Eric Streitberg is the CEO of Buru Energy Limited (ASX:BRU), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Buru Energy

How Does Total Compensation For Eric Streitberg Compare With Other Companies In The Industry?

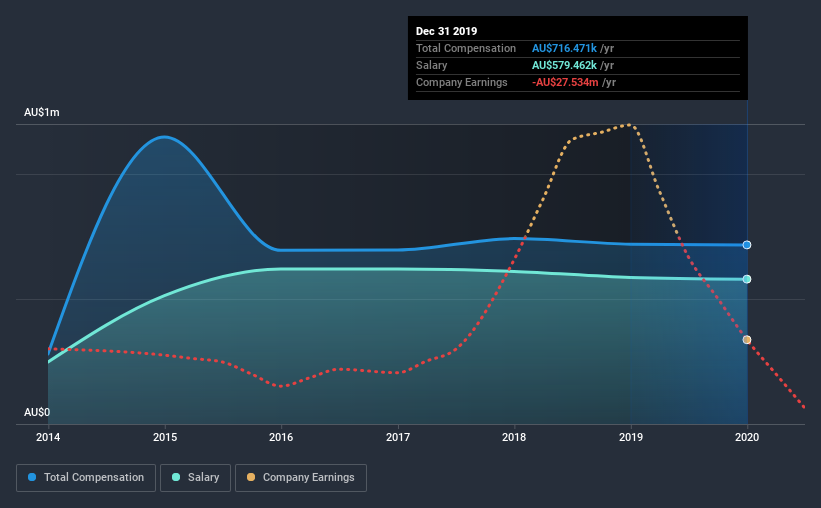

At the time of writing, our data shows that Buru Energy Limited has a market capitalization of AU$41m, and reported total annual CEO compensation of AU$716k for the year to December 2019. That is, the compensation was roughly the same as last year. We note that the salary portion, which stands at AU$579.5k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below AU$265m, we found that the median total CEO compensation was AU$353k. Accordingly, our analysis reveals that Buru Energy Limited pays Eric Streitberg north of the industry median. Moreover, Eric Streitberg also holds AU$2.0m worth of Buru Energy stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | AU$579k | AU$586k | 81% |

| Other | AU$137k | AU$133k | 19% |

| Total Compensation | AU$716k | AU$719k | 100% |

Talking in terms of the industry, salary represented approximately 76% of total compensation out of all the companies we analyzed, while other remuneration made up 24% of the pie. There isn't a significant difference between Buru Energy and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Buru Energy Limited's Growth

Over the last three years, Buru Energy Limited has shrunk its earnings per share by 48% per year. In the last year, its revenue is down 30%.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Buru Energy Limited Been A Good Investment?

With a three year total loss of 67% for the shareholders, Buru Energy Limited would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As we touched on above, Buru Energy Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Unfortunately, this doesn't look great when you see shareholder returns have been negative over the last three years. Add to that declining EPS growth, and you have the perfect recipe for shareholder irritation. Considering such poor performance, we think shareholders might be concerned if the CEO's compensation were to grow.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 2 warning signs for Buru Energy (of which 1 is a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Important note: Buru Energy is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Buru Energy or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Buru Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:BRU

Buru Energy

Engages in the exploration, development, and production of oil and gas resources in Western Australia.

Excellent balance sheet moderate.