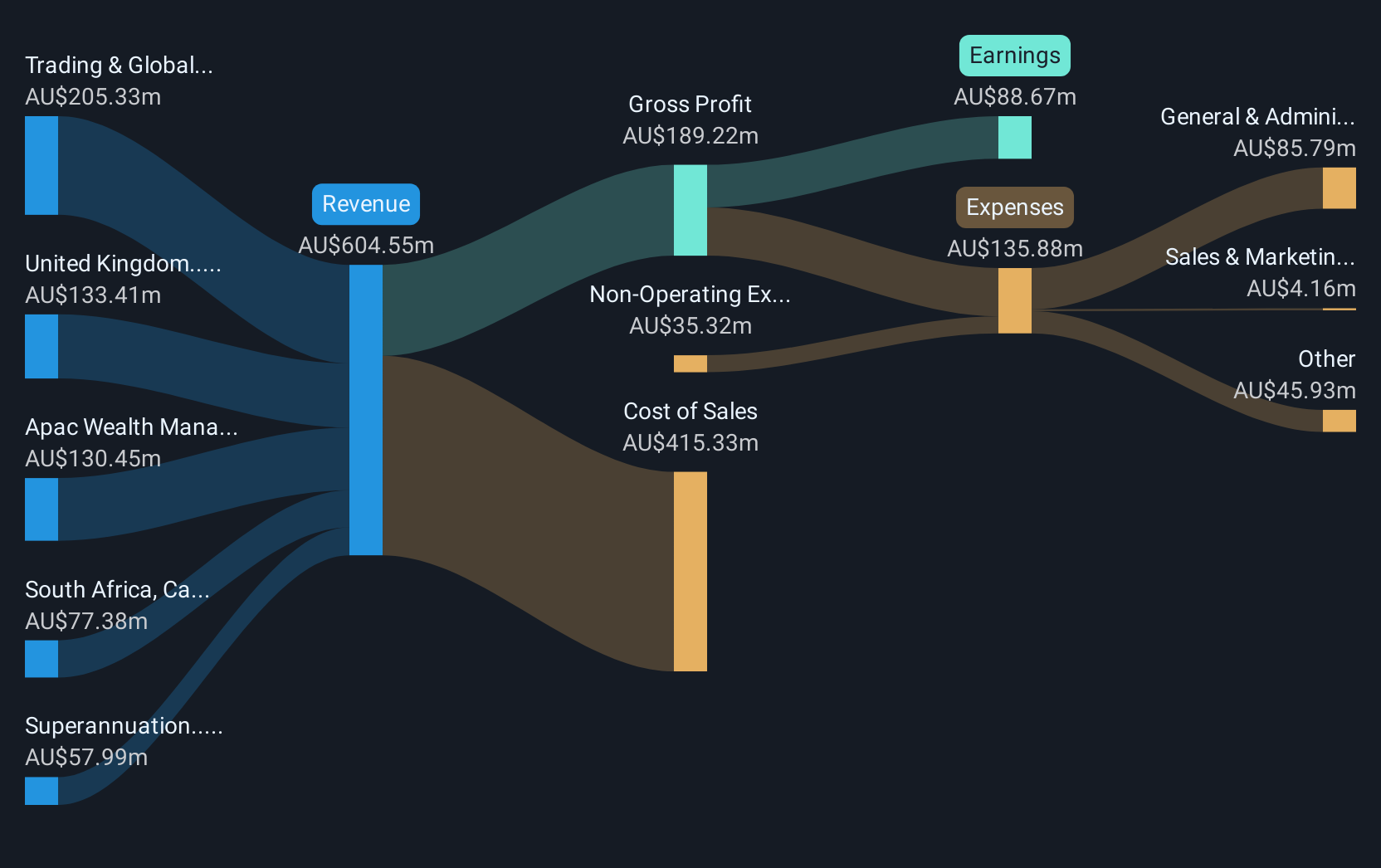

Overview: Iress Limited designs and develops software and services for the financial services industry across the Asia Pacific, United Kingdom, Europe, Africa, and North America, with a market cap of A$1.70 billion.

Operations: Iress Limited generates revenue primarily through its software and services tailored for the financial services industry, with key segments including APAC Wealth Management (A$132.02 million), Managed Portfolio - UK (A$173.43 million), and APAC Trading & Global Market Data (A$179.20 million).

Iress, amidst a transformative phase, is showing promising signs with leadership changes aimed at sharpening its strategic focus. The recent promotion of Harry Mitchell to Deputy Group CEO highlights an intensified approach towards operational excellence and sector-specific growth, especially in superannuation and wealth management across APAC and the UK. This move aligns with Iress's broader strategy to enhance its software solutions footprint, as evidenced by a robust forecasted annual earnings growth of 29.1%, significantly outpacing the Australian market average of 12.5%. However, revenue growth projections remain modest at 1.8% annually, suggesting a strategic pivot towards profitability over volume. These developments come alongside executive board enhancements that promise to inject fresh perspectives into governance and drive forward the company’s ambitious agenda in high-tech financial software solutions.

- Delve into the full analysis health report here for a deeper understanding of Iress.

Explore historical data to track Iress' performance over time in our Past section.

SEEK (ASX:SEK)

Simply Wall St Growth Rating: ★★★★☆☆

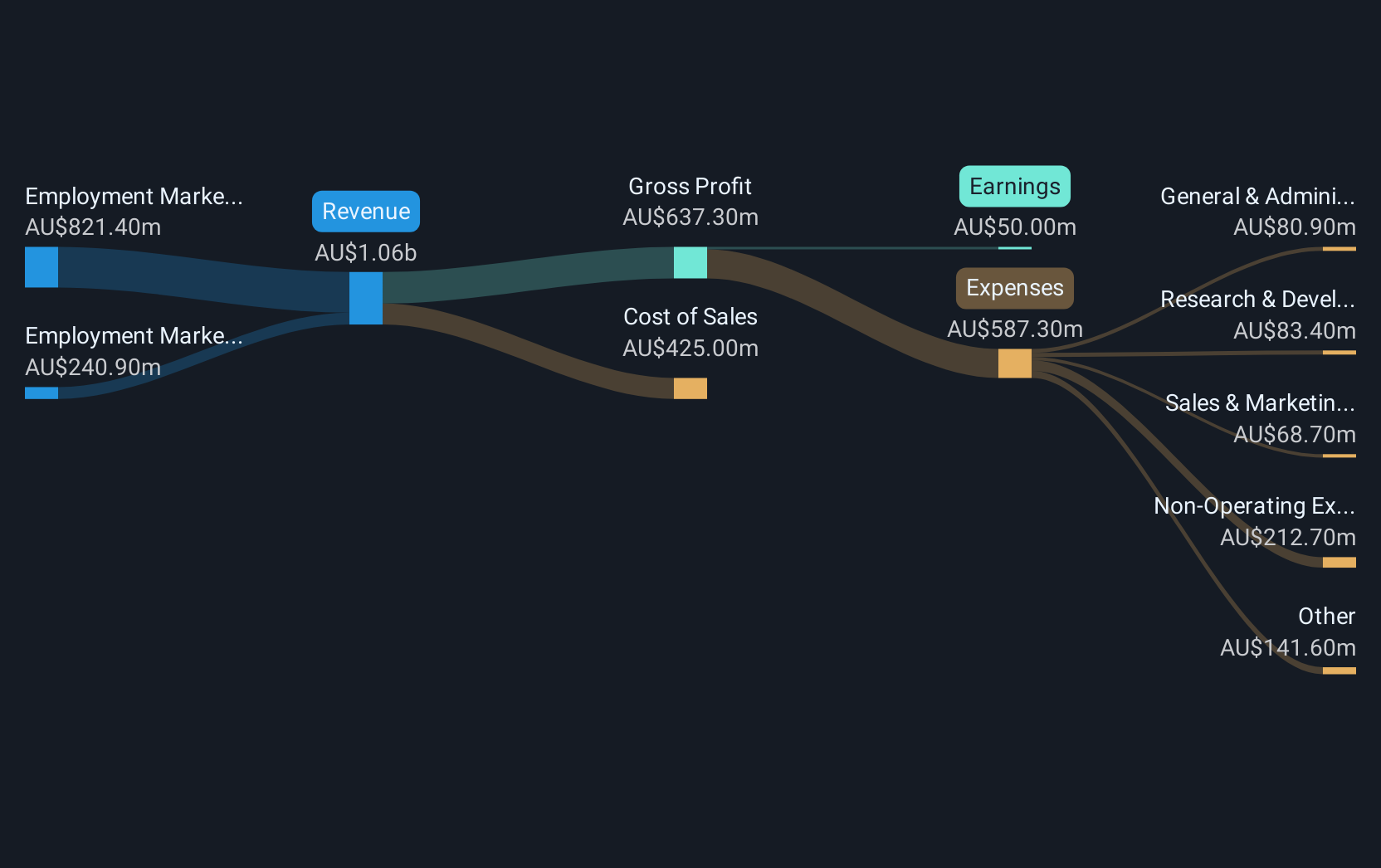

Overview: SEEK Limited is a company that provides online employment marketplace services across Australia, South East Asia, New Zealand, the United Kingdom, Europe, and other international markets with a market cap of A$8.10 billion.

Operations: SEEK Limited generates revenue primarily through its online employment marketplace services, with significant contributions from the ANZ region at A$840.10 million and Asia at A$244 million.

SEEK, set to become profitable within the next three years, is navigating its growth trajectory with a strategic focus on innovation and market expansion. Despite being currently unprofitable, the company's revenue is expected to increase by 7.9% annually, outpacing the Australian market average of 5.8%. This growth is supported by SEEK’s commitment to R&D which fuels its competitive edge in the Interactive Media and Services industry. Moreover, earnings are projected to surge by an impressive 37.72% per year, showcasing SEEK's potential in transforming its financial health significantly. The upcoming Annual General Meeting on November 19 will further provide insights into new strategic initiatives and leadership decisions aimed at sustaining this growth momentum.

- Click here and access our complete health analysis report to understand the dynamics of SEEK.

Assess SEEK's past performance with our detailed historical performance reports.

Next Steps

- Explore the 61 names from our ASX High Growth Tech and AI Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IRE

Iress

Engages in the designing and developing software and services for the financial services industry in the Asia Pacific, the United Kingdom and Europe, Africa, and North America.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives